Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am relatively new to QB. I have returned an item to Home Depot and had them refund me on my Bank Debit card. I see the transaction in the Banking section of QB, But I am not able to Match it to anything. Also, I am not able to see it in the Reconcile section, so I am unable to reconcile by bank statement.

I do see there is a way to do a Vendor Credit, but that is if the refund was in cash or a check, and there is a Credit Card credit, but it is for a credit card and my return was on a debit card.

Solved! Go to Solution.

Welcome to the Community space, Treasurer136.

QuickBooks is use for recording purposes. I'll help you record Home depot refund and match it to the transaction you see in the Banking section.

Recording refund depend on how you record your purchase. To reflect the money you received from Home Depot into your debit card account, you can create a vendor credit and bank deposit in QuickBooks Online. I'll show you how.

These are the steps to create a vendor credit:

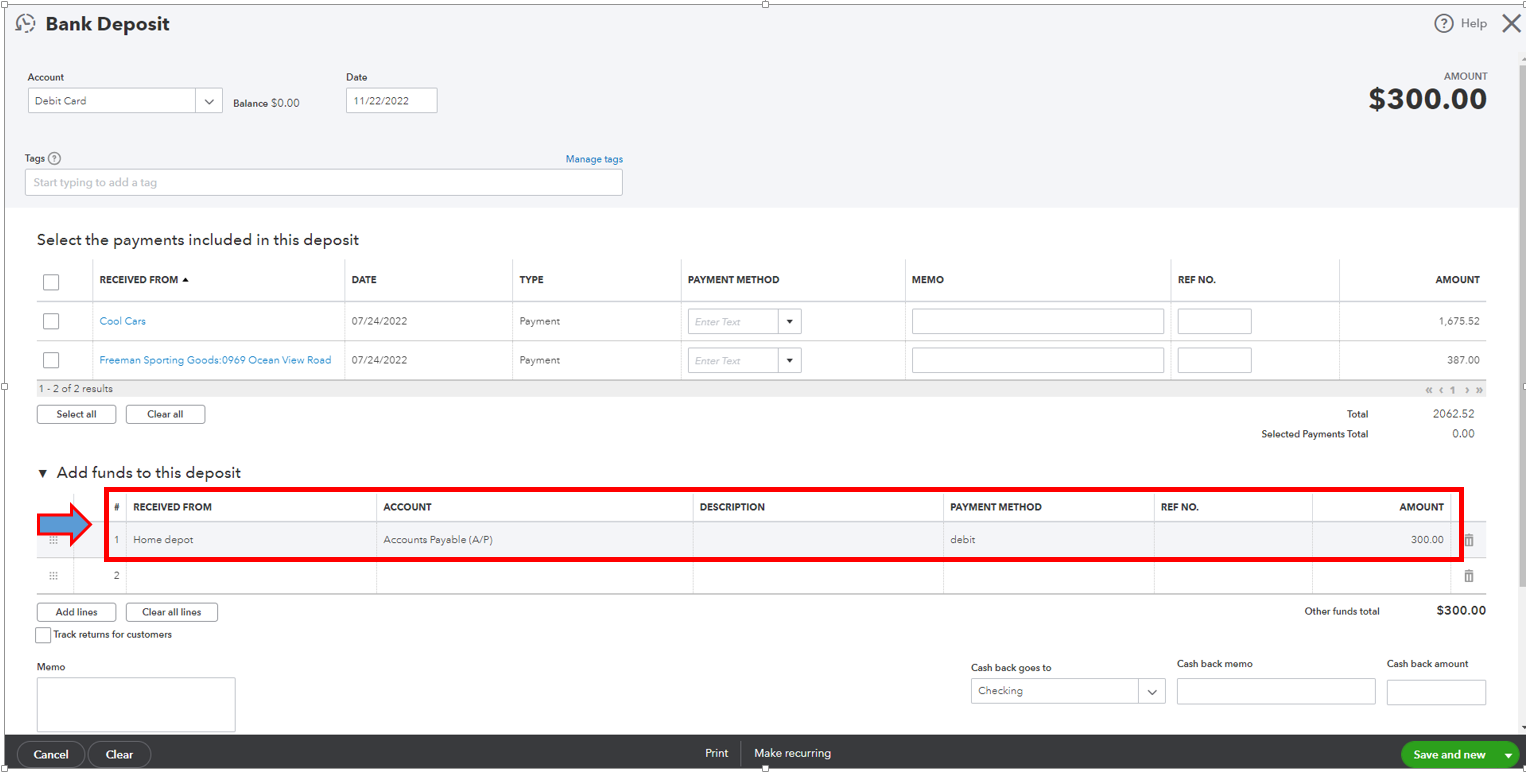

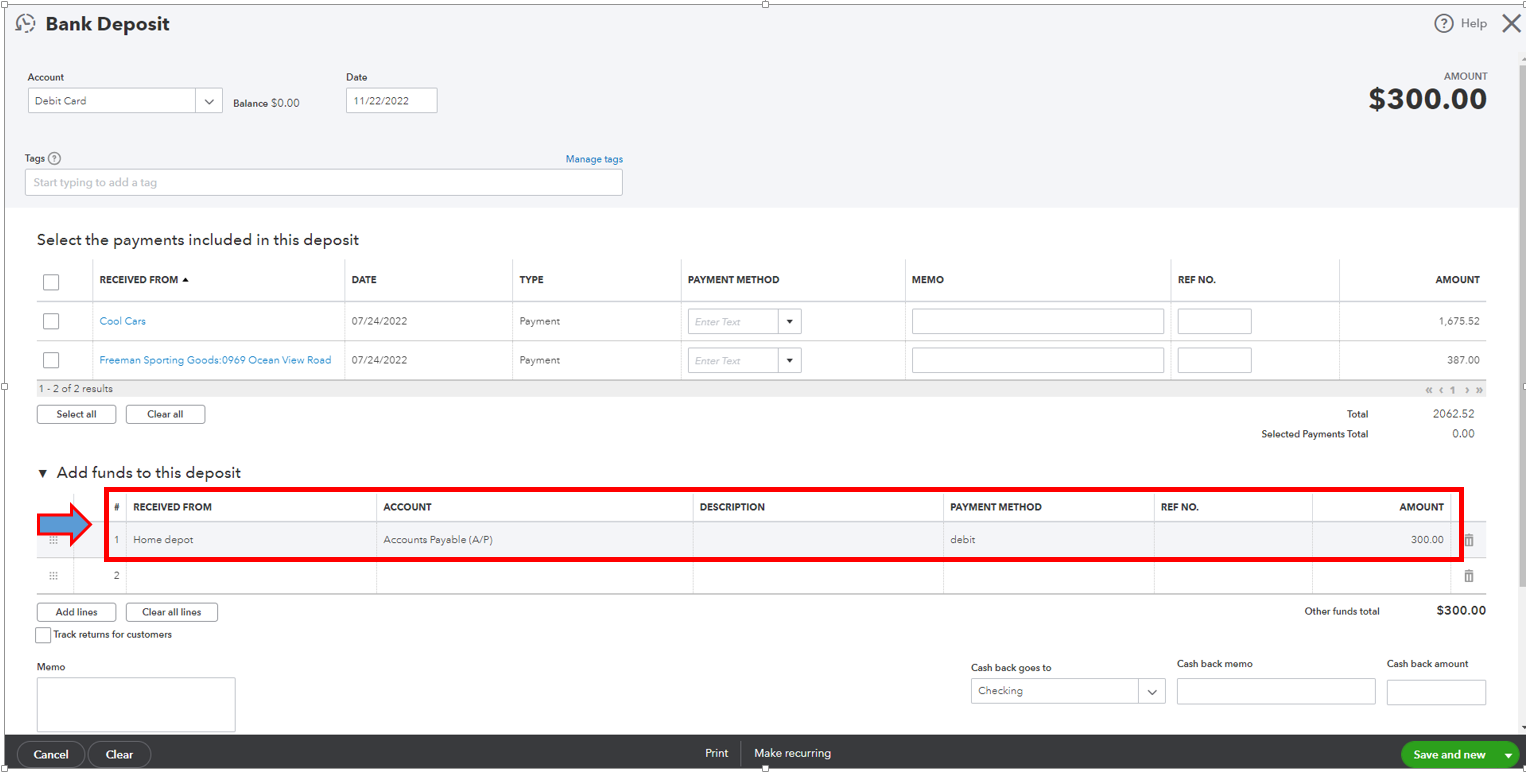

Here's how to create a bank deposit:

Then, let's connect the vendor credit and bank deposit using the Pay bills.

Here's how:

After that, you can now match the bank deposit to the transaction you see in the Banking page.

You can read this article as a reference in the future to guide you with the reconciliation process and make sure your QuickBooks balance matches the value on your bank, credit card, or debit card statement. Reconcile an account in QuickBooks Online.

We'll keep an eye on this post, don't hesitate to add any details below if you need further help with refund. We're always available to help you.

Welcome to the Community space, Treasurer136.

QuickBooks is use for recording purposes. I'll help you record Home depot refund and match it to the transaction you see in the Banking section.

Recording refund depend on how you record your purchase. To reflect the money you received from Home Depot into your debit card account, you can create a vendor credit and bank deposit in QuickBooks Online. I'll show you how.

These are the steps to create a vendor credit:

Here's how to create a bank deposit:

Then, let's connect the vendor credit and bank deposit using the Pay bills.

Here's how:

After that, you can now match the bank deposit to the transaction you see in the Banking page.

You can read this article as a reference in the future to guide you with the reconciliation process and make sure your QuickBooks balance matches the value on your bank, credit card, or debit card statement. Reconcile an account in QuickBooks Online.

We'll keep an eye on this post, don't hesitate to add any details below if you need further help with refund. We're always available to help you.

THANK YOU!!!! This was a great help and did solve my issue.

Happy Holidays.

You’re always welcome, @Treasurer136.

We're happy to know that the information shared by my colleague, @Giovann_G, above greatly helped you. We want to ensure our users get the most out of QuickBooks.

If you have other QuickBooks-related concerns, you can reply in this thread. Our team is always here to assist you more. Have a happy and great Holiday!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here