Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Other questions

- :

- How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

This is maybe a 3 part question sorry for any confusion -

First the loan info was entered as a long term liability account however we were having issues with matching up a transaction that came in from the checking account. We assumed this was an issue with the loan bank account never syncing with QB. I called QB and resolved this by entering another account for the "bank" and syncing it.

After doing this, I added and matched to clean up the match section. We made some journal entries as needed for the matches.

We thought everything was resolved however later found our checking account balance was off close to the amount of the loan - causing issues with year end trial balance for 2020. It appeared that there was double booking of the loan amount between the loan bank account info and the long term liabilities account. I attempted to resolve by deleting the long term liability account - however it is still showing on the trial balance with (deleted) next to it but the amount is still there.

1. Is there a way to remove the long term liability account amount from the trial balance - or should I have NOT deleted that account and done something differently?

2. What is the CORRECT way to handle the loan tranactions moving forward that will not screw up the books?

3. When speaking with QB they thought reconciling the loan account might help - any advice on how to do that for a loan account with no clear statements on ending and beginning balances?

4. Any advice would be helpful, I am clearly not an accountant and have only recently started using QB.

Note this loan several items that were purchased under it spanning over a few months and not just one item so that may make things more complex. I know I need to reduce A/P and reduce cash but not sure how and when to do that as well. If you have any questions feel free to comment and I will edit the post to include that info.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

To handle a loan bank account may sound complicated, but the process is so easy and simple in QuickBooks Online, pennymisale.

Normally, you'll have to set up a liability account to record the loan and its payments. This account then tracks what you owe. To set this up, you can follow the steps below:

- Select Settings ⚙ and then Chart of Accounts.

- Select New to create a new account.

- From the Account Type ▼ dropdown, select Long Term Liabilities. Note: If you plan to pay off the loan by the end of the current fiscal year, select Other Current Liabilities instead.

- From the Detail Type ▼ dropdown, select Notes Payable.

- Give the account a relevant name, like "Loan for a car" or "Covid-19 relief loan."

- In the When do you want to start tracking your finances ▼ dropdown, choose when you want to start tracking the transactions:

- Select Today to start tracking transactions as of today. In the Account Balance field, enter the balance of the account for today.

- Select Other to pick a specific date to start tracking transactions. In the Select a date field, choose the date you want to start tracking transactions for the account in QuickBooks. In the Account Balance field, enter the balance of the account for the date you pick.

- Enter the full loan amount as a negative amount. This sets up the liability account with the full loan amount.

- Click Save and close.

Once done, you already have an account with the full amount. You can record it against this account every time you want to make a payment.

However, if you want your loan to be entered directly into your bank account, you can go ahead and follow this article: Set Up Loan In QuickBooks Online. This will surely provide you all the information you need on your numbered concerns.

You'll also want to correctly categorize your bank transactions in QuickBooks.

Let us know if there's anything else that you need to help us with. We're here to help you always.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

Hello, thank you this is what I saw online but doesn't help with my specific questions on 1, 2, and 3. Should we disconnect the bank loan and only track this through the long term liabilities account? Or how do I handle transactions in the loan bank account and lll to get the trail balance accurate? The checking account where funds were transferred is over due to the loan funds but they've been spent.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

Hi @pennymisale,

Welcome to the Community. Allow me to chime in and provide some clarifications about your loan-related concerns.

For your first question, yes, there's a way to get rid of it from the Trial Balance report. However, it'll also remove all of your inactive accounts.

Here's how:

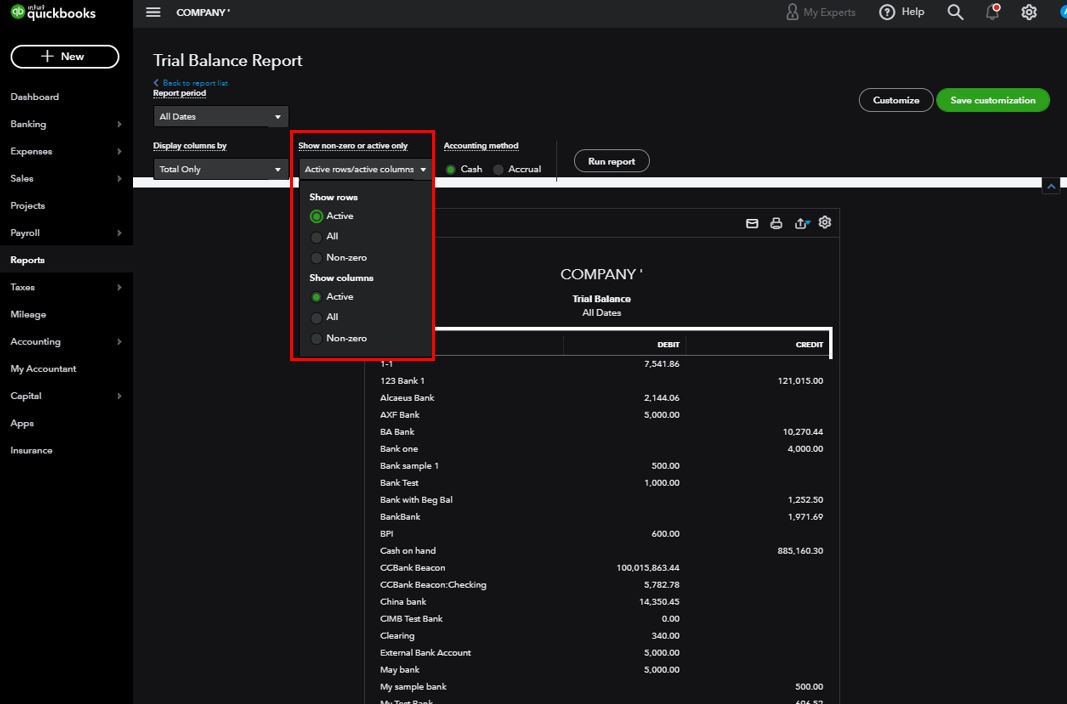

- Open the Trial Balance report.

- Below Show non-zero or active only, select the Active option for your rows and columns.

- Hit Run report.

Another method would be to export data to Excel and delete accounts manually.

The purpose of the liability account is to track the loan amount. Every time you record a loan payment, it decreases the balance.

Second, the correct way would be to use a liability account and the Check feature to record the payment, interest, and other fees. Please refer to this article: Set up a loan in QuickBooks Online.

If you sync your bank account to QuickBooks, any transactions related to the loan are downloaded automatically. To avoid duplicates, you can either exclude them from bank feeds or disconnect the account.

Please note that you can only reconcile your checking, savings, and credit card accounts in QuickBooks. You can review them to make sure they match your real-life bank and credit card statements.

Lastly, it would be best to seek expert advice from an accountant. They' can provide alternative ways aside from the method we recommend and help ensure your books are accurate.

I recommend visiting the following article to learn more about entering journal entries in QuickBooks: Create a journal entry in QuickBooks Online.

Keep us posted if you need anything else regarding the loan setup. Have a great day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

Thank you for your help, is there any way to keep both the loan feed AND the long term liability note? Speaking again this morning with QB and they advised to remove the long term liability account which does not make sense to me. Is it possible, or does it make more sense to un-sync the bank account? Note that the loan funds were transferred to the checking account and we are also making payments from the checking account.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I properly handle a loan bank account in and liability for equipment in QB Online / Trial Balance Issues

Thanks for getting back to us, @pennymisale.

As mentioned by our Customer Support Team, you'll have to remove the long term liability account. This is to ensure that there are no double transactions that will be downloaded.

Also, you can unsync your bank accounts as long as the transactions are intact. For more details on how to recond transfer funds, check out this article: Transfer funds between accounts.

Once done, you can now match your downloaded transactions in QBO and make a loan payment, check out these articles:

- Categorize and match online bank transactions in QuickBooks Online

- Make a loan payment in QuickBooks Online

Need to take care of other transactions or want to run reports? Our articles can guide you through the process. Check them out here. If you want to go to a specific topic, just scroll down to the bottom of the page and select under More Help Topics.

Reach out to me if you have any other concerns while working in QuickBooks. I’m here ready to help you.