Let me guide you in updating your personal W-9 form in QuickBooks Self Employed (QBSE).

Updating personal details in the W-9 form ensures accurate records for tax reporting and compliance before your employer or client submits your 1099-MISC to the IRS:

- Sign in to your QBSE account.

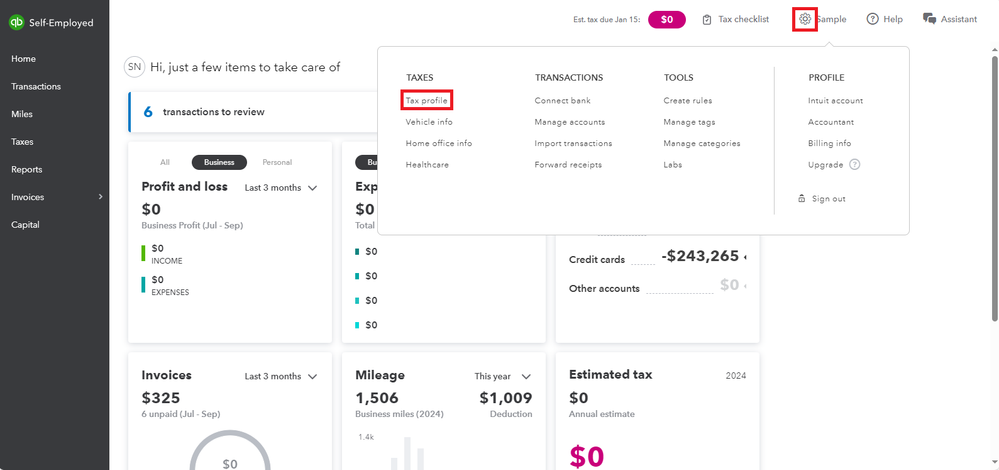

- Select the Settings (⚙) icon in the upper right corner.

- Choose Tax Profile.|

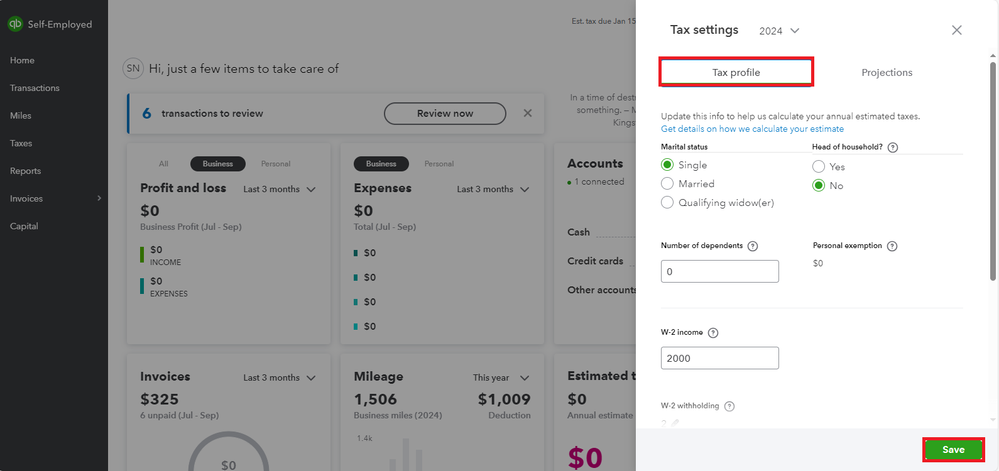

- Make the necessary changes to your W-9 information.

- Once done, select Save.

These updates will automatically be reflected for your employer or client in QuickBooks Online. Also, it's best to notify them directly if you've done making updates.

For more info about W-9 in QBSE, please refer to this article: Fill out a W-9 and view your 1099-MISC.

For future reference, you can check out this article to learn how to generate reports and get federal estimated tax details: Get quarterly and annual tax info from QBSE.

Let us know if you need further assistance updating your W-9 form in QBSE. Have a great day ahead.