Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThere is no outstanding invoice to apply it to. It is actually from the Franchise Tax Board.

Solved! Go to Solution.

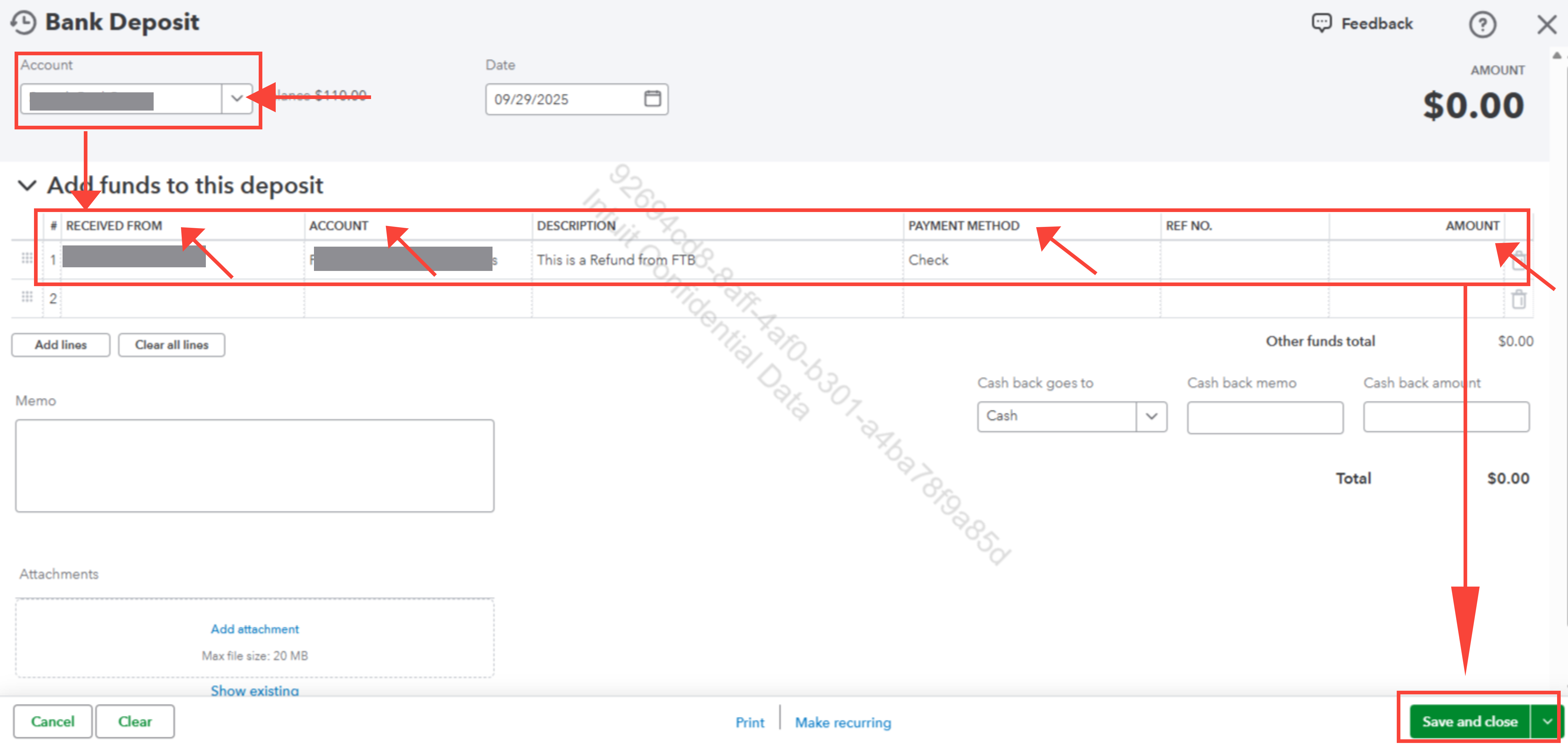

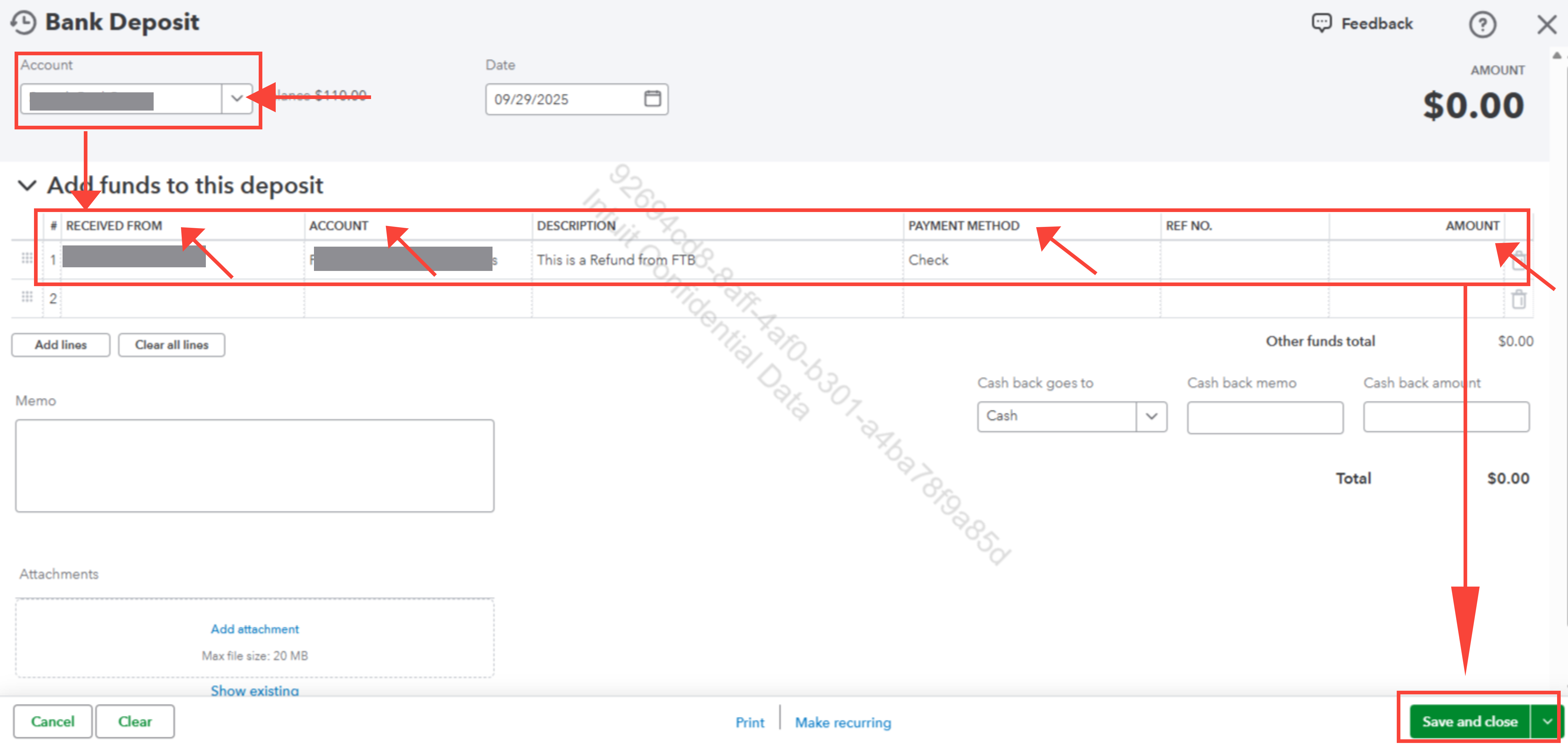

You can record the refund as a bank deposit, Janna1122.

Since there is no outstanding invoice to apply the refund check from the vendor, you can record it as a bank deposit.

Here’s how to record the refund as a bank deposit:

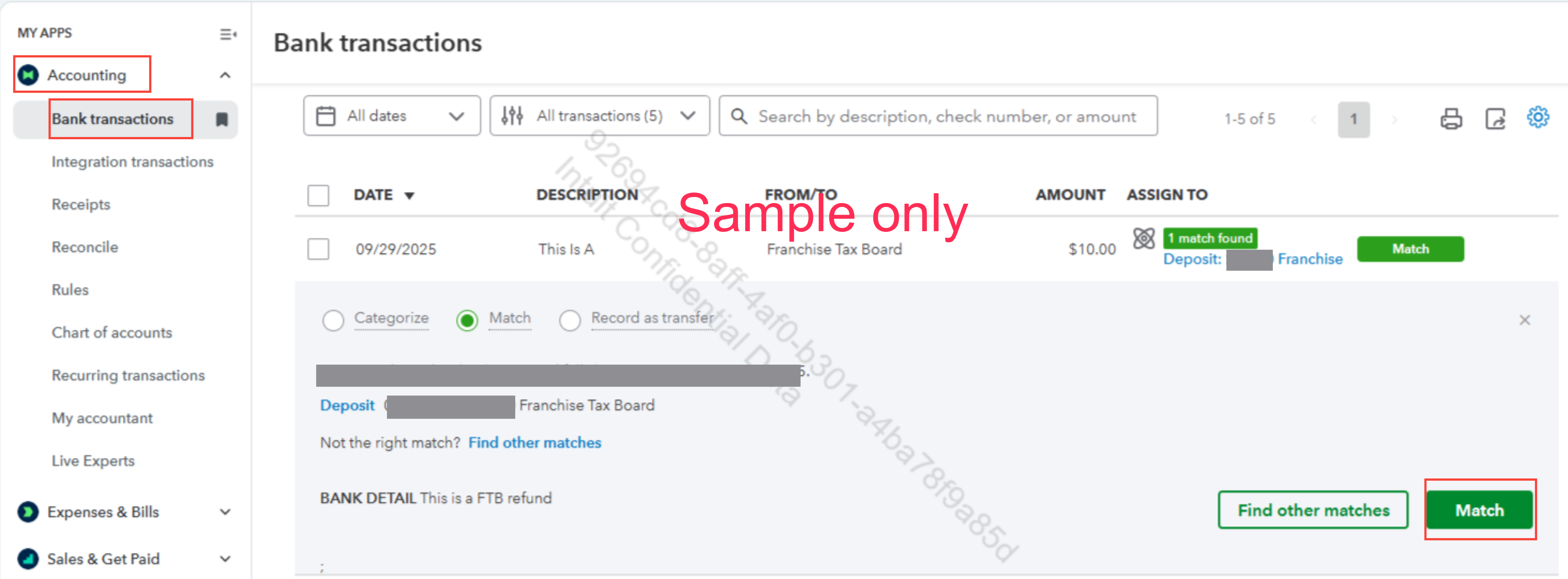

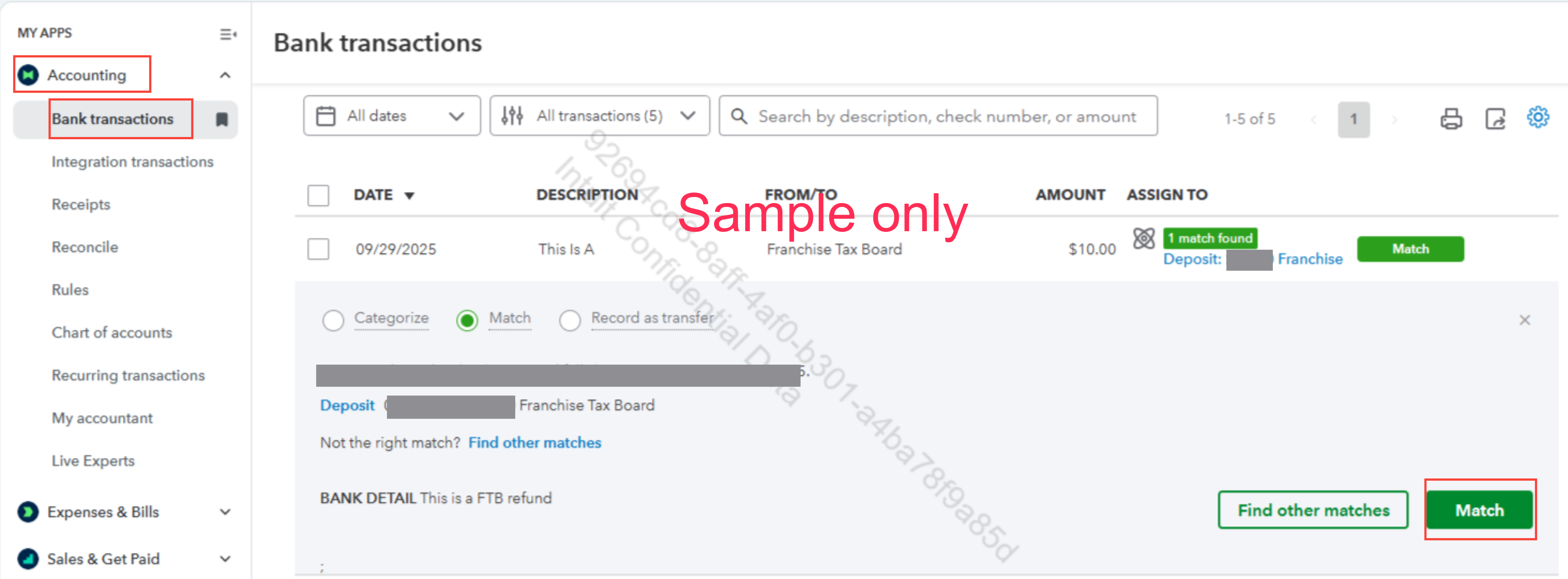

If the bank account where the refund was received is connected to QuickBooks, the transaction will be automatically downloaded. Once the refund transaction appears in QuickBooks, you can match it to the recorded bank deposit.

Here's how:

This method records the refund without applying it to an invoice.

Let us know if you have additional questions.

You can record the refund as a bank deposit, Janna1122.

Since there is no outstanding invoice to apply the refund check from the vendor, you can record it as a bank deposit.

Here’s how to record the refund as a bank deposit:

If the bank account where the refund was received is connected to QuickBooks, the transaction will be automatically downloaded. Once the refund transaction appears in QuickBooks, you can match it to the recorded bank deposit.

Here's how:

This method records the refund without applying it to an invoice.

Let us know if you have additional questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here