Allow me to assist you with recording the Required minimum distributions (RMD) in QuickBooks Online (QBO), @grnmjc.

I recommend consulting your tax professional or an accountant to determine the proper treatment of the distribution amount you've received.

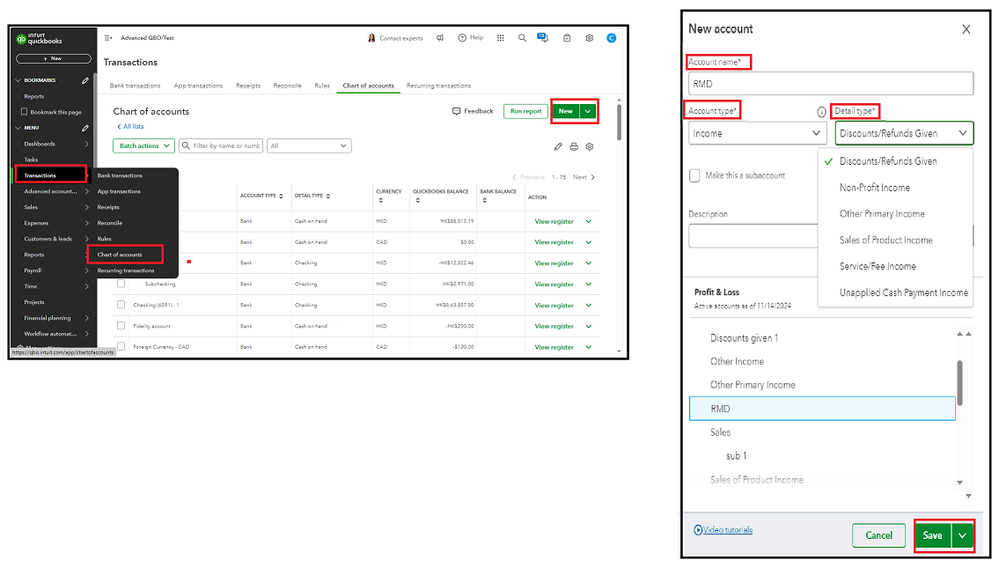

Since RMD amounts are treated as taxable income, I suggest creating an income account in your Chart of accounts. You can follow these steps:

- Go to Settings ⚙ and select Chart of Accounts.

- Select New.

- Enter an Account name.

- Choose Income under the Account type, then select the Detail type from the dropdowns.

- Once done, click Save.

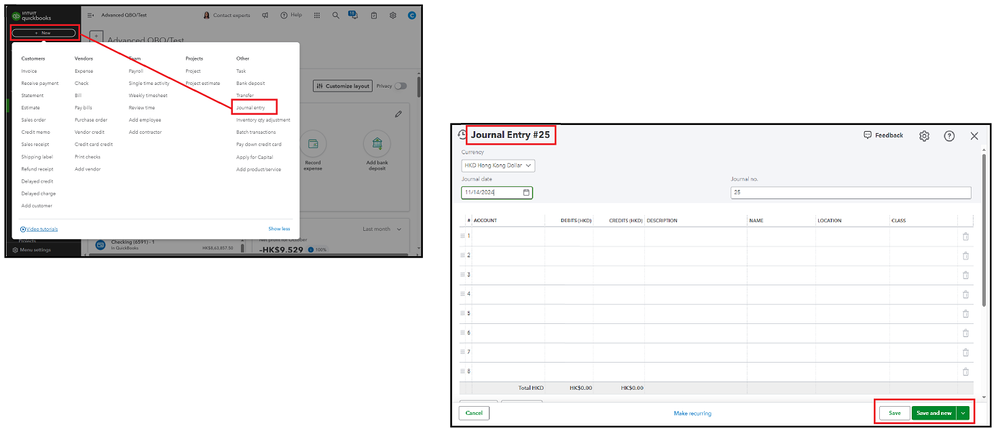

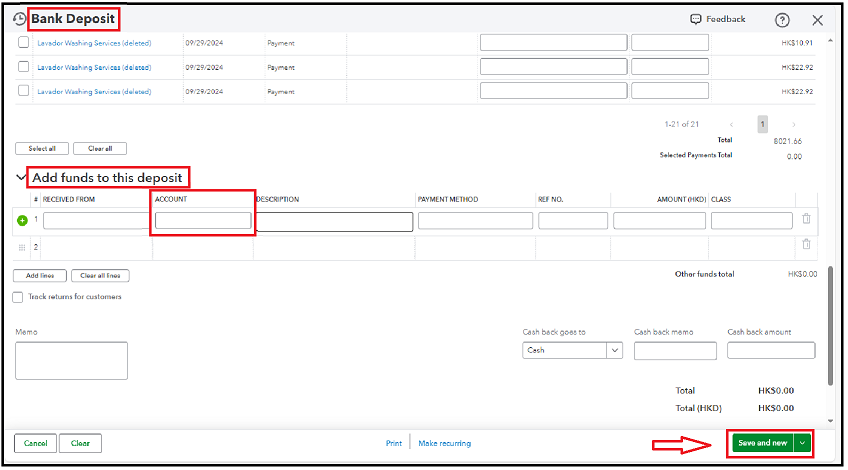

After creating an account, you can record it as either a Journal entry or a Bank deposit.

Moreover, there are lists of QBO reports available in Modern View that will help you a smooth transition over the rest of the year.

I'm here to answer whatever questions you have related to RMDs and any QuickBooks-related concerns. Have a good one.