You can access Payroll Settings to change the QuickBooks posting account of your payroll. I'm here to provide you with a step-by-step guide on how to make this change effectively Xpertise.

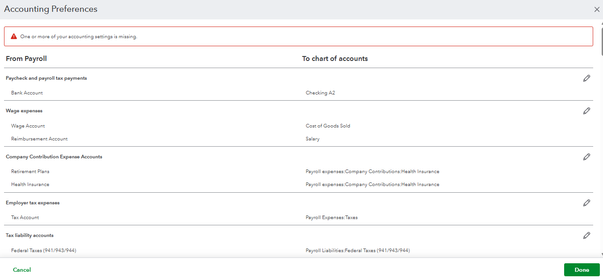

You can modify your default account in the Accounting section to ensure that all payroll transactions and tax payments are posted to the correct account. To do so, follow the below:

- Go to the Gear icon, then Payroll settings.

- In the Accounting section at the bottom of the page, select Edit.

- In the Paycheck and payroll tax payments select Edit. From the Bank account dropdown, select the account you set up in "Step 2: Set up your bank account in your chart of accounts."

- Click Continue, then Done and Done.

Apart from this, you'll also have to ensure to update the bank account with the payroll service before

changing the posting account. Here's how:

- Go to the Gear icon, and then select Payroll Settings.

- From Bank Accounts, select Edit.

- Select Update.

- Select Add new bank account.

- Search your bank name. You may be asked to enter your online banking user ID and password. Otherwise, select Enter bank info manually. Enter your routing and account number, then Save.

- Click Accept and Submit.

To find out more on how to change your company's bank account for payroll, consider checking this article: Change your Payroll Bank Account.

In addition, you may want to update your employees' pay schedule and set up a scheduled payroll afterward. For further details, refer to this article: Create and Run your Payroll.

Explore QuickBooks Payroll to a more efficient financial management, allowing you to focus on growing your business instead of managing payroll complexities.

If you have any other concerns or questions when changing bank accounts for your payroll, let me know. I'm always right here to help you.