Hello @tedra1,

Thank you for posting here in the Community. I'm here to help you with your concern about filing 1099 forms in QuickBooks Online.

Currently, QuickBooks only supports the preparing and filing of the 1099-MISC and 1099-NEC forms. As a workaround, you can run a report to generate the data you need related to Form 1099-DEV.

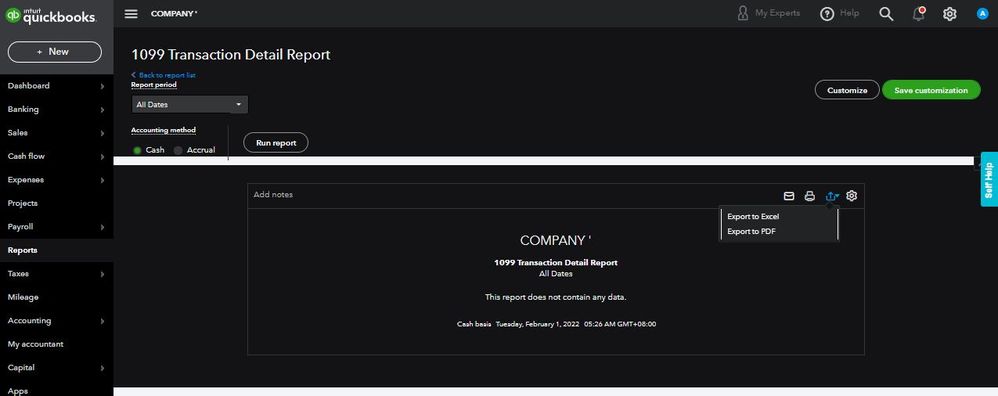

You can go to the Reports section and search 1099 in the search bar. It'll show you the reports available within our system. If you want to customize the data further, I suggest you export the report to Excel by clicking the Export icon (see sample screenshots below).

Once you have the data, you can file the form manually to the IRS. For the detailed instructions, you can visit this link: https://www.irs.gov/pub/irs-pdf/i1099div.pdf

Also, I've found a third-party app that integrates with QuickBooks Online. They offer services for filing 1099-DIV online. Though we can't suggest an app to use, you can check the details from their website: https://www.tax1099.com/integrations/qbo-quickbooks-online-integration.

I've attached an article you can visit to learn more about filing 1099 forms in QuickBooks: Get answers to your 1099 questions.

Drop me a comment below if you have any other questions regarding filing tax forms in QBO. I'll be happy to help you some more.