Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHI if I need to write off an inventory item due to a loss or damage etc what is the correct way so that it shows im out the cost of the item as well as the quantity? It seems if the adjustment on hand using the Cost of goods sold account I dont see any change in my P&L or loss? Please help...

Hi @NauticalJim , Create a sub account of COGS called loss/theft/spoilage and use that account when you do an inventory adjustment. Lower the qty of items that need to be written off. Refresh qbo with clear cache and browsing history. You could use credit memo too for replacing inventory sent to customer. Please see the post and this post . Comment back, cheers.

Good to see you here, NauticalJim.

Let me assist you with your inventory.

The inventory adjustment is the right way to write off inventories. Also, you will need to select an Expense Account as the Adjustment Account to reflect this on your profit and loss report.

Please check this article for your reference on how to adjust your inventory quantity or value in QuickBooks Desktop.

Comment below if you need more help. Have a great day!

Thanks alot! Well what we had done was to put the inventory adjustment into a cost of good sold account however it seems all that does is take it out of inventory so it doesnt affect my P&L or show a loss. All it does is to reduce my inventory so I pay a little lessbusiness property tax at the end of the year but I dont get the writeoff. Am I correct? So exactly how should I make the account so the value of the item taken off inventory shows as a loss on my P&L? Thanks again..keep in mind im notm an accountant or bean counter lol

Thanks also Alex...so it appears thereare different ways to adjust down inventory...one is to just take it off and another is to take it out of inventory and anotheris to take it out of inventory and show the item as a loss...correct? I have another somewhat related question. If I send items to Amazon fulfilment...how do I

1 correctly adjust inventory as its not in my posession

2 At the end of the year do I then put in what was sold and adjust out the cost somehow? Thats a bit more tricky lol

Thanks for sharing additional details, @NauticalJim.

The inventory adjustment will reflect in your Balance sheet report from the asset side. The Profit and Loss report only reflects if there are changes made on your sales and expenses.

Then, to correctly adjust your inventory, you'll want to create sales to put what was sold. This way, QuickBooks automatically adjust your inventory items.

Then, for your 2nd question, I’d recommend consulting with your accountant for the best action to take. Your accountant can give you expert advice on recording it while ensuring your accounts stay accurate.

Also, check out this article for more details in managing your inventory quantity: Adjust your inventory quantity or value in QuickBooks Desktop.

Leave a reply if there’s anything you need help with managing your inventory or with your QBDT software generally. I’m always around to help you.

Thanks for your answer but still a bit confused. I understand that if I sell something it takes out the inventory and applies the cost towards the sale. Inventory adjustment of damage should take out the cost as well as quantity so it shows a loss. Now another question would be if I sell something....gets damaged from Fedex or whatever carrier we use....comes back to us. Then we put in a claim for damage through insurance....and we get an amount that could be cost or more or less...how should we handle it? Currently we are adjusting the item out at zero dollars on the original invoice but keeping in the inventory number...if we get a check we are creating a credit memo putting the item at whatever amount they paid us for damages as well as any refund of delivery. But it appears that isnt going into an income account...Is there another (better)way of doing it? Thanks again.

Hi there, @NauticalJim,

I can share a few insights about the process of writing off inventory in QuickBooks. Inventory tracking uses different journal posting in your books when receiving inventories and selling them.

When you purchase or receive inventory, it debits the Inventory Asset account which is posted in the Balance Sheet report. If there are changes in the quantity because of damages, fire, theft, or breakage, and etc., that's when you use the adjustment option.

This method affects both the Asset and the COGS account, but not necessarily show a loss in your books. This is because, we are only changing the quantity and asset value of the item, but the average cost of the item remains the same. For example, if the average cost is 10 and you reduce the quantity by 2, QuickBooks reduces the value of the items on hand by 20.

If you want to track the loss in the P&L report, you will need to a different entry to account for the unrecoverable funds from damages. This is method is what we call writing off a bad debt. This article can explain the process and steps for you: Write off bad debt in QuickBooks Desktop

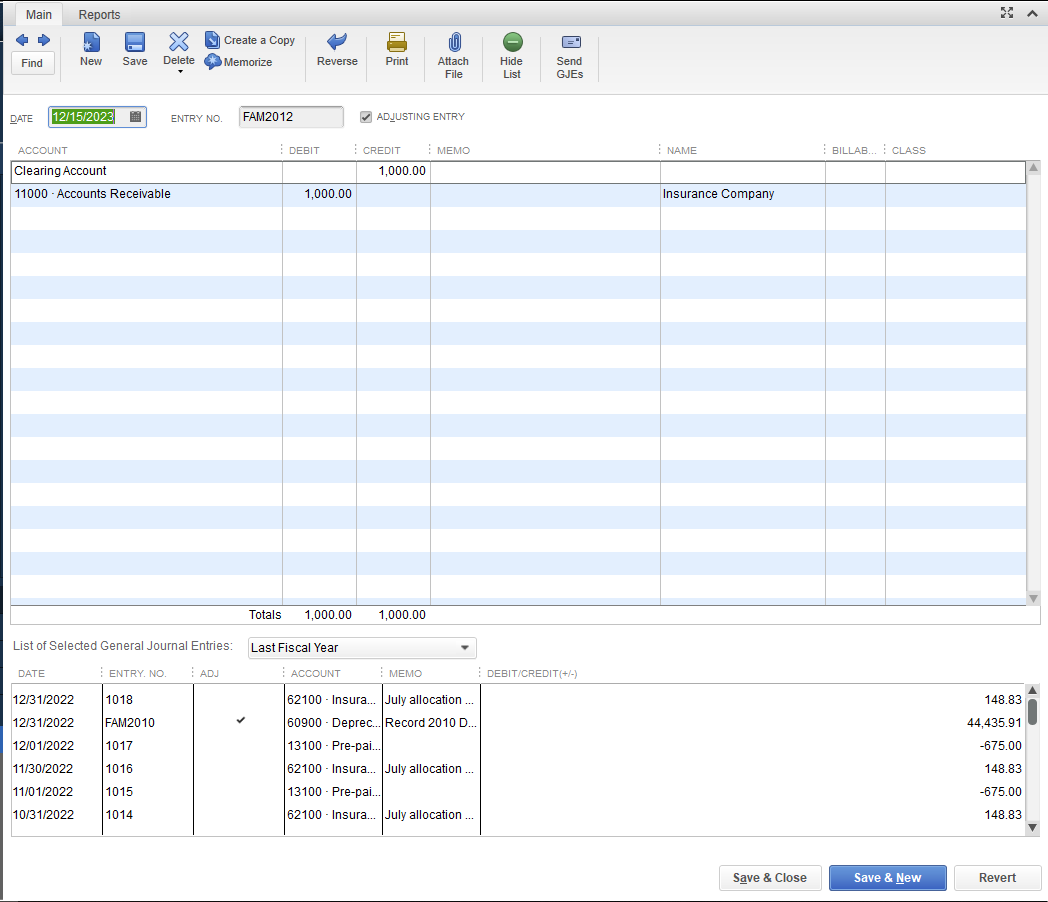

Regarding the other question about the insurance claims, there is a way I can suggest for you. You can set up the insurance company as a customer in QuickBooks, so you can transfer the balance from the original client and apply the claim as a payment. Here's how:

Step 1: Create a clearing account.

Step 2: Add the Insurance Company as customer.

Step 3: Create two journal entries to transfer the Balance.

Step 4: Receive the payment.

Please note that these steps is just a workaround. We always recommend seeking help from an accountant for accounting help and guidance. We want to make sure your books are correct and there is no room for mistakes.

Let me know if you have any questions about this. Feel free to connect with me again by clicking the Reply button below. Have a great weekend!

Hello,

I am new to this community so I hope this is the right place to post a question. I have goods that I can't sell any more. How do I write off these inventory goods as an expense or as a loss?

Which are the specific accounts that must be affected? What is the mechanism in QB to do this?

What happens later if I am able to sell them at a price less that what I paid for them? How would I enter such a sale?

Thank you.

I don't have an answer, just want to stay in the loop for this question, because I have the same one. Expired inventory that needs written off.

Hello beckellh!

You can make an inventory adjustment in QuickBooks Online. Let me show you how.

Make sure to set up an inventory adjustment account to track your adjustments. Follow these steps:

Once done, go to the Inventory menu and select Adjust Quantity/Value On Hand. Then, you can run the Inventory Valuation Summary report to verify that your inventory is now accurate. You can pull up this report when you hover over Inventory from the Reports menu.

Please check this article for more details on how to make an inventory adjustment: Adjust your inventory quantity or value in QuickBooks Desktop.

I'd be glad to help you if you have other concerns. Have a great day!

Since mine is a write-off due to an expiration date, shouldn't it be a loss? Yes, putting it in the COGS affects inventory, but I also need it to as a loss. Now what are my options?

Good morning, @beckellh.

Thanks for reaching back out to the Community. I appreciate you coming here with your question.

Since the problem persists, I suggest contacting our Customer Support Team for further assistance. They'll be able to use more advanced tools to help you out further and take a closer look at your account. Here's how:

It's that simple.

Keep us updated on how it goes. We want to ensure that you're taken care of as soon as possible. Have a splendid day!

To successfully control losses while dealing with inventory of obsolete parts, take into account techniques like inventory write-offs. Partnering with organisations that specialise in optimising spare parts inventories, such as Entytle, can also provide solutions to reduce obsolete stock and enhance overall inventory management effectiveness

This one's a bit of a puzzler, huh? let's dive in with some things you might check. You can print single labels fine, so the connection's gotta be okay. But multiple labels? Maybe there's a hiccup in the process queue or spooler.

I've seen cases where the print queue looks fine but has a backlog. One trick is clearing the print spooler on windows 10. Sometimes a stalled state happens if there's a "ghost" job in the queue, blocking new jobs. Head to services.msc for stopping the spooler, poke around in C:\windows\System32\spool\Printers, and ditch any files there before restarting.

Also, make sure your QuickBooks enterprise is up to date. Sometimes, printing quirks get patched in updates, so keeping QuickBooks and Zebra driver updated might solve it. Try tweaking the printing settings in QuickBooks, especially for your specific label format.

Now, while testing on Windows 11, check for any surprises. newer OS versions might handle USB stuff differently, and it may just skip over whatever glitch you're seeing now. Let me know how it goes or if you spot anything new!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here