Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello. My company is printing QBO INVOICES under EXCLUSIVE OF TAX. With this scheme, I cannot edit the rate. The rate of this item in the screenshot is 95.00. However, when you use EXCLUSIVE OF TAX, it turns into several decimal places and I have no way of changing it. Is there a way to format this to at most 2 decimal places WHILE BEING UNDER EXCLUSIVE OF TAX? The current rate right now looks unprofessional and we would have to send these invoices to the clients and the government.

Thank you for adding a post, Skellytonne. I'm here to share with you some information about handling taxable invoices in QuickBooks Online (QBO).

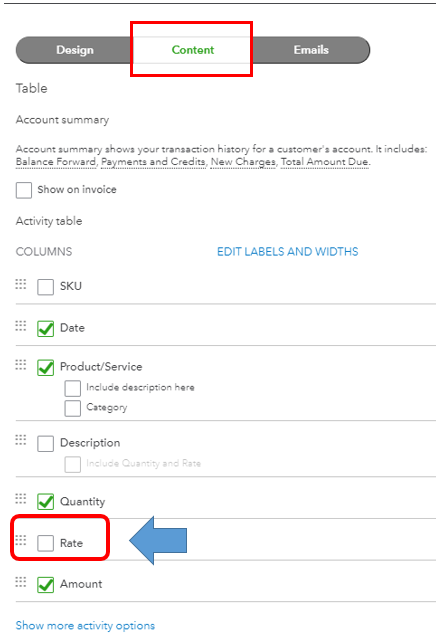

QuickBooks usually rounds up your total invoices or balance dues into two decimal places. However, the rate depends on the quantity, amount, or tax added to your transaction. You can always modify the rate into two decimal places from the Rate column.

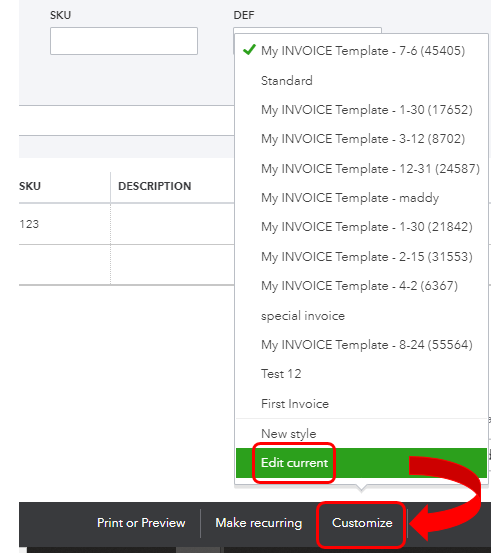

I've added this screenshot for your visual reference.

For more tips about handling your invoice transactions in QBO, you can open this link: Create invoices in QuickBooks Online.

And, here's how you can mark your invoices as paid manually: Record invoice payments in QuickBooks Online.

If you have any other follow-up questions about the rate of your invoices, let me know by adding a comment below. I'm more than happy to help. Keep safe!

I mentioned in my previous post that *I have no way to changing the rate* at all. I don't have that measure to change it as depicted in your screenshot as it's linked to an Estimate.

Thanks for getting back, @Skellytonne. I’ll provide options so you can send these invoices to your clients confidently.

In QuickBooks Online (QBO), you're unable to modify the invoice transaction once linked to an estimate.

You can create a separate invoice then enter the rate manually. Otherwise, remove the Rate column from the template. This way, the amount with several decimal places won’t show up when you send those invoices to your clients.

Here’s how:

These resources contain complete instructions on how to mark the invoice as paid and make deposits in the program:

If you have any other questions or concerns with managing your transactions, please let us know. We’re always here to help.

I do not like the idea of not linking the estimate and the invoice together as they go hand in hand, as per my company's procedure. It is also required for us to put the rate in the invoices to as not only they are for the customer's reference but also in compliance with government laws.

Hello, Skellytonne.

Thanks for the clarification. I have a suggestion to help you round off the Rate to two decimal places while keeping your estimate and invoice linked.

Looking at your previous posts, it looks like you're using the Progress Invoicing feature. QuickBooks locks the Rate column after creating an invoice from the estimate.

In this case, you'll want to edit the estimate first before creating an invoice. Make sure to set the tax scope to Exclusive of Tax, then round off the Rate amount to two decimal places on the estimate. Afterwards, create an invoice out of it.

Doing this ensures the estimate is always linked with the invoice.

If you need more help with progress invoicing, check this article out for references: Set up and send progress invoices in QuickBooks Online.

Need to reconcile your customer payments and ensure your books agree with your statements? Check this guide out for more details: Reconcile an account in QuickBooks Online.

Do you have more questions about your estimates, taxes, or invoices? Please let me know and I'd be more than happy to share a guide or two.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here