Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI had a Payment to Deposit window pop up for $1.00 when I went to Record Deposits. I researched the payment that needed deposited, and it was from an entry into the Undeposited Funds account in 2022. The payment had subsequently been deposited in 2022, and still shows in the Undeposited Funds account as being deposited. The account balance of the Undeposited Funds account shows $0.00. The checkmark is missing in the checkmark column next to the $1.00 entry from 2022. I have no idea why the checkmark is missing, or why this popped up as a Payment to Deposit, but I need to get rid of it because the window pops up with every deposit I make. Does anyone know how this happened and how to get rid of it?

Solved! Go to Solution.

@Angela210 First, I would generally advise against using GJEs in this way. QB has some hiccups with them, both in functionality and in reports.

Second, since you mentioned researching the matter, I am assuming that you were not the person who created these entries.

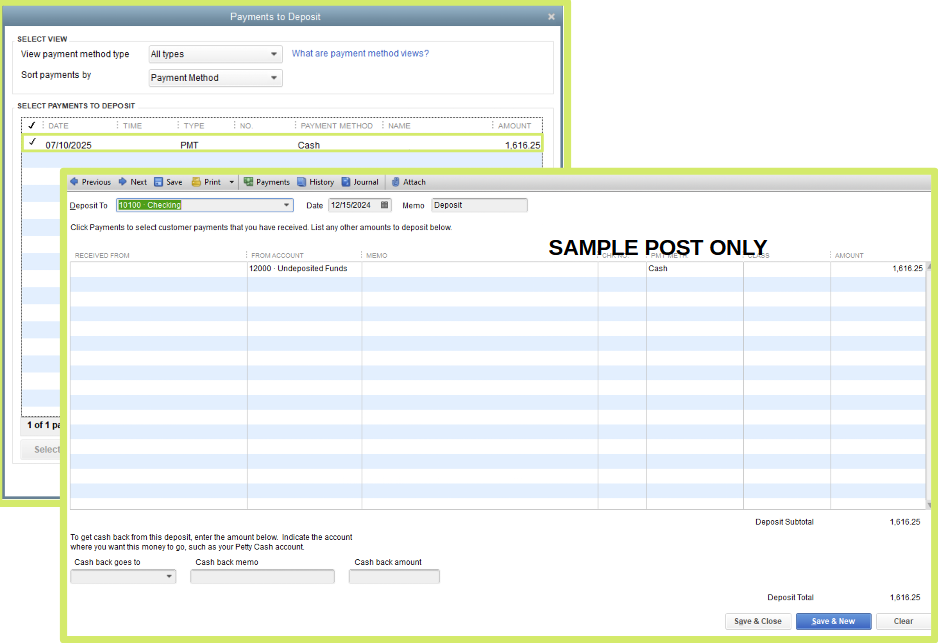

If so, it is possible that the person who did simply used Undeposited Funds as the source account without selecting GJE 904 from the list when they went to Make Deposits.

While this would certainly reduce the Undeposited Funds balance to zero, it would not necessarily use GJE 904's entry to do so. This would cause the behavior you are seeing here.

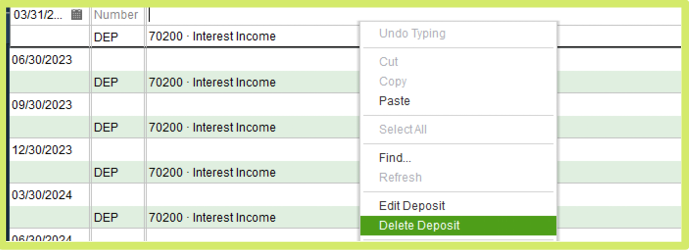

This being the case, the only way I would know to fix it would be to delete and recreate the deposit on 12/30/2022 the way it should have been.

Otherwise, the only thing that comes to mind is that there is another $1.00 at play here. You can sort the Undeposited Funds register by amount to check that kind of thing.

@Angela210 "The payment had subsequently been deposited in 2022---"

Can you provide an image of the entry showing this $1.00 being deposited properly in 2022?

@Angela210 First, I would generally advise against using GJEs in this way. QB has some hiccups with them, both in functionality and in reports.

Second, since you mentioned researching the matter, I am assuming that you were not the person who created these entries.

If so, it is possible that the person who did simply used Undeposited Funds as the source account without selecting GJE 904 from the list when they went to Make Deposits.

While this would certainly reduce the Undeposited Funds balance to zero, it would not necessarily use GJE 904's entry to do so. This would cause the behavior you are seeing here.

This being the case, the only way I would know to fix it would be to delete and recreate the deposit on 12/30/2022 the way it should have been.

Otherwise, the only thing that comes to mind is that there is another $1.00 at play here. You can sort the Undeposited Funds register by amount to check that kind of thing.

Thanks... that worked!

@Angela210 That's good; keep in mind that you'll probably have to do a mini-reconciliation on your bank account afterwards since the recreated deposit won't be reconciled any longer.

That'll correct your ending/beginning balance for the next month you reconcile.

A mini-deposit. Yes! Thanks.

A mini-recon...Yes!! Thanks.

I am having the same with 13 items are in my payment to deposit window. I have researched and the invoice has been paid with a payment already. Any suggestions on where to start this nightmare?

Thanks,

T8terpie_

The Payment to Deposit window will show if you haven't cleared out invoice payments from the Undeposited Funds account, T8terpie.

Firstly, please know that this window will display regardless of whether you've paid these invoices, as QuickBooks requires payments to be moved out of Undeposited Funds before they're considered fully deposited.

If you manually entered deposits directly into the register without going through the Make Deposits section, QuickBooks won't clear the payments from Undeposited Funds, leaving them unresolved. This is why these payments keep appearing in the Payment to Deposit window, even though the invoices are marked as paid.

To fix this issue, follow these steps:

Once we have completed this, let's make sure to accurately record these deposits in the Banking section.

After deleting these, please make sure to reconcile your account again to restore accurate balances.

On the other hand, if these transactions weren't previously deposited into the correct account, the Payment to Deposit window will continue to display them until the Make Deposits workflow is completed. For proper guidance, please refer to this article: Record and make bank deposits.

If you have other questions about this please don't hesitate to reply to this forum.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here