QuickBooks Desktop employs weighted average cost or FIFO to value your inventory and determine the amount debited to COGS, when using advanced inventory. I have tips on what you can do about this, Accounting.

Currently, we're unable to provide you a direct information on how the Inventory Valuation Report can make adjustments at LIFO. The Last-In, First Out (LIFO) method assumes that the last unit to arrive in inventory or more recent is sold. Thus, this results in lower ending inventory on the books and lower net income. This also reduces taxable income and tax expenses. Since QBDT uses the FIFO method, I suggest consulting an account so they can provide you with an application that can simplify the process of how you can do about this.

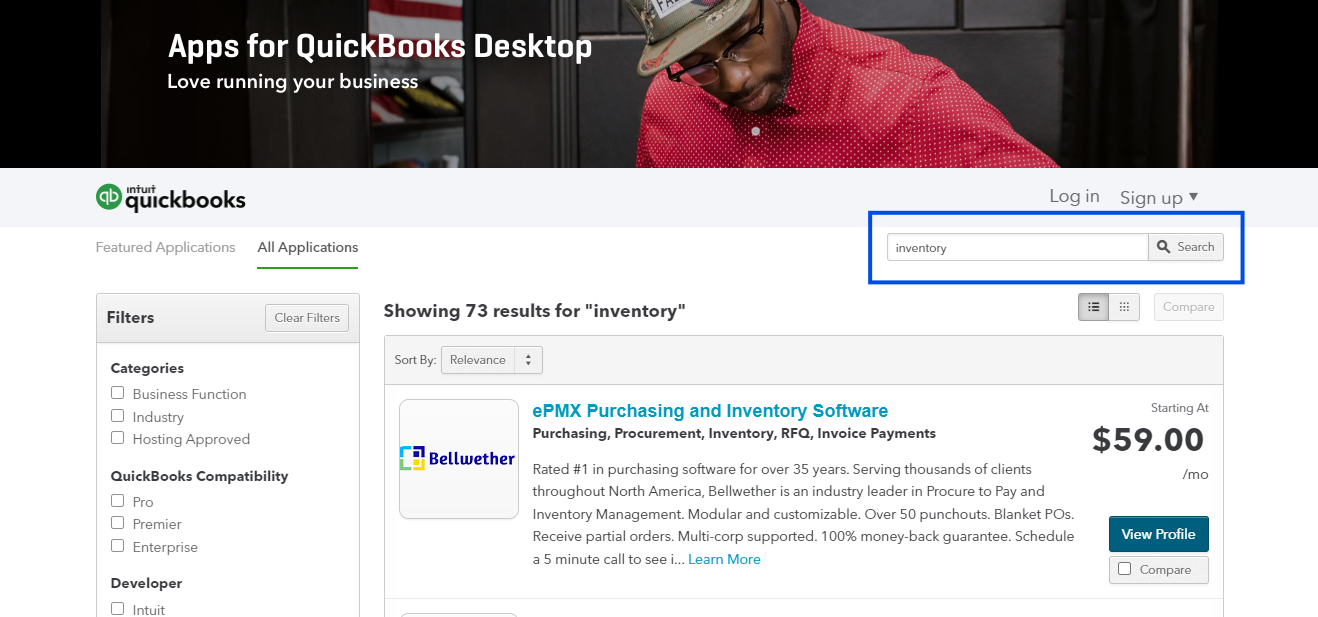

You can check our Desktop Apps website that allows system integration with QuickBooks Desktop:

For further guidance, I recommend checking out this article on customizing reports in QuickBooks Desktop. This resource provides steps on how to generate customized reports to display inventory items that were specifically adjusted in your account: Customize Reports in QuickBooks Desktop.

If you have any additional inquiries or concerns regarding adjusting inventory using reports, please don't hesitate to reach out to us. We would be more than happy to provide further assistance and support you through the process.