Allow me to be your guide and help you record the raincheck in QBO, elevated1.

You can record it as a credit memo so it can be used as a payment for future transactions. It's usually used if a customer has made a payment for a cancelled service, returned a product, or requested a refund.

I'd be glad to share these steps with you:

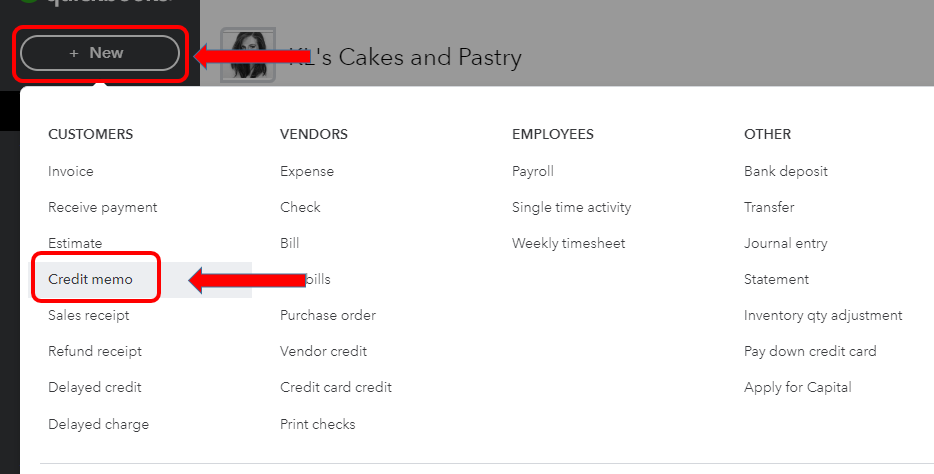

- Click the + New button and select Credit memo.

- Look for the customer's name in the drop-down list for Customer.

- Enter the credit memo details, such as the date and the amount of the refund.

- Choose Save and close.

Then, follow these steps once you're ready to use it in a future invoice:

- Go back to the + New button and select Receive payment.

- Look for the customer's name in the drop-down list for Customer.

- Scroll-down to the Outstanding Transactions section, then select the open invoice you want to apply the credit memo to.

- Select the credit memo that you created for the raincheck in the Credits section

- For the open invoice in the Payment column, enter how much of the credit you want to apply.

- Fill out the rest of the form, including the Payment date.

- Make sure the total is correct after applying the credit memo.

- When you're done, select Save and close.

Here's an article that talks about the process for more details: Create and Apply Credit Memos or Delayed Credits in QuickBooks Online.

Let me know if that answers your question about recording the raincheck in your account. You can also post more questions if you need anything else from us.