Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a few expenses that were marked as billable in 2018 for a project that will be invoiced in 2020. Considering the transactions have been reconciled; the 2018 Federal Tax Return has been filed and; the expenses were entered in 2018 and marked as billable however, the markup has not been applied to the expense entries...can I add these billable expenses to my 2020 invoice? If so, can I add a mark up to the 2018 billable expenses?

yes you can add them

billable expense charged to the customer is income not expense, in company settings you should set it to record billable expense as income and choose the income account

Thank you for taking the time to reach out to us here on the Community page, @KrisG9988.

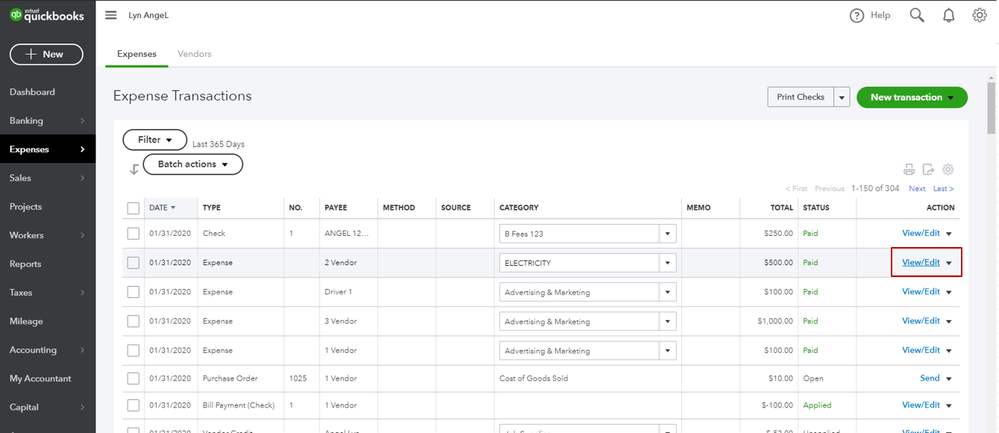

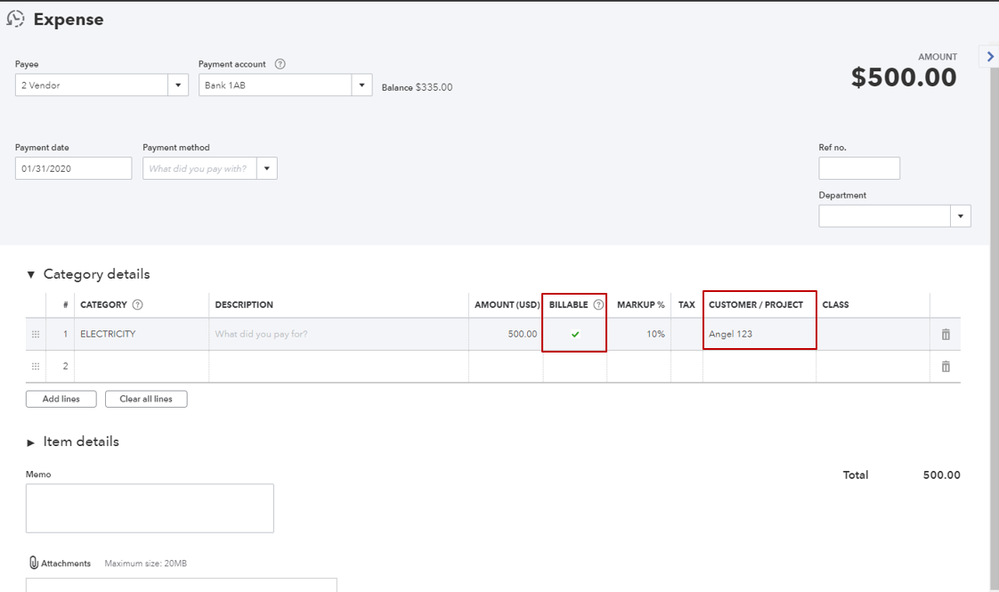

If the expenses have billable selected to a customer, then yes, these can still be added to the invoices dated this year. If they don't, you can edit those transactions and put a check-mark on the Billable column and select a customer. Just be sure not to edit the amounts or dates as this will affect the reconciliation.

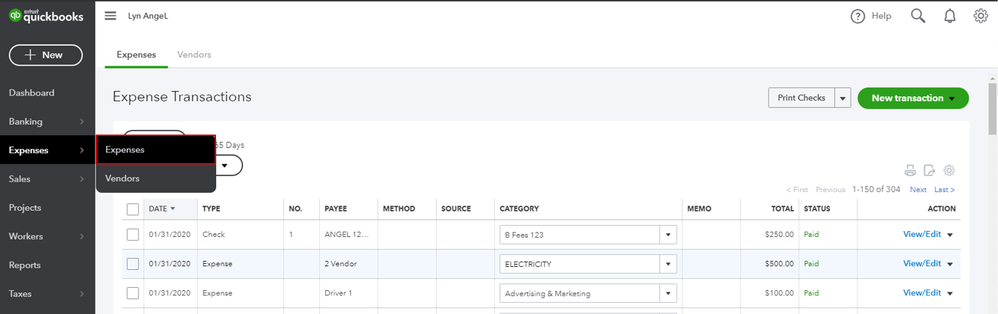

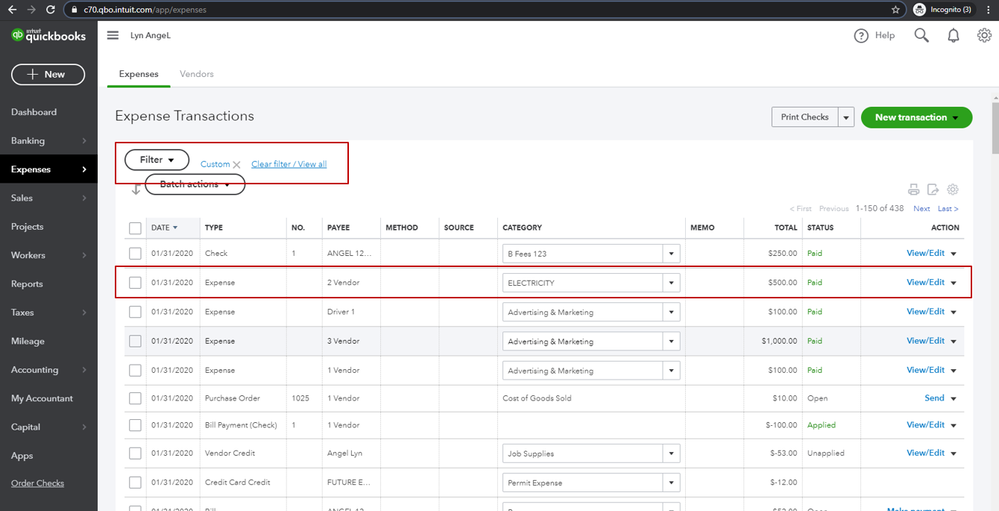

To modify the expenses:

Once completed, you can now add the billable transaction to the current invoice. For your guide, check out this article: Enter billable expenses.

You can reach out to me if you have any other questions. I'm a few clicks away to help. Have a good day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here