Yes, you can add the payments in QuickBooks Online (QBO), acleangetaway. I'd be glad to show you how.

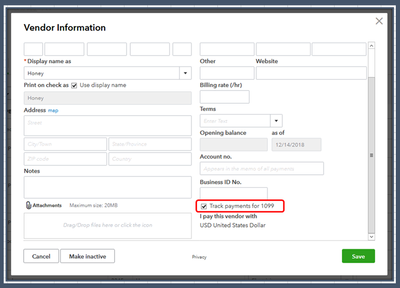

The prior transactions can be entered as an expense in QBO. Beforehand, let's ensure the vendor is set up and tracked for 1099. Here's how:

- Go to Expenses, then the Vendors tab.

- Select the name of the vendor.

- Click Edit.

- Make sure to put a checkmark on the Track payments for 1099 box.

- Update other information, then hit Save.

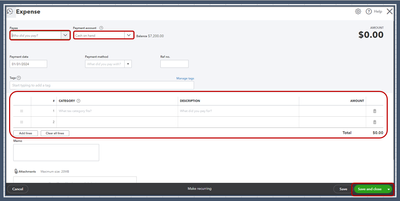

After that, you can start tracking:

- Click the Plus (+) icon in the upper-right corner.

- Below Vendors, select Expense.

- Choose the vendor.

- Add the Bank/Credit account.

- Enter the necessary information.

- Click Save and close.

In addition, you can also track them as bills or checks in the program.

Once everything is all set, I suggest checking out this article to prepare and submit the form: File 1099 with QBO.

Please don’t hesitate to add a comment below if you have additional concerns or questions about managing transactions for contractors. I’ll be here anytime to help. Have a good one!