You can definitely create and file additional 1099s in QuickBooks Online, Sherry.

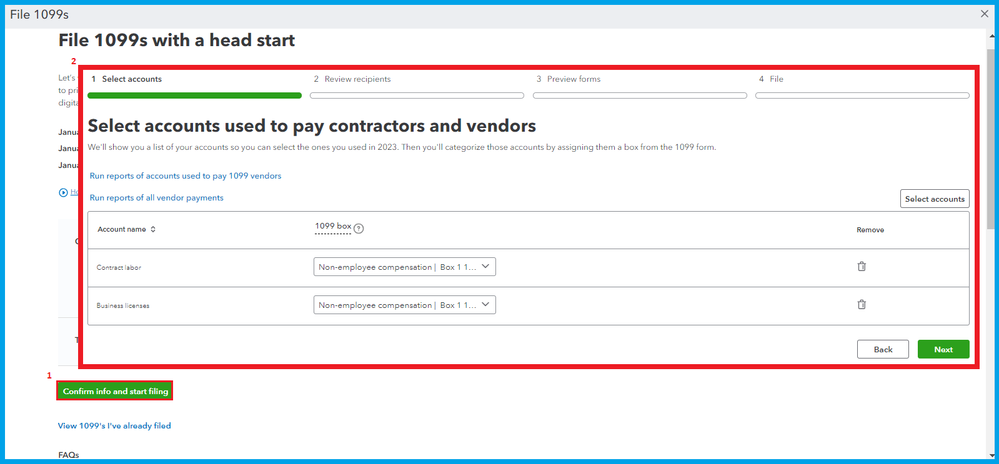

We can process and e-file your contractor's 1099 forms following the usual procedure. However, please note that each form or batch that we send will be charged separately to your account. Before submitting them, ensure all information and accounts are set up correctly.

Here's how:

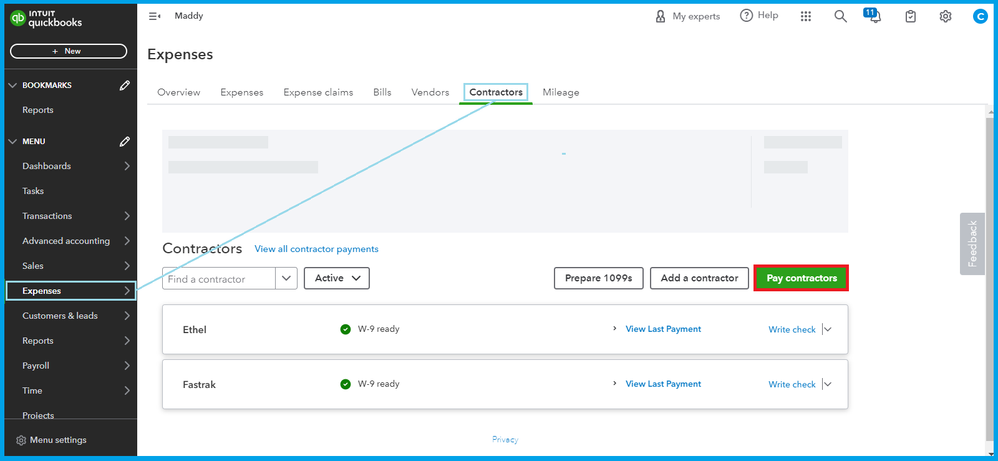

- On your left panel, go to the Expenses menu.

- Select the Contractors tab.

- In the right corner of your screen, you will see Prepare 1099s.

- Once routed to the next page, click the Continue your 1099s or Confirm info and start filing.

- Follow the next steps for filing.

Once done, proceed to step 3 of this article to check your filing status: Create and file 1099s with QuickBooks Online.

Save this reference in case you need to change or modify 1099: Correct or change 1099s in QuickBooks.

Please keep us posted if you need more help with 1099 filing or delivery. I'm always here to assist you.