I'm here to assist and direct you on how to record your transaction, hihtatafu.

QuickBooks Self-Employed (QBSE) uses single-entry accounting and is designed to track business income and expenses. That’s why the option to write off gift cards is currently available.

You can consider using QuickBooks Online (QBO) to track transactions for your business accounts. Click here for more information on the features and benefits of each version.

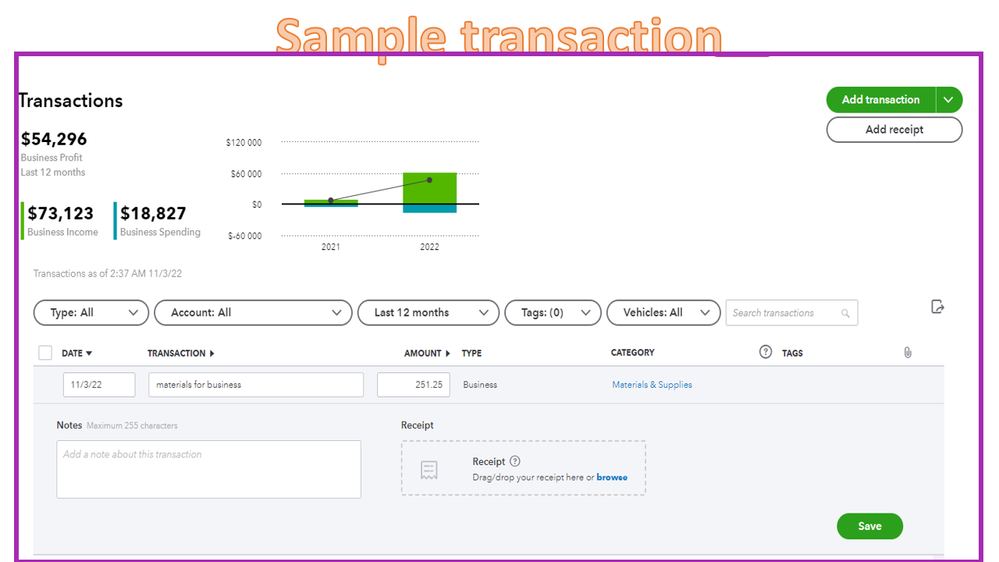

In QBSE, you can record the materials for your business on the Transactions page and classify them using the Schedule C categories. I also recommend consulting with an accountant to ensure the accuracy of your records, particularly the specific category to use on the entry. Let me show you the steps to input the entry:

- In your company, head to the Transactions menu on the left panel and click the Add transaction button.

- This action will expand a line where you can input the entry.

- From there, fill in the fields with the correct information and tap the Select a category link.

- Then, select the category type from the list.

- Once done, click Save.

I've included a screenshot of how it should like after following these steps:

For more details on how to enter sales income and expenses using a mobile device or browser, check out the following guide: Manually add transactions in QuickBooks Self-Employed.

You can also use our online resources to help you complete specific QBSE tasks. From there, you'll find information on mileage tracking, banking transactions, tax payments, and forms.

If you have any further questions about recording your transactions or other product-related issues, leave a comment below. I'll get back to assist further. Have a wonderful rest of your day.