Good day to you! I'd be glad to answer your questions about tracking transactions on a branch level, JCTFG.

Yes, you can create classes or sub-classes and use them to separate transactions from each branch. The Class tracking feature is also used to track transactions not only for departments, but also for product lines and other meaningful segments in your business.

Here's how to activate it:

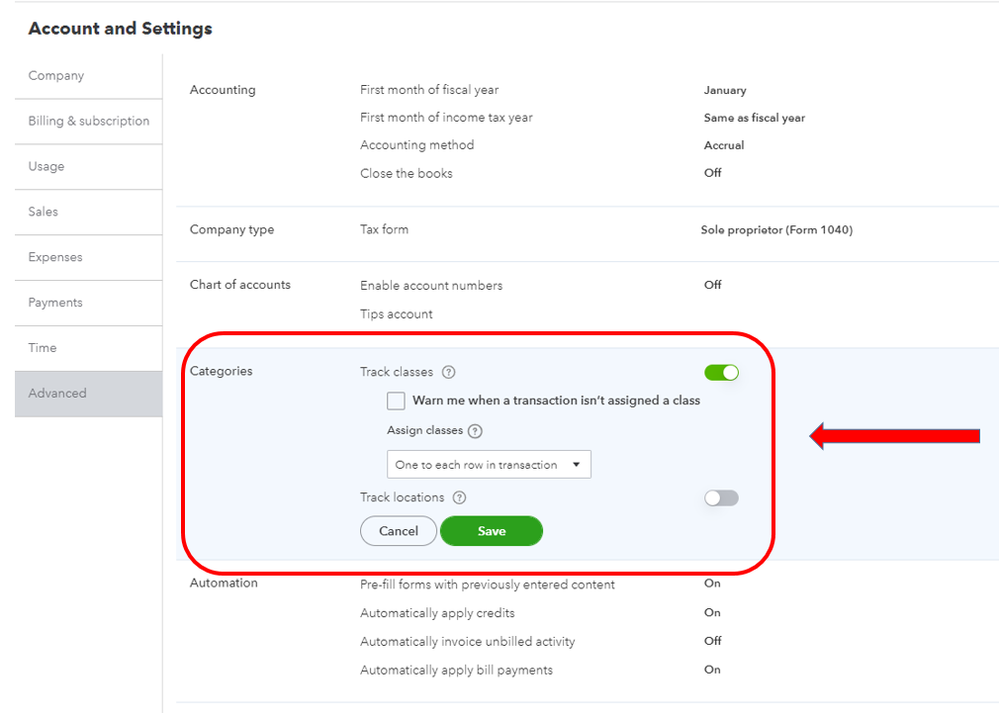

- Go to the Gear or Settings ⚙ icon and select Account and Settings.

- Proceed to the Advanced tab, then click Categories.

- Slide the bar to right beside Track classes.

- Under Assign classes, select One to entire transaction or One to each row in transaction.*

- Choose Save, then click Done.

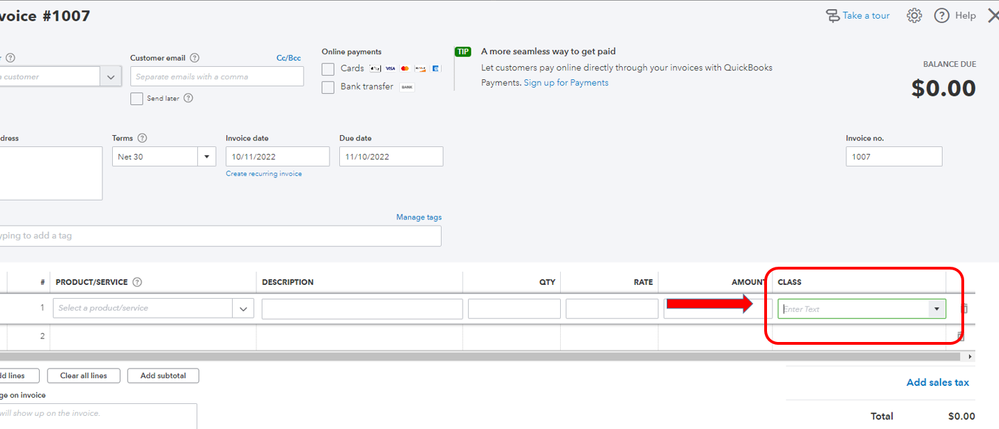

Once done, you can now assign classes to the entire transaction or per line items. As the name name suggests, the One to entire transaction option will apply the selected class to the entire transaction. While the each row option is commonly used if there are different classes to a single entry.

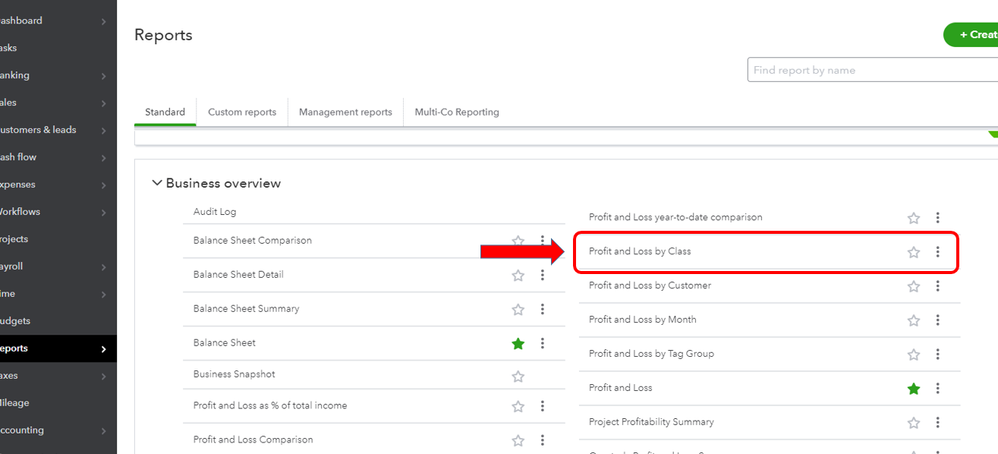

Then, run the Profit and Loss by Class report to get the data you need about each department or branch. Here's how:

- Go to the Reports menu and go to the Business Overview section.

- Click Profit and Loss by Class.

Additional guidance and references on how to use this feature are discussed here:

Let me know if that's all the information you need about tracking classes. You can also ask follow-up or post more questions if you need anything else.