Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I want expenses incurred to show up on the books for 2019; however they are not payable until 2020. Do I input this by entering bills and it show up correctly for my accountant or should I do some sort of journal entry?

Entering Bills in AP for the money you owe vendors will hit your books on the date of the Bill when reports are run on an accrual basis.

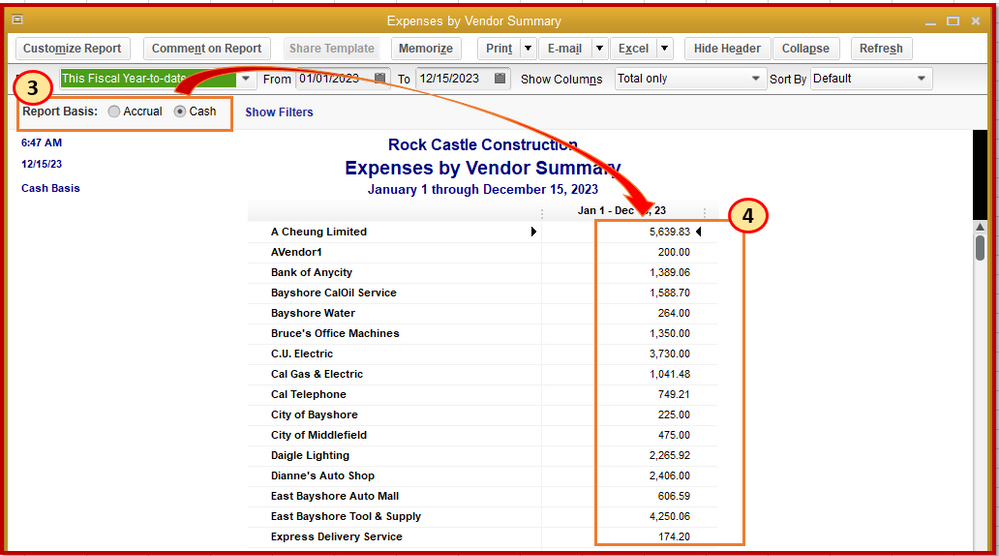

We run on a cash basis. Will the expense still show up as accrued in the current year? Also, what report will the accountant run to get this information?

Hey there, sdgamble1,

The cash basis counts expenses you've paid this year, while the accrual method shows them regardless of whether you've paid all your bills.

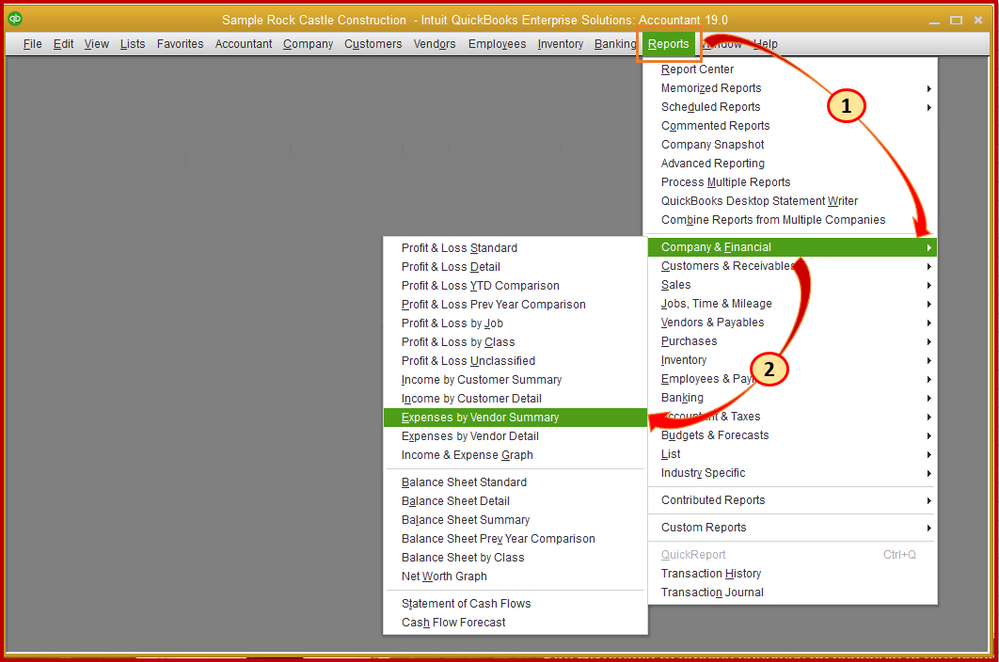

Also, you can run the Expense by Vendor Summary report to see the total expenses for each vendor. Let me show you how:

If you want to filter it, you can refer to this link, Customize reports in QuickBooks Desktop. Then, go over to the Display, Filters, Headers/Footer, and Fonts & Numbers tab link for the detailed steps.

I've added this article for additional information, Choose between cash and accrual accounting methods in reports. It will tell you more about the accounting method in QuickBooks Desktop.

Don't hesitate to leave a comment below if you have follow-up questions, and I'm happy to answer them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here