Hello there, @cwspringshoa. I'll be glad to help you check your Sales Tax Liability report so it will not show as zero since you set up your invoices correctly. That way, everything is accurate before you file your return to your tax agency.

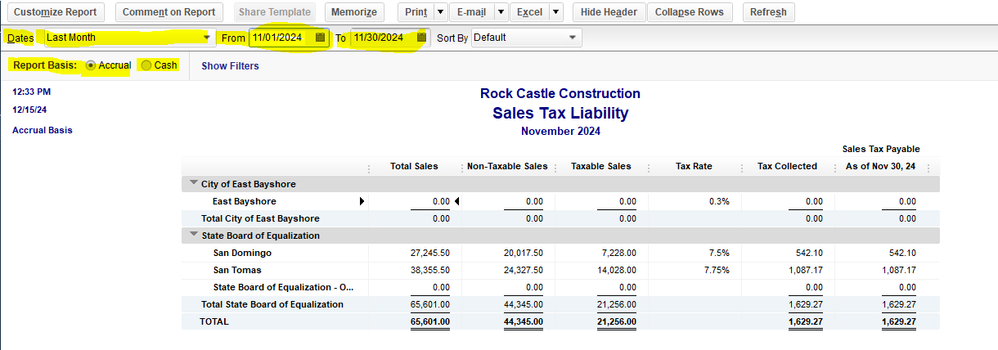

The Sales Tax Liability report displays the summary of your taxable and non-taxable sales, as well as the total sales tax collected from customers. If the report does not show any details, even if you have collected thousands of dollars, you should double-check the date range and the report basis you have selected. If the chosen date range does not include any sales tax transactions, the report will display zero.

To review the report basis and date range, follow the steps below:

- Go to the Reports menu.

- Select Vendors & Payables and click Sales Tax Liability.

- Set the dates and Accounting method (Cash or Accrual).

- Click Run Report to refresh the page.

Then verify if all the transactions will show in the report. For more details about reviewing your sales tax report and report basis, see these articles:

I'll be adding these articles that will help fix common issues when running the Sales Tax Liability report in QuickBooks Desktop:

That should do it. If you have any further questions or concerns about sales tax reports, please don't hesitate to reach out. I'm here to help. Take care and have a great day.