Congratulations on upgrading your QuickBooks! Grmw33.

The entire process will not impact the payroll subscription since they are two different licenses. The data will also be intact and will automatically incorporate as long as your using the correct backup file when moving to the new version.

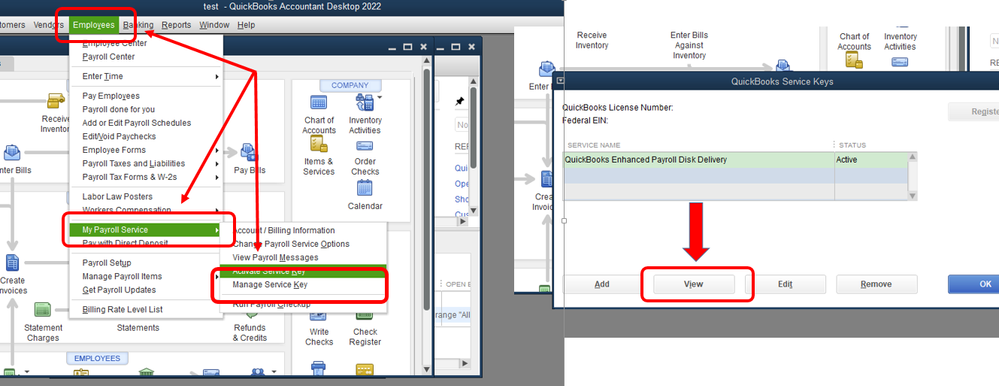

However, you can still take note of payroll service key and type it in your company file once the upgrade is complete. Here's how to view in your existing version:

- Go to the Employees menu, look for My Payroll Service, and then select Manage Service Key.

- Click View.

- Select Next, then choose Finish.

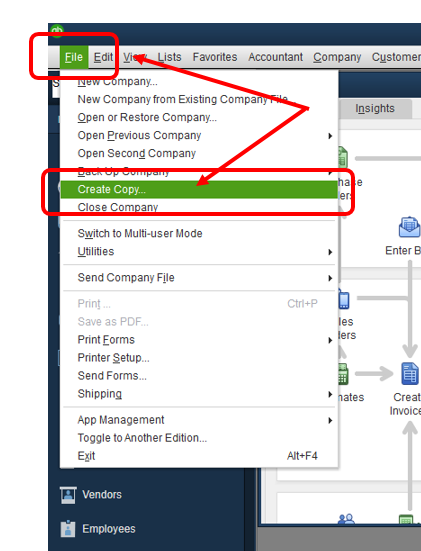

You can also follow these steps on how to create a backup copy to make sure all information are saved and transferred into the new one:

- Go to the File menu again and hover over Back up Company.

- Select Create Local Backup.

- Follow the succeeding steps and prompts on how to save the file.

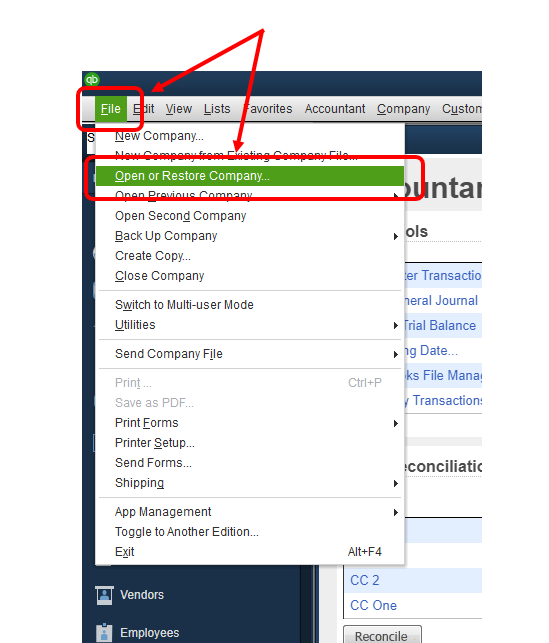

Then, use these steps on how to restore it in the new version:

- Go back to the File menu and select Open or Restore Company.

- Select Restore a backup copy and then Next.

- Choose Local Backup and then Next.

- Look for the the file that you saved and click on it. Then choose Open.

Feel free to take a look at these articles as well for additional information and references:

Let me know if that's all the information you need about moving to the new version of the program. I'd be glad to join you again in your future posts if you need more help from us.