Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWhen recording an expense in QB online, it was initially paid with a credit card (not linked to QB). I have since paid the credit card with the business checking accout that is linked to quickbooks. How do I properly record the expense so that I don't show anything for that credit card in my balance sheet? I want to just record the expense and say it was paid via checking- is that correct? If I show paid via credit card, how do I show the creidt card was paid via teh busines checking account?

Recording a business expenses that's paid with a credit card not linked to QuickBooks Online (QBO) is easy, and I'm here to show you how, @CarolCromack.

Generally, we recommend not to mix business and personal expenditures in QBO. While it's sometimes unavoidable, you can record one as an expense transaction. With this process, you properly record the expense and not showing anything for the credit card (not linked to QBO) in your balance sheet. Then, indicates that the credit card was paid via the business checking account.

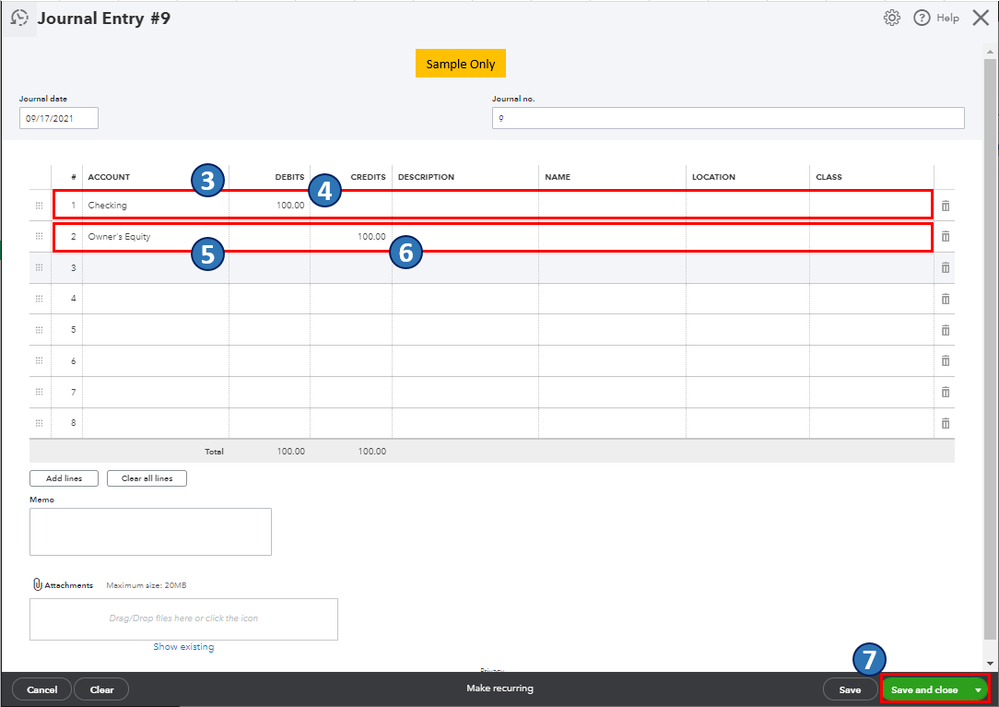

To do this, you'll first have to enter a Journal Entry (JE) to record the business expense you paid for with your credit card. Here's how:

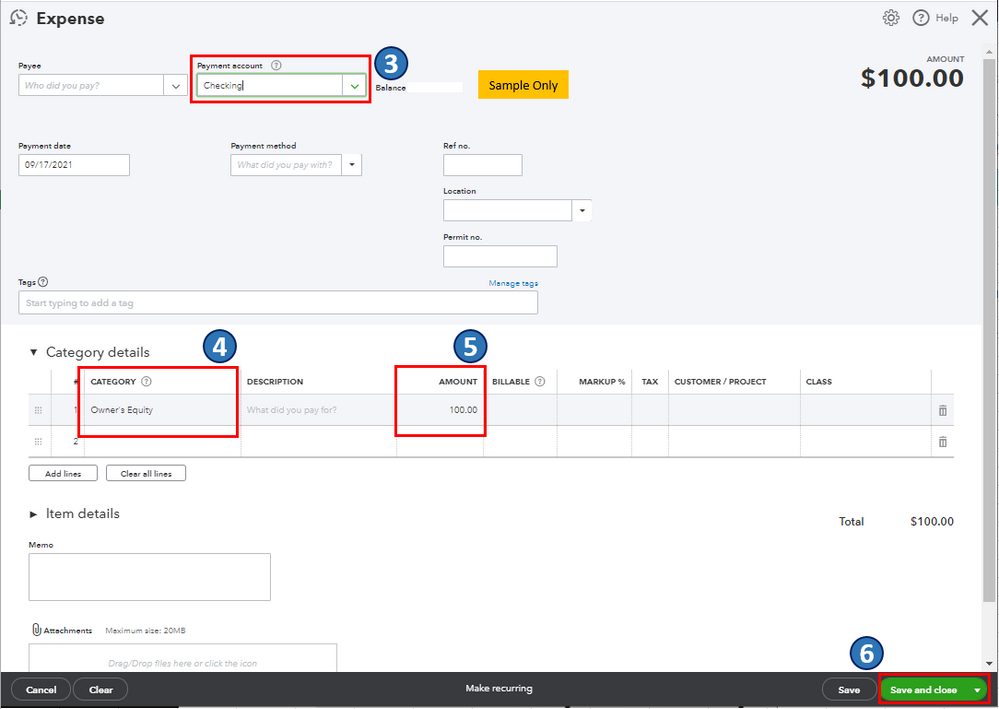

Then, record a reimbursement as an expense. This will show that the credit card was paid via the business checking account. Here's how:

Once you're done, I'd recommend pulling up the Transaction Detail by Account report. This is to verify that the expense is recorded to the appropriate account. Go to the For my accountant section from the Reports menu's Standard tab.

Also, I'm adding this article to know more on what transaction to create for a specific business expense in QBO: Learn the difference between bills, checks, and expenses in QuickBooks Online. It includes topics on when to enter bills, payments, and checks or expenses.

Keep me posted on how it goes in the comments below. If you have other concerns about recording and managing business expenses in QBO, I'll gladly help. Take care, and I wish you continued success @CarolCromack.

Thanks- I will try that. Just a side note- The expense wasn't paid with a personal credit card. I decided to unlink the credit card we use for business expenses because QB was not pulling every expense automatically. Some expenses were pulled in twice and some had incorrect amounts altogether. The software simply wasn't doing this accurately. I decided to go back to manually entering all my business expenses. Thanks again for your help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here