Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a situation where I need to refund a customer after an invoice has been paid, and I have tried the following steps:

1) Create Credit Memo

2) Create Expense/Check

3) Apply the Expense/Check via "Receive Payments"

The end result is that the Customer has a "0" balance, however, when I run a P&L find that both the Expense/Check & the Credit Memo are showing up under "Unapplied Cash Payments". Can you help me to understand why this is happening, and what if anything I can do to resolve this issue.

I appreciate the detailed information with regards to how the refund was recorded, cleco1.

The term "Unapplied Cash Payment" is a concept frequently utilized in QuickBooks Online (QBO). It typically arises when there's a payment check that has not been allocated to a vendor bill.

Additional details about this are discussed in these resources:

Now, let's examine the Expense or Check transaction to verify if the Accounts Receivable account was used. After confirming the use of the Accounts Receivable account, it's important to ensure that the Credit Memo and Expense transaction are correctly linked in the final step.

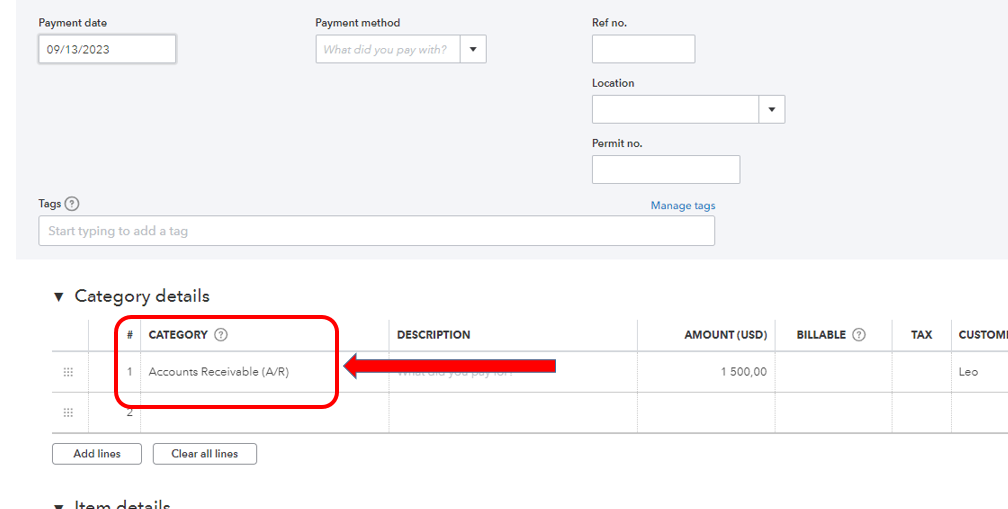

First, access the Check and proceed to the Category column. If it's assigned to a different account, modify it to "Accounts Receivable A/R."

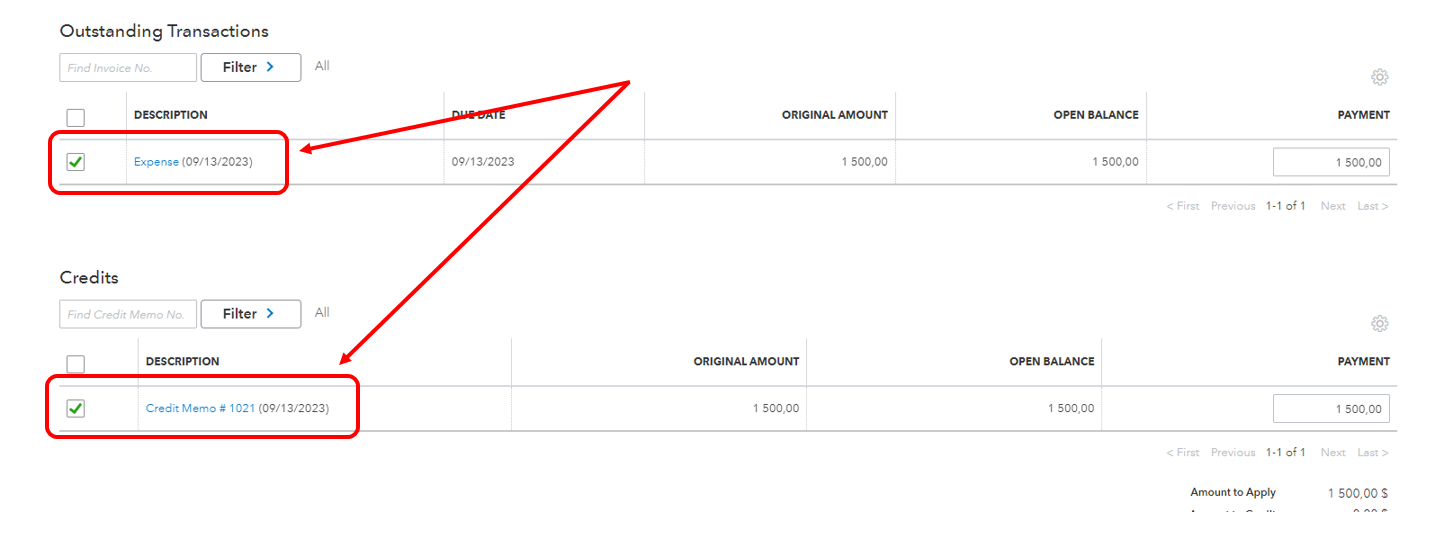

Second, go back to the Payment transaction and make sure that both Expense and Credit Memo are selected.

Once these steps are completed, revisit the Profit and Loss report to check if the Unapplied Cash Payment is no longer present.

Feel free to use these articles as your guide in case you need to record customer credits in QBO:

Remember, the Community is always available should you require any further assistance or have additional inquiries.

I have applied the expense to the A/R account. The Expense has been applied to the Credit Memo. I have attached a screenshot of the Profit and Loss showing still showing the Unapplied Cash Payment account reflecting these values. Incidentally, the Credit Memo is also showing up under Not Specified, even though I had assigned it to the same Class as the Expense/Check (8010 Arrow Creek)

Good morning, @cleco1.

Thanks for reaching back out with additional information about your issue.

With the details you gave, I recommend contacting our Customer Support Team for further assistance. They'll be able to review each part of your account that has to deal with this situation so they can determine the best solution for you. Here's how:

It's that easy!

Keep us updated on how the conversation goes with our support. We're always here to have your back. Have a splendid day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here