Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt only needs a few easy steps to talk to our customer support team and I'm here to guide you how, csnodgrass.

You can always post your questions here if you have any questions and need help with QuickBooks Online. We have our customer representative who'll be able to attend to your needs.

However, if you still want to request a callback, you can follow these steps:

You can also check out and browse these help articles for more information.

If there's anything else that you want us to help you with, let me know so we can assist you further. Hope you have a great start to the year!

Request a call to me that someone speaks English very well. Being charged for Payroll in November 2021 for 2022 Payroll Taxes, and your company is wanting to charge me again in the next few days. I need some explanation on this, please!

I'm Barbara Strickland, with Hugo Plumbing Co., Inc., (XXX-XXX-XXXX).

Thank you!

please call at [removed]

@Gilandrivera It wasn't a a mistake that the previous phone number was removed. Yours has been too, for safety and security reasons.

Follow the steps already provided to reach someone. YOU have to take those steps to reach QB. You can't just post a phone number here in the community.

QuickBooks desktop payroll

Hello there, @Sunlight.

Thank you for reaching out. I'm here to assist, but I need more specific details to address your concerns about QBDT. Can you provide more information?

Any additional information would help me check for solutions to address your concerns better. Please don't hesitate to provide any further details or a screenshot as a visual guide to explain your scenario more clearly.

I'll also add this article to learn more about QBDT: Get Started with QBDT.

Welcome to post back in the Community so we can address the issue you've encountered, @Sunlight.

we need to renew our tax table that we had with enhanced payroll before we can switch over to Diamond payroll assist. This needs to be done asap today. [Removed]

The latest Payroll Update is 22508, released on March 21, 2025.

Then you can purchase a new license for Enterprise Diamond from a partner + get 10-15% discount.

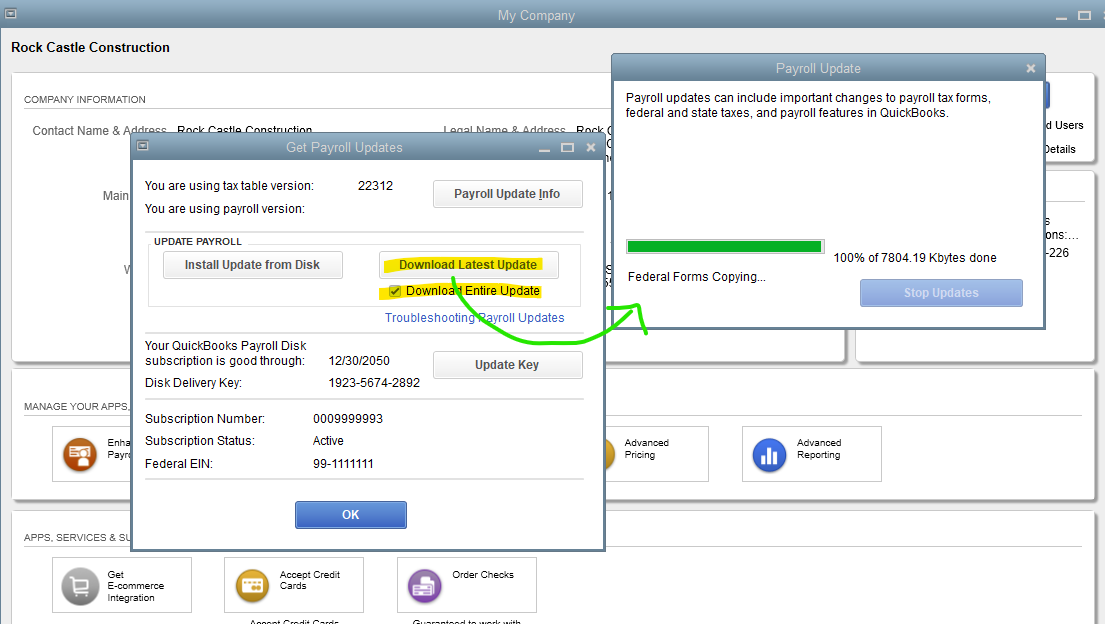

We always appreciate your help sharing information and details, @Chrea, to help @ksprinkle get the latest tax table payroll updates before running payroll. Make sure to run QuickBooks Desktop, once there, go to the Employees menu and select Get Payroll Updates. Allow me to provide more details.

First and foremost, please review Chrea's guide to get the most recent and previous updates, including your past payroll update number and its release date. Kindly use the article mentioned.

Then, please follow these steps to download the latest payroll tax table updates:

Then you're good to go. You can reference this article for more information: Get the latest tax table update in QuickBooks Desktop Payroll.

You can also check this article as your future reference to run reports for your financials and payroll data efficiently: Customize reports in QuickBooks Desktop. On the other hand, you can contact our Sales Support team to help you switch to Diamond tier assisted payroll using the phone number from this page: QuickBooks Desktop Enterprise.

That's all about updating the latest payroll tax table. If you need more assistance with desktop payroll updates, please don't hesitate to hit the Reply button and leave a comment. We're always here to further help you. Have a great day and more power with your business.

Can you contact me about problems I am experiencing with spreadsheet sync and quickbooks

You can use the Help feature in your QuickBooks Online account to securely request a callback or start a chat for assistance with Spreadsheet Sync and QuickBooks, @Adrian F.

Here’s how:

For more information about our call and chat support hours, kindly refer to this article: How and when can I contact QuickBooks Online support.

Please let us know if you need more assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here