Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

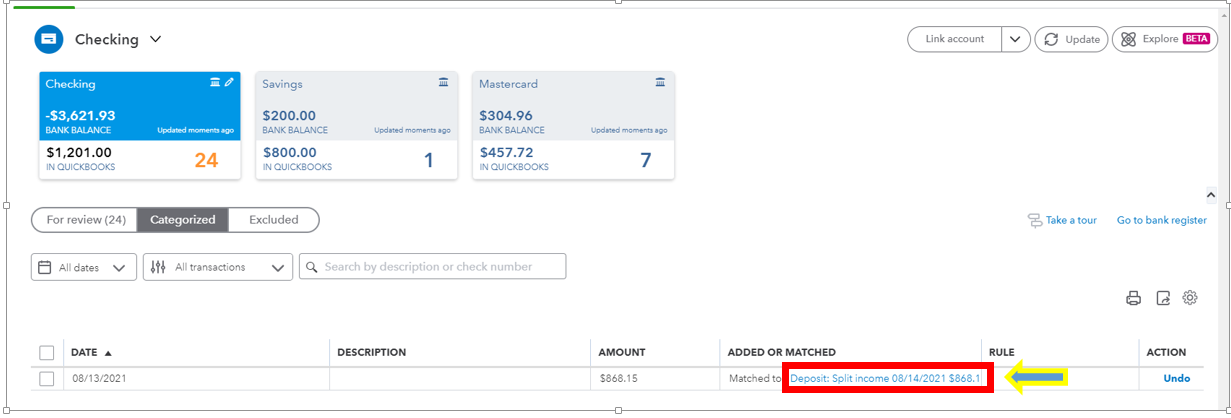

Buy nowTelpay withdrew funds from our bank account on August 30th but the payments to vendors are dated September 2nd, so I cannot reconcile my bank statement. How is this supposed to be handled??

Depends on what your bank statement itself says. If the bank reports the payments being deducted before month end then uncheck the box that hides transactions after statement date while reconciling and check off teh appropriated payments recorded in QB in September

Hello, casagrande.

I'll ensure you're able to reconcile off-date transactions in QuickBooks Online.

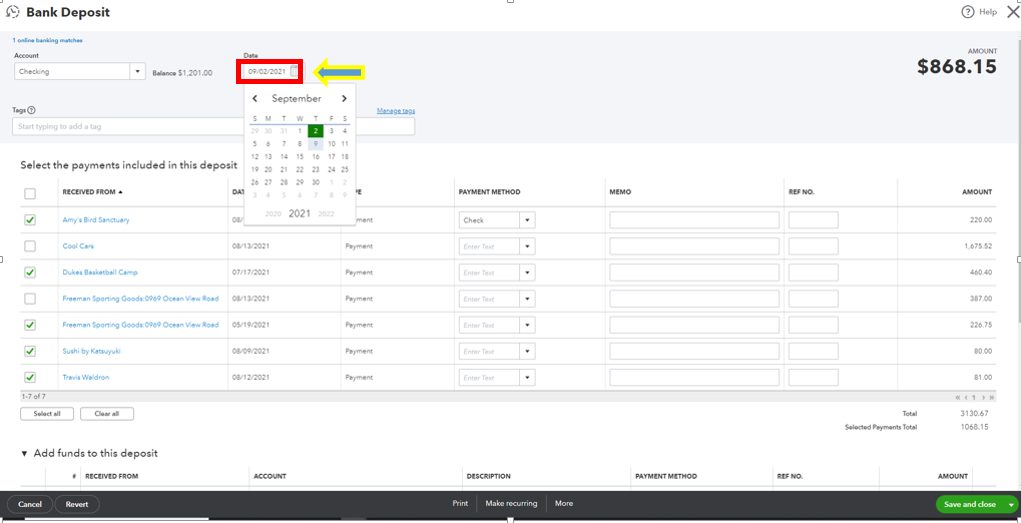

In rare cases, there are times that bank statements and QuickBooks posted payment doesn't match. You'll have the option to change the date to reconcile them. I'll show you how.

Then, you can continue your reconciliation for August to make sure the account in QBO matches your bank statement.

In addition, you can check out this article: Learn the reconcile workflow in QuickBooks. Here you can find more details about starting, fixing any differences to complete the reconciliation process.

Feel free to post a reply if you have further questions about reconciliation. I'm always here to help you.

There are situations when it is never a good idea to change dates on transactions. One example is deductions from banking for direct deposits for payroll. A bank deduction might happen on the 32st but payroll is actually the 1st and that is when money actually hits recipient bank accounts. As convenient as it might be to change the transaction dates from the true date in September to a false date in August does not make it right to do so.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here