Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowA couple things first to set the stage: our company operates on a cash accounting basis; we use the Enhanced Inventory Receiving feature; we are on Enterprise 18.0 Contractor Edition.

On the P&L and Balance Sheet (cash basis) there are a handful of accounts that if you click to open up the Transaction Detail report (again, cash basis), it comes up with a list of transactions that has a much lower total than the number listed on the P&L or Balance Sheet. If I switch the Transaction Detail report over to accrual, it will usually come up with either the same number as the cash P&L / Balance Sheet or be very close. In digging into it, what is missing from the cash basis Transaction Detail report is anything that is on a PO and corresponding Bill as an Item (both Inventory and Non-Inventory). The Transaction Detail report appears to be set correctly to include all Transaction Types, etc., but it's not showing the bills we pay that are classified as Items (as opposed to Expenses). Is there any way to come up with a cash basis Transaction Detail report that shows everything included in the P&L / Balance Sheet numbers?

I’ve got some information here that could help balance these reports, @djlapage.

In QuickBooks, it is possible to have either the accrual basis or the cash basis that are not balanced. But in some instances, both report types display a discrepancy in your Balance Sheet.

QuickBooks automatically creates a balance sheet, thus eliminating some issues that cause the report to be out of balance. However, there are still a few reasons why it's inaccurate.

Most unusual behaviors in QuickBooks, such as sudden discrepancies in reports, are caused by data damaged. Which can be fixed easily by re-sorting the lists and rebuilding the data.

Multi-Currency and incorrectly linked or entered transactions are the other reasons. Although they appeared to be entered correctly can push the Cash Basis out of balance. The usual scenarios include the use of credit memos for returned inventories, discounts for jobs, and general journal entries that offset other transactions. Also, when the exchange rate of the payment is different from the exchange rate from when the invoice was created.

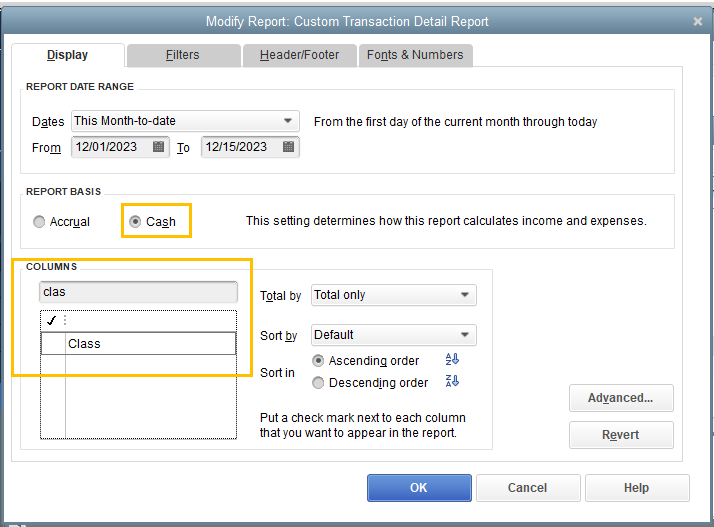

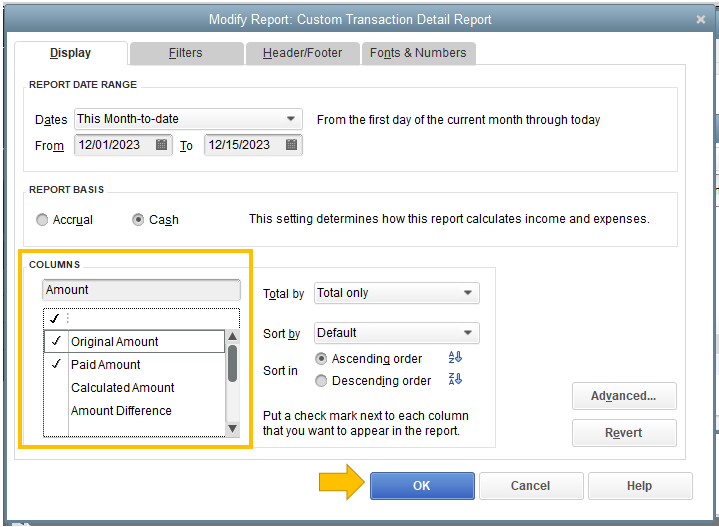

You can run a Custom Transaction Detail report to search the transactions that make your Balance Sheet and Profit and Loss out of balance. Here’s how:

The ending balance in the Paid Amount column should equal the amount that is out of balance. Look through the report to find the event or transactions that add up to this amount.

I have here resources that can help check and fix issues on your financial reports:

I’ll be here anytime if you have additional questions about reports or something else. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.