Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThis is complete BS - I can't run my business until I delete +/- 1 million dollars worth of invoices so I can turn the tax off via the taxes screen and then what, reenter them? QB didn't think this through and apparently doesn't care given this thread started in 2021. Not impressed, not happy, and would like some compensation for my time seeing this was basically a mandatory move.

I use QuickBooks Online is a state that does not collect sales tax. How do you turn off or deactivate the sales tax function.

Hi @meadowlakenorth.

I know how beneficial it is to disable the automated sales tax function when you're not collecting sales tax from your customers. But once enabled, the ability to turn it off is unavailable.

You'll want to make sure your products and services aren't taxable. To check this, you can open each item and categorize it as non-taxable if you aren't collecting customers' sales taxes.

Let me show you how:

Additionally, make sure you set each customer's profile to tax-exempt. Here's how:

I'm adding these articles for additional guide:

I'm still here if you need more assistance with disabling sales tax from your customers. Take care and more power to your business!

I tried this several times. It does not work.

Hey there, @Tom V2.

Thanks for joining the thread. I'd be glad to provide you with further help in addressing the issue.

Before that, can you share with me the troubleshooting steps that you've followed? It would also be great if you can add more info about the problem you're experiencing in QuickBooks. Any additional info would be much appreciated.

Please add them to this thread and I'd be happy to assist you further. Have a good one.

We have literally thousands of donors. Opening each account and checking tax exempt is NOT a solution.

Totally agree @JeffCrk . This is a QBO PROBLEM, not a customer problem. They do not employ best software development practices - if they had they would have tested this "feature" themselves and discovered all of the shortcomings. Instead, they left it to the unsuspecting customers to be beta testers for this shoddy feature that was foisted upon us. Disable it. Figure out a way, QBO and DO IT. We have been complaining about the for over 2 years. It's time you made this right. Stop giving us "workarounds" that don't work.

Hey,

QB.........Fix this. Why is this so difficult? You guys are absolutely terrible listeners.

We just switched from Desktop to Online last month. On desktop we had our sales tax turned off because when we did the import from a third party sales site QB never recorded sales tax correctly.

When QB did the import of our files from Desktop to Online the sales tax was left turned on. Now we are unable to to import because it is on, but I am unable to turn it off because of our historical invoices from 2010 and previous had sales tax on them from before we used the third party. I tried the QB online chat and was told I would have to remove the sales tax from the invoices before I could turn it off. This is a ridiculous solution as those years have been closed by the accountant, filed with the IRS, and would amount to changing thousands of invoices from over 13 years ago and previous. Please tell me someone on the back end can just turn this feature off? We were told the online version was "much better" for our business needs. So far it has cost us more, forced us to buy a third party subscription to import our files because the format desktop supported is not supported online, and countless other functional workarounds. If this sales tax can't be resolved then we are unable to use the product at all.

Hey there, @jp415.

Thanks for taking the time to follow along with the thread and share your concerns.

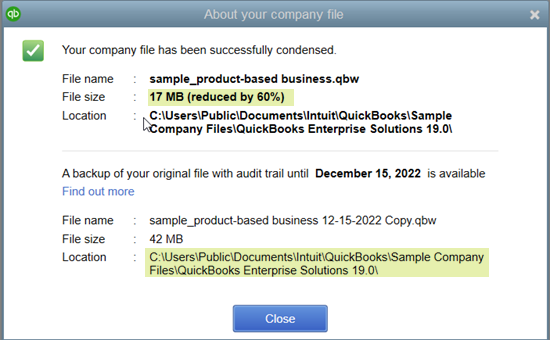

I have a suggestion that you could try out to complete the import to QBO without sales tax. You could condense your QuickBooks Desktop company file and only bring over 2010 and forward to QuickBooks Online. This way, it will remove the transactions that have sales tax associated with them. However, please remember to back up the company file before condensing the data. Once you condense the data, it is irreversible.

Here are some steps to condense your data:

That should do the trick. For more information about condensing a company file and to ensure this is the right choice for you, check out Use the Condense Data Utility.

Please let me know if you have any follow-up questions or concerns about this process. I'm always happy to lend a hand. Take care!

So we would have to overwrite what we currently have in QB online with the condensed file, and would lose the work that several different admins had done over the course of the month we have been using online? If we condense won't it throw off our balances? And we would not be able to access or view those invoices for those customers in QB online, correct? While I appreciate the try at a solution, that won't work for us. We really just need someone to fix the issue. It worked in desktop, it should work in the online version.

Importing your data to QuickBooks Online will override the ones entered in the online program, and it can no longer be undone, jp415. Let me elaborate things further and guide you on what to do.

Furthermore, the condensed data only reduces your file's overall size and still keeps all your data. Therefore, it won't throw off your balance.

Finally, if you're referring to your ability to view the invoices prior to the completion of the import process, you no longer have that capability, as the new file has replaced it. However, if you're referring to the invoices imported from QuickBooks Desktop, then you'll indeed be able to access and view them. Browse this module to know more about how your books are transferred to QBO: Learn how features and data move from QuickBooks Desktop to QuickBooks Online.

Here are some useful articles to enhance the program's performance and personalizing your invoices:

Fill me in so I can help you more in managing your data, invoices, or QuickBooks. Have a good one and stay safe!

So to clarify, if we do this:

Anything done online since w switched up to this point is gone and must be re-entered? (Again 5 admins working daily in here)

And basically we are starting fresh so to speak and importing a condensed file that tricks the online version into believing there are no invoices with sales tax because they are no longer read as invoices, only data?

I'm skeptical to do this since we have had so many problems with the functionality of a program that was supposed to be "better". I can only imagine the can of worms we will open doing something that cannot be undone.

So again, can't you just override the tax issue in the online programming like it was in desktop? That would easily solve our issue, and is what all the comments previous to mine in this thread are asking for, not tedious work arounds that can't be undone.

Hi there, @jp415.

It's imperative to take precautions when transferring invoices with sales tax from QuickBooks Desktop to QuickBooks Online. Your clarification is a good idea to prevent misunderstanding. With this, I'll address your questions one by one.

For your first question, yes, you'll need to reenter the data again using the condensed file. I recognize the inconvenience as it involves the work of your five (5) admins.

The condensed file allows the system to override transactions. Therefore, for the second question, you're right about the invoices read as data. Only the logo, PO No field, Sales Rep, and Credit card info saved on an invoice in QuickBooks Desktop will be moved to QuickBooks Online.

Once the invoices are recorded in the system, you can override the sales tax amount. It can help account for rounding differences.

Since QuickBooks Desktop is distinct from QuickBooks Online, you may also detect differences in your books. For complete information on what doesn't move when switching, refer to this article: Learn how features and data move from QuickBooks Desktop to QuickBooks Online.

In the same manner, read these resources to learn more about how you can convert your data:

Don't hesitate to post again here if you have other questions or concerns with QuickBooks tasks and navigations. I'm always around happy to help. Take care and stay safe!

But it’s SUPER ANNOYING that we can’t turn off automated sales tax.

I’m in Texas and only collect sales tax in Texas. But for my out of state clients, qbo always gives me an error (since the terrible updates that make the invoices harder to read). I reverted back to the old invoices because it’s slightly less annoying there. But I loathe day I’m forced to use the new ones and have to go through extra steps to tell qbo that I am not collecting sales tax for any other state every single time I creat a new invoice for an out of state customer.

I am having a huge issue with this auto sales tax "based on location". I've read through these threads and QBO suggests changing the tax for each customer. I have a list of THOUSANDS of customers who need their tax rate corrected from "based on location". How in the world am I supposed to get through that list in a timely manner? As more come in every day, the list remains constant.

I've asked a QBO rep if there was someway to at least update multiple customers at once, and that is not an option either! Maybe a drop down next to each customer name in the customer tab, so we can easily change the tax rate there without having to do them one by one and save and open the next?

Please QBO, I beg you - allow us to turn off the automatic sales tax based on location!

It's not the kind of experience we want you to feel when using QuickBooks Online (QBO), fittlefart. We're committed to addressing this issue promptly and implementing the necessary changes. Your satisfaction is important to us.

Currently, the option to turn off the based on location feature is unavailable. We suggest manually establishing a custom rate and employing it for sales tax calculation during your invoice creation process.

Therefore, I'm adding this article to learn more about manually creating a custom sales tax rate: Use Custom Rates to Calculate Taxes on Invoices or Receipts.

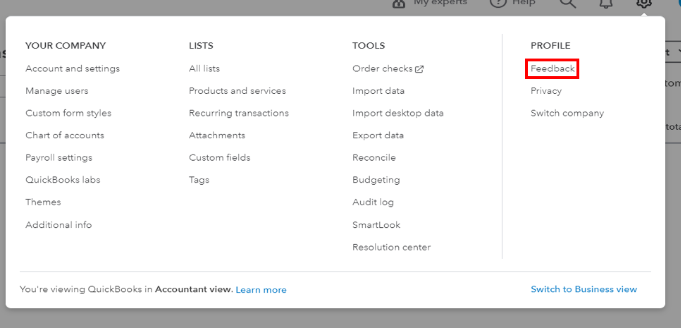

I can see the importance of having this option for your business. With that, I suggest sending feedback to our product developers so they can review it and might consider adding this in future updates. Please refer to the steps below:

You can track your feature requests through our QuickBooks Online Feature Requests website.

I'm always here to assist with any inquiries beyond using sales tax for invoices. Feel free to utilize the Reply option below to share your questions. Stay safe and take care!

Just read through this thread, as I am no longer able to import invoices into QBO because of the automatic sales tax configuration. See screenshot.

Is there a solution to this?

QB, you have basically halted our entire bookkeeping process in its tracks with this implementation. We collect and remit sales tax through Avalara and it's a manual process because only some of our invoices are taxable (wholesale versus direct-to-consumer). Why is this a mandatory part of QBO?

I heard your view, @Wonder. It is also a helpful feature to turn off the sales tax in QuickBooks Online. Let me route you to our product developer and discuss this with them.

Once the Sales Tax feature is turned on, there isn't a way to turn this off. With that, providing us with feedback will help enhance and enable this feature. This way, they'll see your recommendation and consider counting it to the following schedule update.

Follow the steps below:

Our Product Development team receives your thoughtful comments (QBO) through the feature request link: QuickBooks Online Feature Requests website.

Visit this article for further information on how to keep track of your client's sales growth by pulling specific reports:

Please feel free to remark with your reply. I'm eager to deliver knowledge with the sales tax topic in QuickBooks Online. Have a great day.

Great. Feedback submitted. But in the short term, HOW DO I IMPORT INVOICES INTO QBO?? We have been doing this process for years and now we can no longer do this? Is there a solution to this today?

I appreciate you for submitting feedback, @hydaway. Let me share another way to import your invoices into QuickBooks Online (QBO).

Currently, the only option to import invoices if you have automated sales tax enabled is by utilizing a third-party application.

While I cannot recommend a specific app, I can direct you to a website where you can look for an application that allows you to import invoices with automated sales tax enabled. Let me show you how:

Alternatively, you can look for a third-party app outside the QuickBooks website.

Moreover, you'll have to record a Receive Payment transaction when your customer pays their invoices to keep track of your sales transactions.

The Community is always open if you have other questions about importing invoices into QBO. I'll be around to help.

So now another $10-$20 per month just to import invoices so we don't have to manually enter them line by line? This is such a simple process, why do you keep changing things and making us small businesses change our automatons and processes? Bookkeeping is the furthest thing from our minds on a daily basis, and you keep making us work harder (not smarter) at it.

So if it helps this thread, I spent an hour on the phone with a QBO help rep. She had no idea any of this was happening and spent most of the time doing the research. In the end, she found no solution, so she reduced our QBO subscription rate for 12 months to make up for the fact that we have to use a 3rd-party import tool at $15/mo to import invoices. Onward I guess.

I second everything said here. TURN IT OFF

I also use Avalara and I have to check every single invoice to make sure that the automatic calculation is turned off and the AvaTax is turned on. It has added a time-consuming step to my invoicing process that I didn't need. I have asked and there is apparently no way to make the AvaTax calculation the default sales tax calculator. So I googled "disable Quickbooks automatic tax calculation" and found this thread of misery.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here