Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI own a small restaurant that uses the Square POS. Square has an app that syncs each customer transaction with Quickbooks. I originally used this app, but ran into some issues with my undeposited funds account. Now this account has a balance of over 12k and I don't know what to do.

With the square sync app the transactions from the POS come in as individual Square Customer invoices and automatically land in the "undeposited funds" account as payments. When the credit card is processed and the amount is deposited in my bank it creates a match connecting each original customer invoice to the lump deposit. When clicking "match" the undeposited funds balance is affected creating Square Customer deposits that zero out the account. Unfortunately cash has made this more complicated.

Originally I didn't even know what the undeposited account was I would just blindly hit "match" and all my deposits would get directed to income. I had been so busy I didn't deal with my cash sales for the first three months. At the end of the year with the help of my CPA we created journal entrees to to move all my cash from undeposited funds to petty cash which either ended up deposited in the bank or as a cash expense which was all tracked. In the new year I started diligently moving cash from undeposited to petty. In August I decided to stop using the sync app because it seemed unnecessary to log each customer transaction in Quickbooks.

When I stopped using the app I made sure it was after the last deposit had been matched (we were on vacation for a week so it allowed all deposits to hit our bank account). However, I still have a balance of $12,669.81 in "undeposited funds." I have gone over the journal entrees and the amount of cash I accounted for equals the cash sales entered. I'm not sure where the discrepancy is coming from and there are over 7,000 entrees in the "undeposited funds" account so I don't even know how to start combing through these transactions to make sure there are no duplicates.

Any advice on how to zero out this account without upsetting my profit and loss would be super helpful.

Thank you,

Rosemary

Thanks for turning to Community, Rliss.

I appreciate every detailed information you provided.

You have the option to correct your Undeposited Funds balance using a journal entry. Before doing so, I recommend consulting an accountant for guidance on what accounts to be used and for more expert advise on how to handle this type of situation.

Here's how to create a journal entry:

Check out the video tutorial in this article to learn more about Journal Entry (JE): Create a journal entry.

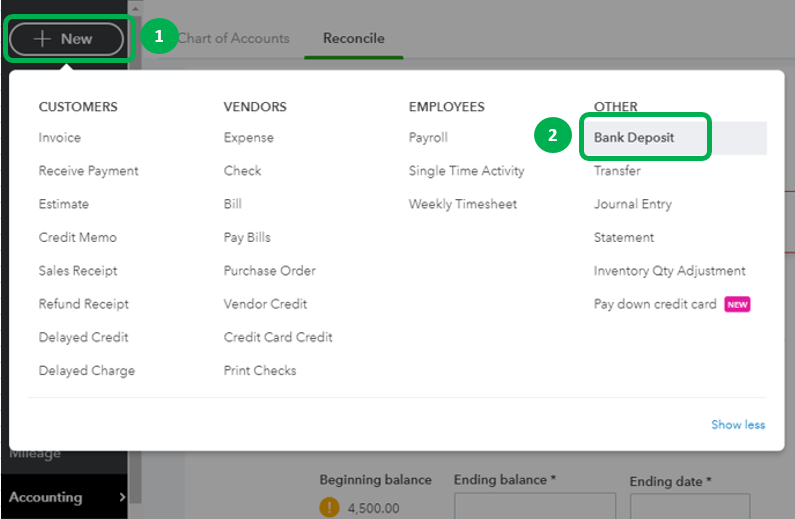

Once done, create a Bank Deposit and select the Journal Entry and the transaction to zero out the balance.

You can always visit us again if you have follow-up questions. It's always my pleasure to help. Have a great day ahead!

Hi Charies,

If I create a journal entry will I have to select the 7,000 transactions in undeposited funds?

Wont creating a bank deposit change the balance of my bank account?

I personally reconcile all my accounts each month so everything is up to date.

thank you,

Rosemary

Thanks for the quick response, @Rliss.

Yes, for both questions. Though creating a deposit can change the bank balance, this won't fix the amount showing in the Undeposited Funds account.

Take a look at these articles for more information: Deposit payments into the Undeposited Funds account and Record and make Bank Deposits.

I recommend following the solution provided by my colleague to ensure everything is correct. Please reach out to an accountant for assistance in performing the steps.

If there's anything else you need, let me know in the comment section. I'm right here to help. Have a good day!

Hi Khim,

As I stated before my accounts have all been reconciled and cash is all accounted for so if I make a deposit to clear out my "undeposited funds" account that will completely screw up my balance sheet.

I am worried that when square sync was still being used there it created duplicate transfers, but there are so many entries I'm not sure how to go through them all to see where the mistakes were.

thank you,

Rosemary

Hello all, I have the same issue and my undeposited amount is higher than 12k. Has anyone been able to fix this before we have to file for taxes in 2020?

Hello there, emersonrharo.

Undeposited Funds is a special account created by QuickBooks as a clearing account for payments that have been received but not yet deposited into the bank account.

As suggested above, we can create a Bank deposit or a Journal entry to post the amounts to the correct bank account. This way, it clear out the amounts showing in the Undeposited Funds account. Here's an article for more information on how to record and make bank deposits.

I also suggest reaching out to your account on where to post these amounts. They can guide your through where to account the payments.

You can always reach out to me if you need more help. Thanks!

I have a 'bank' account called "cash on hand". This is the float that is at my store. In quickbooks, I deposit the 'Undeposited funds' cash transactions generated by square to my "cash on hand" account... When I take the cash to the bank, I record that transaction as a transfer from my "cash on hand" to my bank account.

I find this works smoothly for my set up.

I am having this same issue and cannot find the offsetting entry. When Square syncs it hits the "Undeposited Funds" account and the offset is Accounts Receivable. But my A/R account shows the offset when the invoice is "paid", but does not clear "Undeposited Funds" when it posts to my bank account. So where is the offset going that is clearing the A/R account? Because that is the other half I need in order to clear the Undeposited Funds. They are not automatically clearing when the funds are deposited to my bank account. And if I offset the undeposited funds with the imported transaction from my bank account then how does the transaction post to my Sales account?

Thanks for joining us here, TherouxG!

When you create an invoice, the affected accounts are Accounts Receivable (A/R) and the Income account. Then, the A/R decreases and the Undeposited Funds increases since the payment is posted to the Undeposited Funds.

We need to deposit the money from Undeposited Funds to the bank account in QuickBooks Online so it will affect your bank register.

You can check these links for more info about Square and QuickBooks Online integration:

Keep on posting here if you need anything else. Take care!

These answers are incredibly vague and misleading, sorry to say. So for anyone interested in reading this,...

I did some digging because, well, debits and credits. Where can you find the other half of the transaction that is clearing out the A/R Account? There are two transaction types, INVOICE and PAYMENT.

When the INVOICE transaction type is posted it affects Accounts Receivable and an income account. To find out which one, select the transaction on your A/R register and at the bottom there will be options that say "Print or Preview", "Customize", and "More". When you select "More" there will be a menu to choose Transaction Journal. This will show you both the debit and credit side of the entry and which Income account is being affected.

The PAYMENT transaction type affects the A/R and Undeposited Funds Account; your A/R account has now been cleared out.

If you have a bank import, as I do, and post to a specific Income account, as I do, you will have an outstanding balance in your Undeposited Funds account with no offset and your net Income is overstated. (Income posted from the clearing of the bank import and income posted from the Square transactions).

FOR ME, the Square invoice transactions are posting specifically to the Square Income account that was created automatically when I linked/synced to Square. Since I do not use this account to record any of my income, I will be creating a manual entry to reverse this posting with the undeposited funds (zero out the Square Income account with the Undeposited Funds account)...which I will do during my month end closing process.

So, the short answer is check to see what's in your Square Income account, if this is listed on your chart of accounts.

Now that you know where to find the details for both sides of your transactions, be sure to consult your Accountant (or an Accountant) before completing any adjusting entries.

Good Morning,

First off thank you. Your message on the matter is the most helpful I've read out of all.

A question still lingers though. If your backing out the entry of Square Income vs. Undeposited funds how are you recording your income then?

Thank you

My A/R account is 0, but my undeposited funds account is still artificially high. I used the Square Sync, and did not manually do anything. My bank account is matched, but the undeposited funds account is just messed up and didn't clear out for certain transactions. But the same transactions are already matched correctly. Why did this happen and how do I fix this since it is overstating my P&L?

Hello there, jses.

Thanks for chiming in on this thread.

The Undeposited Funds account is used to hold invoice payments and sales receipts until you physically deposit them to your real-life bank. In your case, it's possible that the default Bank account selected where Square deposits your money is set to Undeposited Funds.

Since you mentioned that your transactions are already matched, you'll want to undo them. Then, create a bank deposit for the figures showing up in the Undeposited Funds account and match them after.

To undo, here's how:

Please see this sample screenshot:

Then, make bank deposits by following these steps:

I have this article for more details: Record and make bank deposits in QuickBooks Online.

Once done, match the deposits you created to the downloaded transactions. Doing this process will clear all the transactions in your Undeposited Funds account and correct your P&L report.

I'm also adding this article to learn more about Sync with Square: Sync Square with QuickBooks Online.

Please keep me posted on how it goes. I'll be right here to help you out some more. Take care and stay safe.

This is legitmately the best, easiest solution I have read! Do you know how to batch move the undeposited cash sales into "Cash on Hand" or do you do it individually?

Yes. We'll have to manually deposit the transactions, luccaworkshop.

As of now, the option to batch deposit from multiple accounts to another is unavailable in QuickBooks. You can follow the steps shared by my colleague on how we can enter a bank deposit.

You can also check this reference for more information: Record and make bank deposits in QuickBooks Online..

I'll be around if you need help. Keep safe!

I have read this entire post, and have found the issue that is happening in QuickBooks. I help manage a small retail business, and maintain the QuickBooks file. When you are using Square, it is an issue either created by them, or by QuickBooks when the transactions are being downloaded from Square to your bank account, and then your bank account to QuickBooks. We record an invoice for all sales. However, a customer is only required to pay a 50% deposit, leaving the other 50% for when the product(s) are picked up or delivered, which often is not in the same month. The whole issue is this: Square does not provide a "Payment Date" in its "Add a Payment" function which attaches to the invoice being paid. What this causes is for the payment to be posted to QuickBooks on the date of the invoice and not the date of the payment. This then causes a mismatch of the Monies being deposited, and creates what is called a "Square Non-Matching Payment" to be generated either by Square or QuickBooks, so that the Deposit downloaded is balanced out in the detail, and this Square Non-Matching Payment is being posted to Square Income, when it is in reality a payment for an invoice that was posted in a previous month. I tracked an invoice and it's payments to the Square Sales, Deposits, Receivables and Undeposited Funds, and the invoice is only recorded once, the payments are only recorded once, but for some reason the payment made after the initial invoice date is not being assigned a date in the current period in which it was paid, and thus it cannot be matched to the invoice because it is being posted to a prior period, thus relieving the invoice and creating an inability to match the payment to the deposit, so Square or QuickBooks generates the Square Non-Matching Payment to balance the transaction when entered to QuickBooks. The situation, in my opinion is occurring, because Square does not provide a data entry field for the date a payment is received, and thus when it is posted to QuickBooks, it is being posted on the Invoice Date instead of the payment date, thus causing the mismatch. Because of this post being created to balance the deposit, it is being posted to income as a credit, when it should be posted to Undeposited Funds because it represents a payment received on a prior invoice that was credited to the wrong period. Thus, your accounts receivable, income and undeposited fund accounts are always changing in prior periods because of payments being received in the current period. The issue resides in a miscommunication of Square and QuickBooks, in that Square does not supply the proper payment date, and QuickBooks is not equipped to handle this error on Square's part. The reason I know this is true is because "Deposits" should never be posted to Square Income when you have already generated an invoice, thus your income is overstated by all of these "Deposit" postings labeled as a "Square Non-Matching Payment." We are notifying both QuickBooks and Square of this issue, and asking Square to create a "payment date" field when adding a payment, to properly identify the right date to QuickBooks for matching purposes, so that this Non-Matching Payment will not be created in error. This is a systemic problem with Square and QuickBooks. The funny thing is, when you look at the detail of any deposit in the "Transfers" detail section of Square, you can see the actual payment date is recorded on the date you received the payment, but it is not used in transferring the data to QuickBooks through your banking transactions when they are downloaded. If I had to hazard a guess, this is a problem on Square's end, but can be easily fixed by a journal entry, monthly, to remove all transactions labeled "Deposit" in Square Income to Undeposited Funds, as the invoice has been closed and shows as being paid in full in QuickBooks. This problem on Square's end messes up your Accounts Receivable, Undeposited Funds and Sales, because your bank downloads the correct deposit total, and thus the bank reconciles, but it mismatches the payments because it uses the invoice date because it is not programmed to use the payment date for payments received. Your financial statements thus are always in a state of flux because of this error, as A/R will change in a prior period due to the improper use of the Invoice Date to identify a payment posted instead of a Payment Date, especially if you are receiving payments after the original invoice date. This is also why you cannot void a check directly in QuickBooks in a prior year, because it will use the wrong date to void the check. It is an identical issue of not assigning the proper date to a transaction.

Thank you for your research. I am having the exact same issue. My bank accounts are all reconciled but I have $44k sitting in undeposited funds. My income looked really high and so it now makes sense to me that these transactions are posting twice. I don't know how to correct it going forward. I can clear out the account by offsetting against my income account but I don't want to have to keep correcting it every month. Have you found a way to correct it as Square items are synced into QB?

Thanks so much!

Hey there, GatherBloom.

To get this corrected, you can exclude and delete them to avoid duplicates. Let me show you how:

I'm leaving you this recommended article: Setup bank rules to categorize online banking transactions in QuickBooks Online. This will provide you more information about managing your transactions in QuickBooks Online as well as how bank rules work.

Please know that I'm just a post away should you need anything else. Wishing you a wonderful week ahead.

Are all these "colleges" just bots? You always regurgitate the same basic information Chat GPT could do and never actually add anything intelligent and helpful like a human would.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here