Having timely access to funds is essential for financial stability and business operations, Ctodd41. At QuickBooks, we strive to ensure that our customers have a smooth and seamless experience.

First off, let's create a liability account to record the loan from your customer. Here's how:

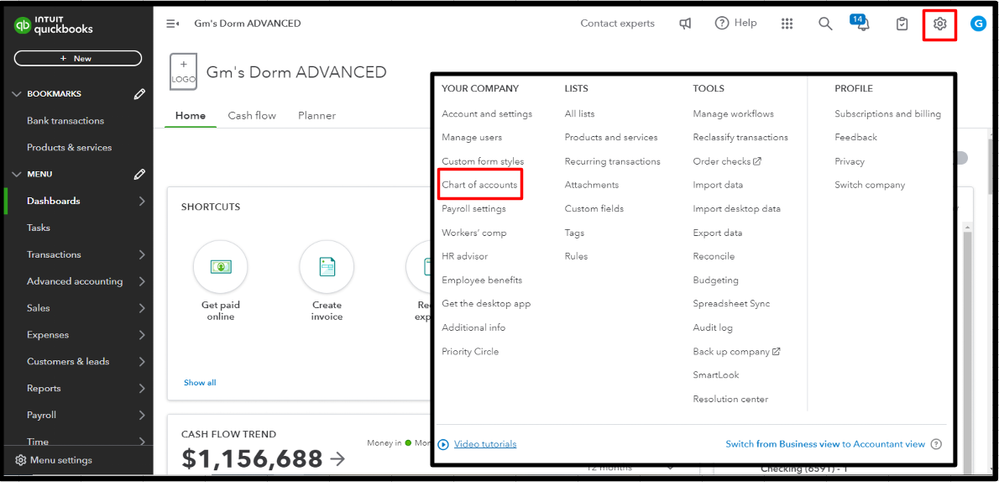

- Go to the Gear icon, then click Chart of accounts.

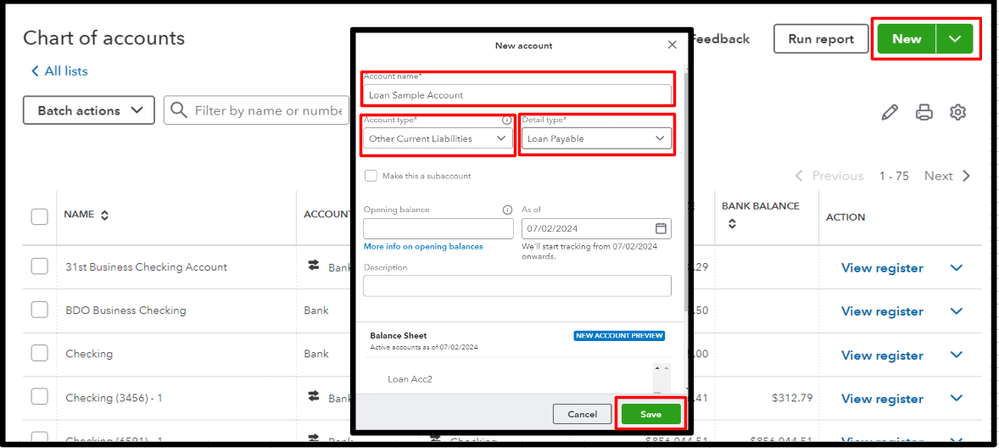

- Click New and enter the Account name.

- Under the Account type, select Other Current Liabilities then choose Loan Payable for Detail type.

- Once done, click Save.

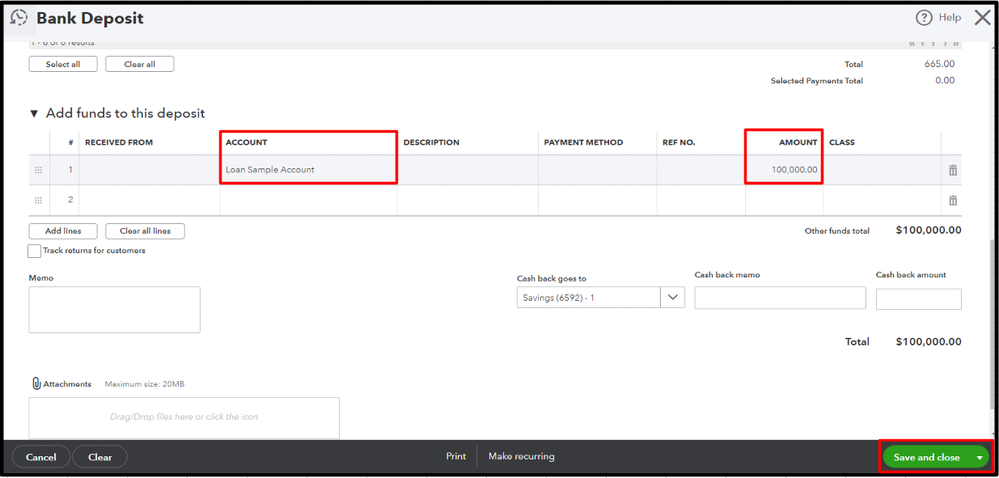

Now, let's record the loan from your customer by making a bank deposit.

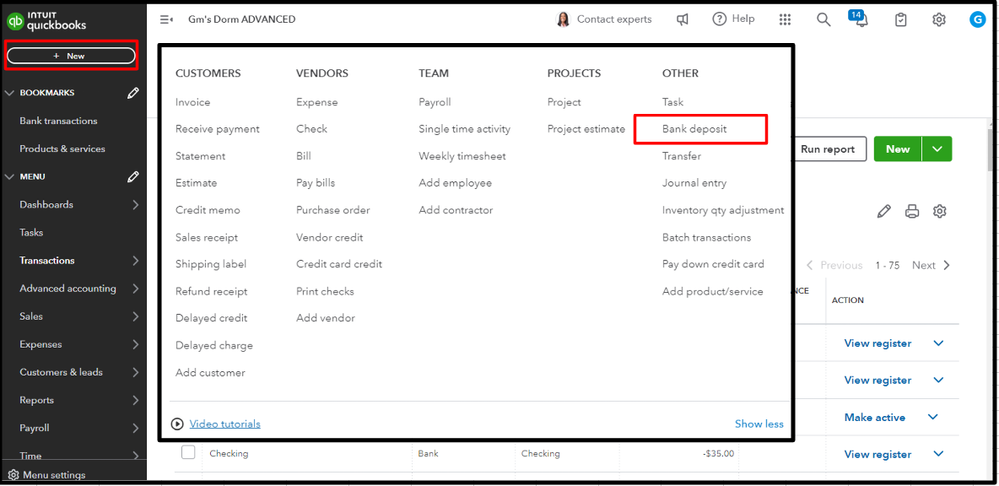

- Go to +New, then click Bank deposit.

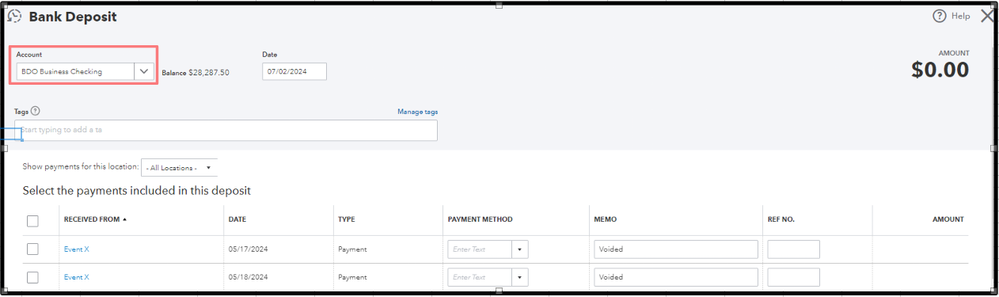

- Choose an Account and under the Add funds to this deposit, choose the liability account you created.

- Enter the amount and Save.

Finally, in deducting the invoice payments from the loan from your customer, I recommend referring to your accountant for the accuracy of your financial records. If you don't have an accountant, we can help you find one. Feel free to visit this page to find an accountant for your business: Find a QuickBooks ProAdvisor.

Shoot me a reply if need further assistance about your financial workflow in QuickBooks. I'll circle back to help at any time.