Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a customer that paid via ACH, the funds cleared, the batch was processed and the money funded. Now the customer canceled the order and is asking for a refund check. I want to make sure that the customer CANNOT now go back and dispute their ACH (trying to prevent fraud, do not know the customer). How long after I receive an ACH is it safe to assume the money is cleared and that there is no way for the customer to dispute it?

It's great to have you join us in the QuickBooks Community, @DarrinShamosh! Let me provide you with some insights regarding ACH payments in QuickBooks Online (QBO).

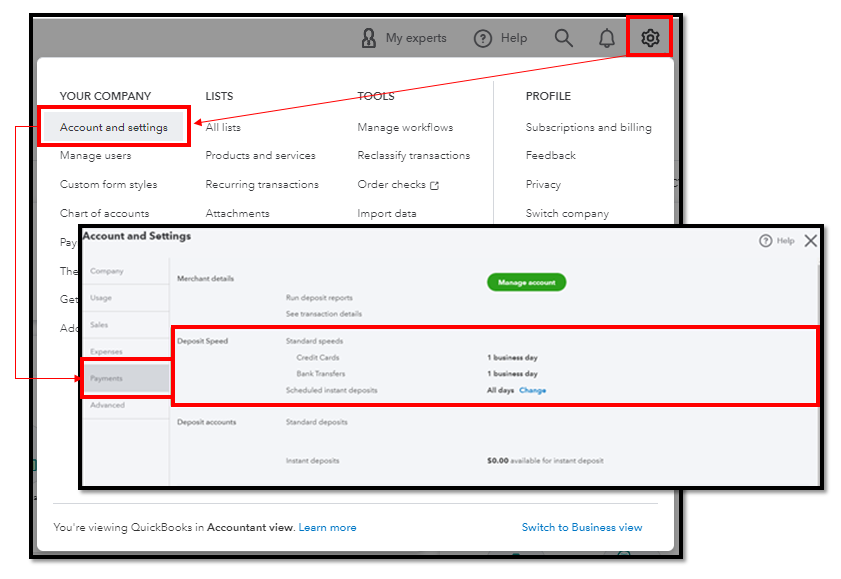

The deposit speed relies upon the specific product you're using and the nature of the payment. Standard deposits are processed on all days, except Sundays, Thanksgiving Day, and Christmas Day. Instant deposits, on the other hand, are handled every day without any exceptions.

Here's how to determine the processing time for the payments you handle:

For more comprehensive information, please refer to this article: Find out when QuickBooks Payments deposits customer payments.

Moreover, it's possible that a customer might contest a transaction. In such instances, the financial institution will notify QuickBooks Payments, and you'll receive emails regarding chargeback notices or retrieval requests. Rest assured, our team is fully dedicated to conducting a thorough review of any disputes that arise. The timeframe for majority of disputes is 120 days (for U.S.) and 180 days (for International) from the initial sale or from when the issue was identified. However, the specific duration may differ depending on its cause. To assist you through the process, here's a link: Handle chargebacks and retrieval requests for QuickBooks Payments.

Additionally, you'll want to check out this reference that can help answer your QuickBooks Payments questions: QuickBooks Payments FAQ.

Please don't hesitate to reach out whenever you need further assistance concerning payment disputes. The Community is here to lend a hand. Keep safe!

Thank you, but I knew all of the information you wrote. Please read my question again. Thanks!

Thanks for getting back with the Community, DarrinShamosh. I appreciate your question you'd mentioned in the original post.

When you process an ACH transaction, your customer can issue a dispute/return as far back as their bank allows them to. Ultimately, the timeframes and legitimate reasons for submitting such a dispute are up to the financial institution sending the funds to Intuit.

Just like with processing cards, it's always best to get a copy of a signed agreement. You can also request a copy of a customer's drivers license to verify their billing information matches the customer information for a transaction.

I've also included a couple detailed resources about working with ACH returns/disputes which may come in handy moving forward:

Please don't hesitate to send a reply if there's any additional questions. Have a great Friday!

Hey Darrin, This happened to me and it was fraudulent. A customer made a large order and requested to pay via quickbooks ACH payment. I thought that sounded totally legit and secure. They made the payment for $7500 and we planned on going ahead with their order. Then the customer asked for a refund. They appear to be taking advantage of the fact that Quickbooks doesn't offer ACH refunds. To refund them we'd have to pay them via a separate ACH payment, Zelle, or something like that. There would be no way to confirm in advance that the money was going back to the same person that payed it to us. The original ACH payment could still be contested and charged back from our account, leaving us out $7500 in the end. I ended up digging into the original payment that we got from them and finding the name of another small business in NC. I called this business and they hadn't even realized that their account had been compromised. The funds had been stolen from them to pay us. The scammer wanted us to send the refund directly to them. Watch out for this! Quick books needs to offer ACH refunds in order to prevent this type of fraud. Scammers are taking advantage of it.

In the end, the other business was very nice and worked with us to report this as fraud and get it corrected. The down side was that we both had our accounts frozen. These are the accounts that we pay payroll from. A huge problem, even though the scammer didn't get away with it.

Hi Sarah,

I believe this is happening to me right now, and I have no clue how to handle it. I am trying to void the transaction, but I fear I have missed the window to do so. Any advice you have on finding the business that may have been impacted would be greatly appreciated! Until I figure that out I'm guessing we can refuse to repay outside of Quickbooks and force them to file a fraudulent claim with their bank?

This just happened to me. A person from " CB Procurement" company ordered 150 units for a client, and when I sent a credit card invoice for 50% deposit they requested an ACH invoice. Once they paid, they immediately requested to "hold the shipment" because "client has requested a change in the shipment plan". The next day the said they needed to cancel "35 units from the original order of 75 units" (which 75 units was 1/2 of the original order, they started to get their story mixed up, but I digress) and requested a refund. I immediately felt this was fishy and called my bank, but they couldn't do much besides close the account but since the account information wasn't compromised because I used QB payments we didn't feel that was necessary. So then I requested a call back from Quickbooks bc they were the payment processor. I told them I thought this was a scam and wanted to reverse the ACH (this was about the third day from payment and the funds were in our account) so they opened a case, started that process and I was told someone would call me in 1-3 business days. 3 business days later and call so I got a hold of them again and found out the payment was reversed by the original bank due to insufficient funds (QB didn't get a chance to reverse the ACH payment).

SO, moral of the story - only work with trusted people and DON'T RUSH - just because the cash is in your account doesn't mean it's clear - ACH payments are like checks and can "bounce".

Be safe out there!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here