Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowFor ck#27498 there was never an invoice entered at all. Check was just drawn and sent out.

Yes this is old I am trying to clean up some old transactions.

This is for a union payment for dues. This info comes from the payroll

I am just trying to figure out the best way to enter an invoice so this check can be applied to it and not be on the vendor detail balance as an -11,892.27 see attached

Thanks Lisa

Hi there, Lisa Di Cristo.

Thank you for the screenshot. I'm here to help you clear up old transactions in QuickBooks.

A bill payment with no invoice will become a credit. Since the check was drawn and sent out, you need to create a bill. This will then reduce the vendor balance.

Here's how:

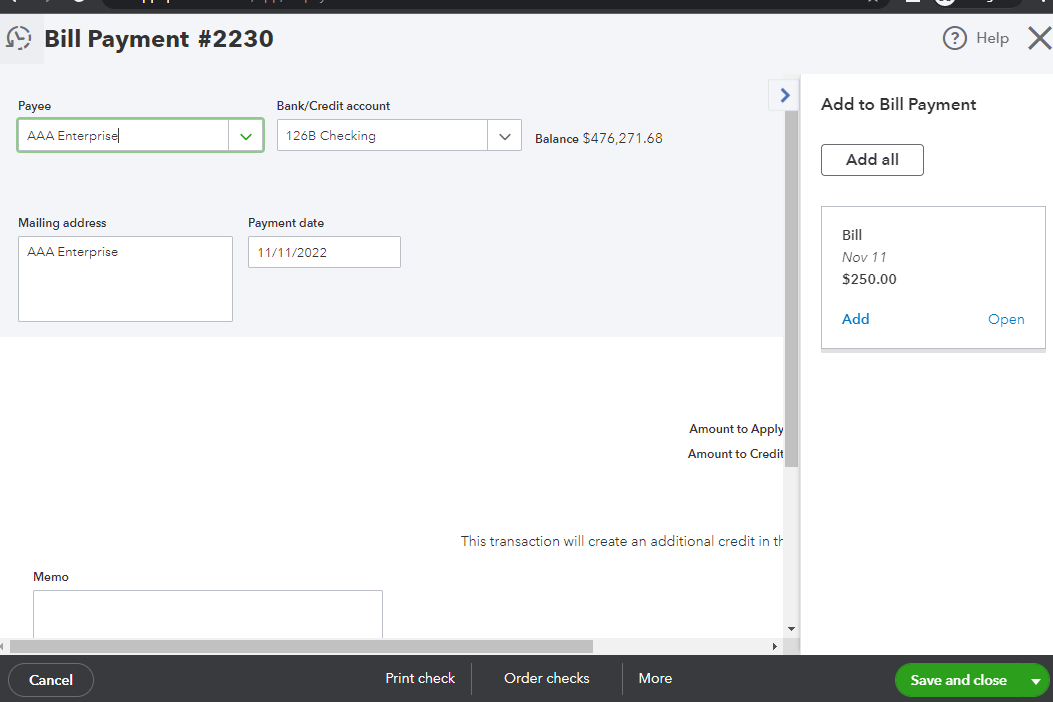

Once done, open the bill payment. The bill will appear on the right side. Click Add, then Save and close to link the payment. I've added a sample screenshot below as your visual guide.

It's important to learn how to handle bills to be paid later and bills to be paid immediately. This is to prevent recording transactions that will cause incorrect balances on your account. That being said, you can use this article so you know what transaction to use: Learn the difference between bills, checks, and expenses in QuickBooks Online.

You can also consult your accountant since you're clearing old transactions. This may affect your closed books. Hence, your accountant can help correct your entries in QuickBooks.

Stay in touch with me if you need anything else. I'll be around to help clear your old transactions.

There must have been a bill entered at some point, that's why it's a 'Bill Payment' and not a 'Check'. The bill(s) that this payment covered must have been deleted. Unfortunately, there's no easy fix for this. Yes, you need to create a bill and then apply this credit to the bill. That's the easy part. The hard part is finding out what bill(s) were deleted and when they were deleted. Once that's figured out, then you can re-create them. It seems you had a similar scenario previously.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here