Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowA few months ago, I recorded a number of deposits from QuickBooks Payments as deposits to my checking account and credited sales revenue. I now see that many of them are listed in my Undeposited Funds Account. I'm concerned that if I create deposits in QBO to clear the UF account, I will be duplicating items in my checking account register. What can I do to clear out these UF account lines?

Thank you!

Hi ShariWhite,

I'm here to help fix the issue you encountered.

When clearing Undeposited Funds (UF) account, you'll have to make a deposit. All payments in the UF account automatically appear in the Bank Deposit window. To do so, you can follow these steps:

Afterward, let's review your Undeposited Funds account. Here's how:

I'm always around whenever you have concerns about managing bank transactions.

How did the duplicate amounts end up in Undeposited Funds (UF)? Did you manually enter the deposits to sales and then the duplicates UF entries came in through bank feeds? If you're sure these are duplicate deposits, then you need to figure out which one to delete because, if you see them both in UF and your bank account register, they are already duplicated. If the entries to UF were invoice payments received and brought in through bank feeds, then I would delete the deposits posted to sales revenue in the checking account because you want the payments received to close out the invoices. If neither of the entries to UF or the checking account are payments received on invoices, you can delete the UF entries.

Thank you. This was very helpful! Now, I have made things worse because I didn't think they were tied to invoices, and I deleted the UF entries. Then I discovered that they WERE tied to invoices, and I have this A/R hanging out there. Is there a way to delete or write-off the invoices so my A/R goes away for each of these customers? Even though I am an experienced accountant, I can see that I needed some QB specific lessons before I set up this business. Your help is greatly appreciated!

"Is there a way to delete or write-off the invoices so my A/R goes away for each of these customers?"

Just to confirm, you have duplicated the income - once when you recorded the deposits as Sales Revenue and again when you created the invoices. Am I understanding that correctly?

If so, then you have a couple options: if you're on cash basis, you can zero out the invoices since cash basis taxpayers don't have A/R and zeroing out the invoices should not impact previous periods reports on cash basis. Or, create credit memos with a service product linked to Sales Revenue and apply that to that to the invoices. The credit memos will close A/R and cancel out the duplicate income from the invoices. Or, create journal entries: debit Sales Revenue, credit A/R for each customer's deposit. You should use credit memos or journal entries if you're on accrual basis. In the case of credit memos and journal entries, don't forget to apply the A/R credit to the invoices.

I’m trying to clean up QuickBooks UF because when my boss would make a new bank deposit he didn’t change the account to the “business checking”. It had “undeposited funds” as the account so now everything is duplicated because of the bank feed. How do I clear out UF and then I’d like to just turn it off. Thank you!

Let's head to your Chart of Accounts to edit the transactions that have been deposited into UF, MTS Cindy. I'll walk you through the process.

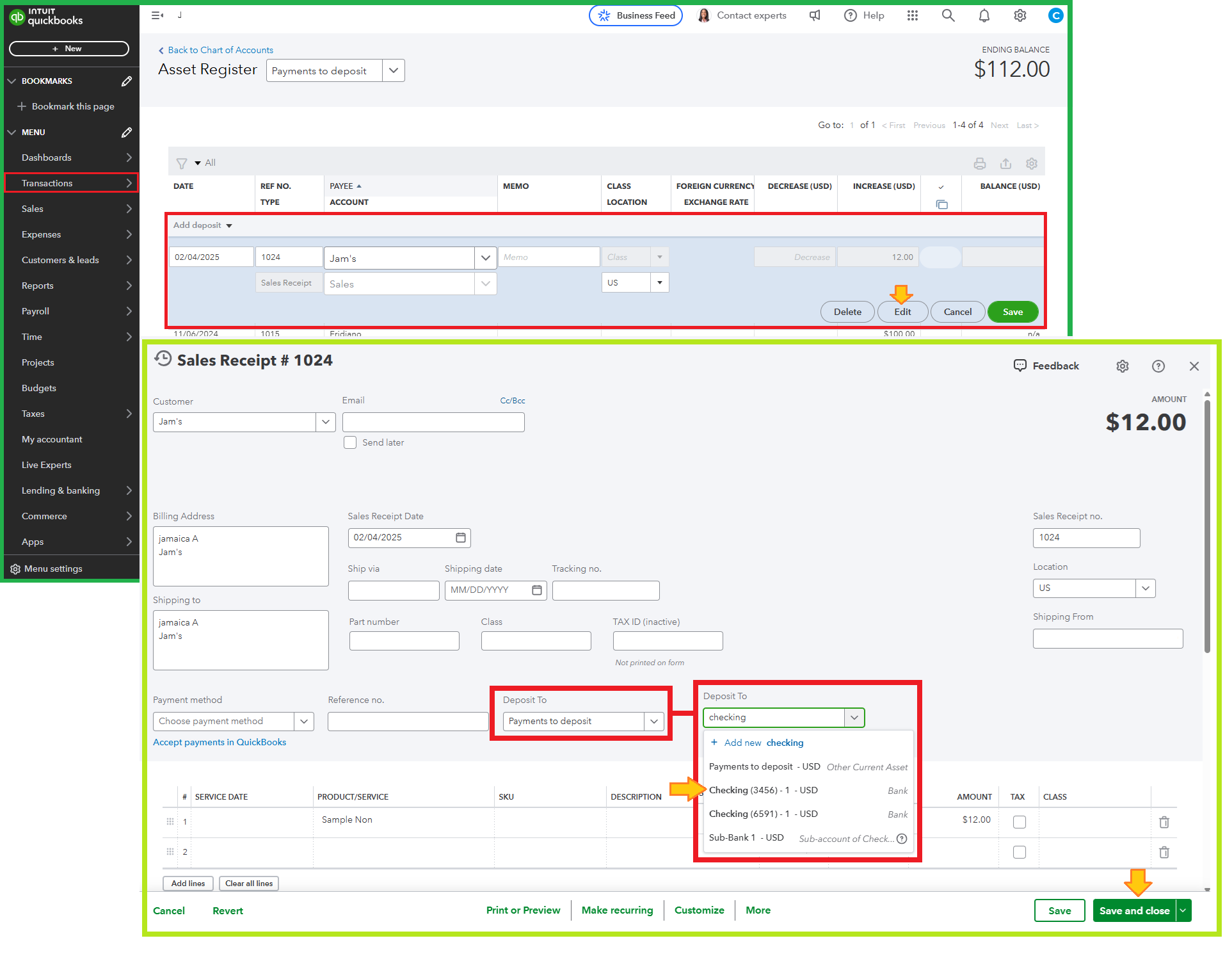

You can locate the entries within the Undeposited Funds account to move them directly to the correct account. Follow the steps below:

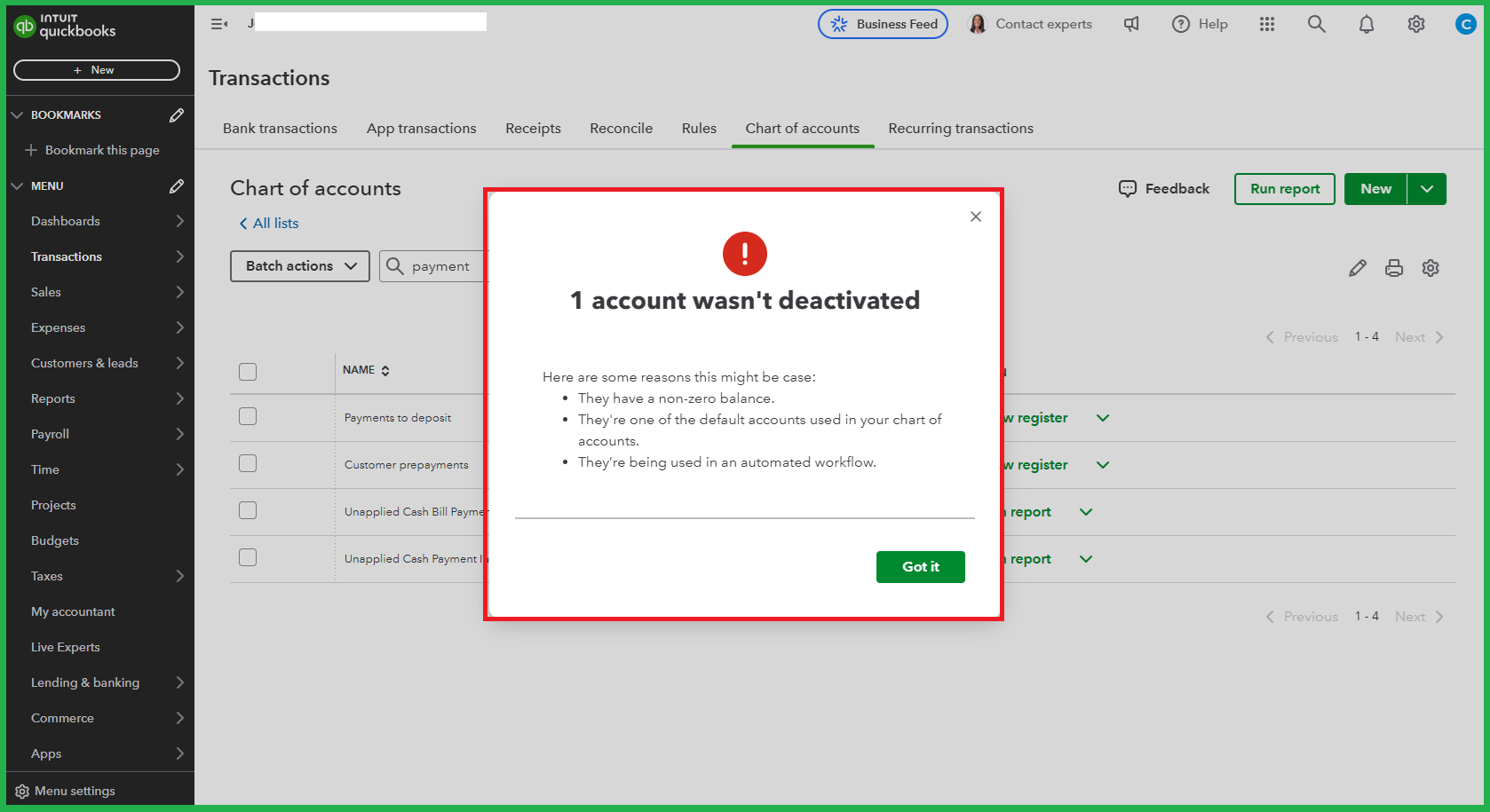

Speaking of the Undeposited Funds account, disabling or making it inactive is unavailable because this is a permanent account in your COA. QuickBooks ensures these default accounts remain active to maintain the integrity of your financial data. In the meantime, you can avoid selecting Undeposited Funds when recording deposits.

If you'd like to combine multiple transactions into a single record or make a bank deposit to clear the UF, refer to this article for more details: Record and make bank deposits in QuickBooks Online.

Next, you'll want to reconcile your accounts so they always match your bank and credit card statements.

With that in mind, do you require assistance with payment management and account reconciliation? Connect now with a QuickBooks Live Expert for more tailored support.

Please keep in touch with me if you have any other concerns about bank deposits or the reconciliation method. I've got your back.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here