Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe always pay our credit card off each month and I know this is not the right way to do this but I enter the credit card as a bill when I get the statement and expense all the charges accordingly. Then pay the bill from the pay bill feature. One month we had a large charge on our business card that caused us to go over our credit limit. This large charge was actually for 2 pieces of equipment one for the this company and one for another company we own. When the card went over the limit I transferred the payment amount online from the other company to pay down the credit card for this piece of equipment. How do I account for this in Quickbooks when the payment was from a checking account not listed in this company but our other one?

Recording a payment in QuickBooks using funds from one company to pay a credit card bill for another is possible, Kgard. Rest assured, we can collaborate to ensure efficient fund management across your companies.

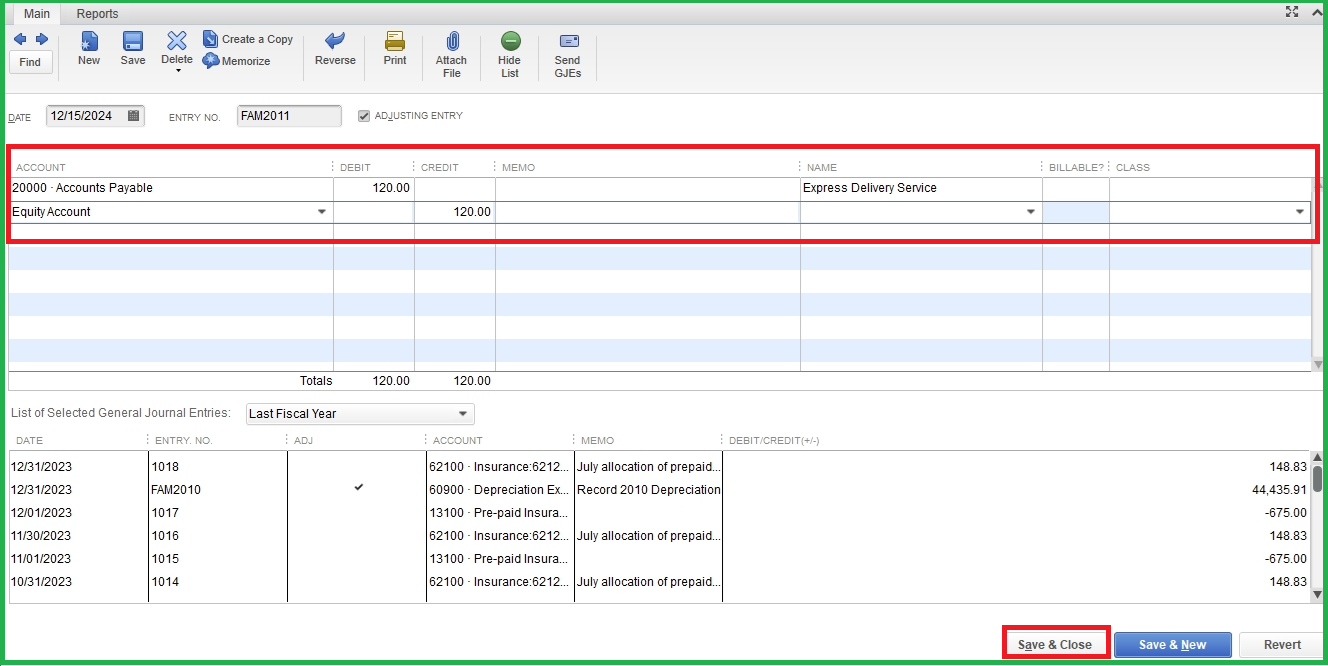

To accurately record this transaction in QuickBooks, you’ll need to start by creating Journal Entry (JE).

To create JE:

Please be reminded that it's always wise to consult with your accountant to make sure that the JE accurately captures all necessary data, thereby avoiding any discrepancies in your transactions. This ensures that your financial records are precise and reliable.

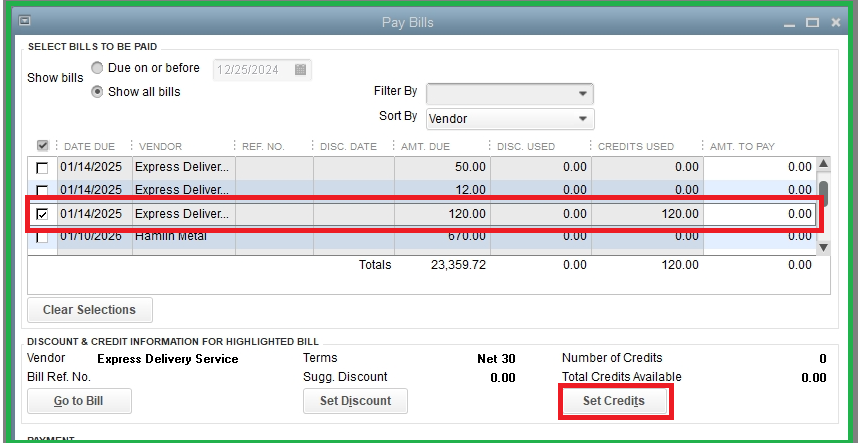

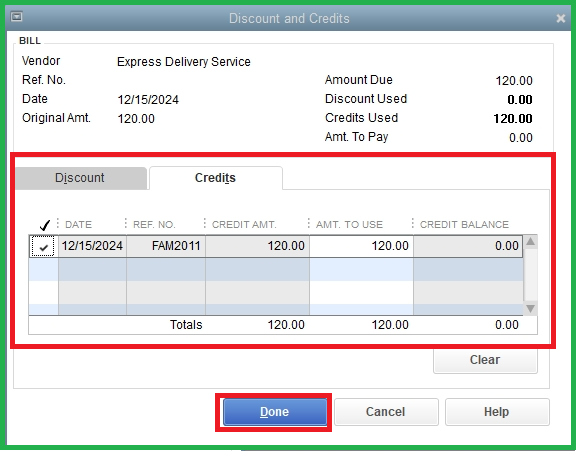

Once the JE completed, link the JE to the Bill using the Pay Bills feature:

This process ensures your financial records are both accurate and compliant.

You can refer to this article for guidance in creating a journal entry in QuickBooks Desktop to know more.

Additionally, this article can guide you on transferring and applying credit from one vendor to another in QuickBooks Desktop.

I'm happy to assist you with managing your financial transactions in QuickBooks, Kgard. If you need further help, please don't hesitate to click the Reply button and leave a comment. We'll be here to support you.

That was perfect! Thank you so much!

On behalf of my colleague, you're most welcome, Kgard. Thank you for getting back on this thread.

I'm glad that the steps provided by my colleague ThomasJosephD have helped you resolve your concerns about recording credit card payments in QuickBooks Desktop (QBDT).

We appreciate your effort in letting us know about this. Please let me know if you have any QBDT-related queries, and I'll get back to you as soon as possible. Have a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here