Hi there, sskid.

Ensuring all your transactions are categorized properly is essential to keep your tax forms accurate. So, I would like to show you the way and give you an idea of how to handle credit card payments.

When paying off your credit card in QuickBooks Self-Employed (QBSE), it's categorized as a transfer of funds from one account to another. This transaction doesn't directly affect your profit or spending.

Since the payments increase your profit, I suggest re-categorizing the entries. Here's how:

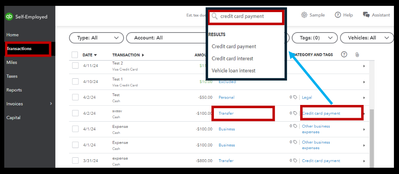

- Go to the Transactions menu.

- Find the payment transaction on the list.

- Click the category under Category and Tags and type in Credit card payment.

- The entry will now show as Transfer under Type.

Please note that this type of transfer isn't considered a business expense since you're not buying anything. Instead, you're categorizing the payment to your credit card for business-related purchases.

For more information about categorizing transactions and learn more about Schedule C categories, you can browse these resources:

Additionally, I'll add these references on how you can add older transactions and how the program tracks everything throughout the year to ensure your books and tax filings remain accurate:

I'm always here to help if you have other questions about ensuring your bank transactions are categorized correctly in QBSE.