Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am new to QuickBooks Online and still am unfamiliar with how things work. I have a customer with three sub-customers. I invoiced Sub-customer One two separate invoices for $2600.00 and $350.00. I invoiced Sub-customers Two and Three separate invoices for $350.00 each. Parent Customer paid $3125.00 through the online payment feature which covered the two invoices for Sub-Customer One and left a credit memo of $175.00 on Sub-customer One's account. Parent Customer then made another payment by check which covered Sub-customer Two's entire $350.00 invoice and $175.00 of Sub-customer Three's $350.00 invoice. Per Quick Book's Help section, I created a Journal Entry debiting Sub-customer One and crediting Sub-Customer Three for the $175.00. When I look at the Parent Customer's profile totals, everything is correct. Sub-customer One and Sub-customer Two both have correct info on their individual profiles. However, Sub-customer three is still showing an unpaid, overdue balance of $175.00. What have I missed?

Solved! Go to Solution.

We're happy to see you in the Community space, @Sharmonet57. Let me help you overcome this challenge to resolve the overdue balance showing in sub-customer three's account in QuickBooks Online (QBO).

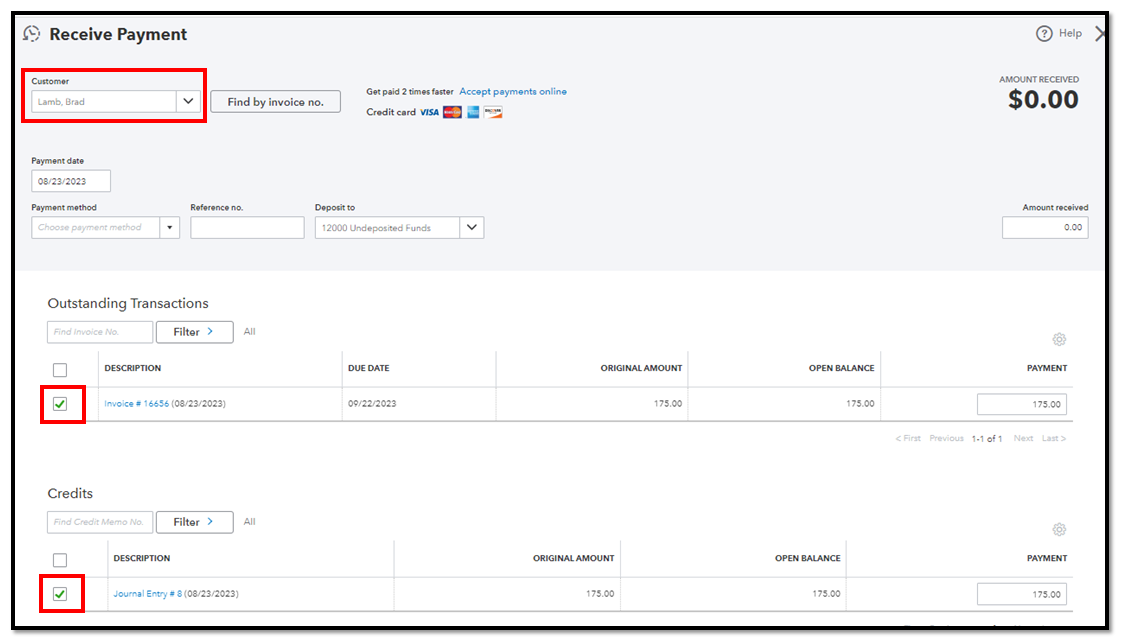

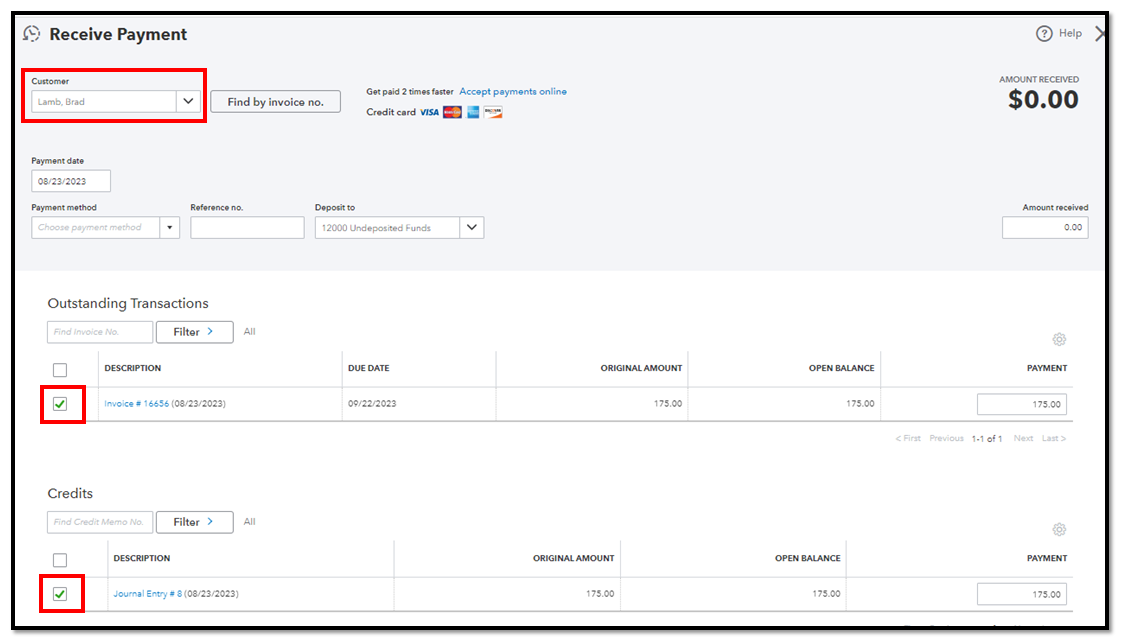

After creating a journal entry for the credit memo, we'll need to apply it to an invoice to mark it as paid. To do that:

Furthermore, you can set up your QBO to apply credits automatically. Doing so can save you time and prevent errors in recording transactions. To do that, please refer to Step 1 in this article: Create and apply credit memos or delayed credits in QuickBooks Online.

Keep me updated on your future concerns about applying credit memos by leaving a reply below. I'll chime in right away to assist you further. Stay safe!

We're happy to see you in the Community space, @Sharmonet57. Let me help you overcome this challenge to resolve the overdue balance showing in sub-customer three's account in QuickBooks Online (QBO).

After creating a journal entry for the credit memo, we'll need to apply it to an invoice to mark it as paid. To do that:

Furthermore, you can set up your QBO to apply credits automatically. Doing so can save you time and prevent errors in recording transactions. To do that, please refer to Step 1 in this article: Create and apply credit memos or delayed credits in QuickBooks Online.

Keep me updated on your future concerns about applying credit memos by leaving a reply below. I'll chime in right away to assist you further. Stay safe!

Thank you so much for your help!

Hi there, Sharmonet57.

Glad to hear that we're able to provide the help that you need.

Please don't hesitate to reach out to us again if you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here