Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi, we have customers who are not invoiced but send us automatic ACH payments into our business checking account. How do I register these payments received without an invoice? Thanks so much!

Good day to you, @afsmith. I''ve got some options about how you can record your customer payments in QuickBooks Online (QBO).

First, if the payment is for your sales, you can either create a sales receipt or record a bank deposit transaction for income.

The second option is to create a credit memo or generate a bank deposit affecting Accounts Receivable (A/R) if you want to apply your customer's payment to their future invoices.

Also, before creating a credit memo, please make sure the Automatically apply credits feature is turned off so that the credit won't apply to any open invoices. You can read through this article for more information: Create and apply credit memos or delayed credits in QuickBooks Online.

Furthermore, if you've linked your bank accounts to QBO and the transaction shows up in your bank feeds, you can simply match it to the sales receipt or bank deposit you've recorded. Here's an article for your reference: Categorize online bank transactions in QuickBooks Online.

I'm just around the corner to provide additional assistance to help you manage your customer payments in QBO. Have a good one, and stay safe.

Hi Kevin_C,

Thanks so much for your prompt answer. I am going to work on that now.

Hi Kevin_C,

Well I got halfway there. I've created a credit memo and completed the information, but I am not seeing how to like the credit memo to my downloaded deposits in my checking account. So sorry to bother you. Thanks!

Thanks for the update, afsmith.

You're on the right track in receiving customer payments by creating a credit memo in QuickBooks Online (QBO). Before you can link it to your downloaded deposits, you'll first have to apply it to an invoice. I'll gladly guide you on how to do this below.

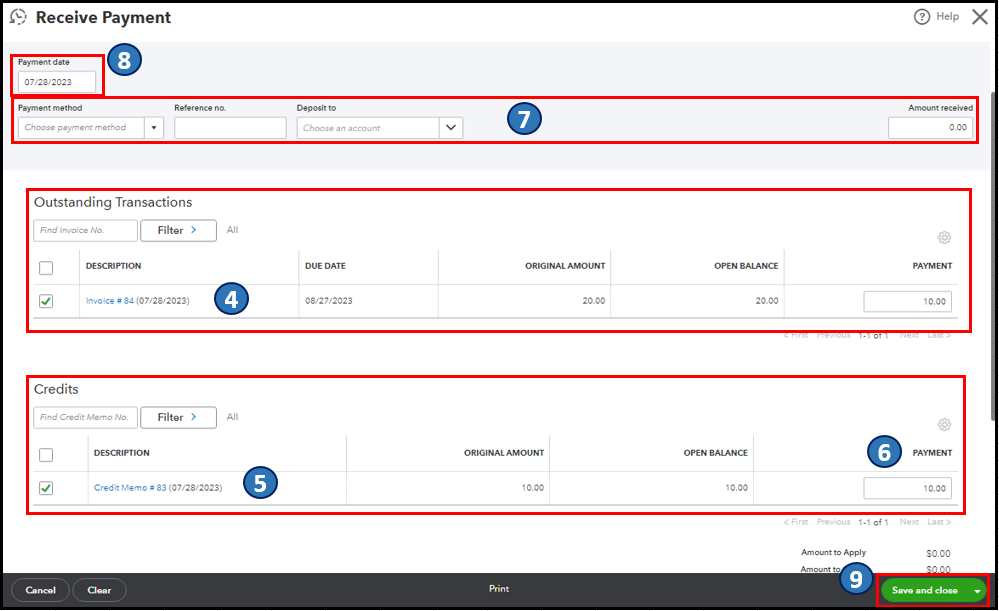

Since my colleague recommended turning off the Automatically apply credits feature so the credit won't apply to any open invoices, let's manually apply it to the appropriate one (if you've already created one for them). Here's how:

Once you're done, go to the Banking menu and link or match the invoice to your downloaded deposits in your checking account. For the step-by-step guide, please see this article: Categorize online bank transactions in QuickBooks Online.

Also, I encourage you to reconcile your checking account in QBO regularly (every month) to monitor your income transactions. You may want to check out this article as your reference in doing and fixing reconciliations in QBO: Learn the reconcile workflow in QuickBooks.

Let me know if there's anything else you need in managing payments and customer transactions in QBO. I’m more than happy to help. Wishing you the best!

Let me start by saying I am NOT an accountant. I'm just a user who believes in doing things the EASY way. I do NOT know how to create a Credit memo...well actually, I muddled through once when a customer asked for it but normally, I don't do this...I just apply the payment to the appropriate customer & I have my system set up to automatically apply to the next invoice created for that same customer.

When I receive a payment that will create an invoice (occasionally some customer pays too much OR accidentally pays the same invoice twice. If this is a customer we do quite a bit of business with then I will receive the payment normally in the following way:

1) Click New button on main screen & select "Receive Payment."

2) Select customer & then complete rest of form as normal by recording type of payment, any notes & amount of payment.

3) If you have NO open invoices for the customer then the system will note (on the bottom of the form) that the transaction will create a credit when you save it.

4) Save the transaction as normal. (ie: Save & New, or Save & Close, etc.) Please note, you MAY have to check the box that says "I have authorization and would like to process this transaction." before the system will allow you to save the payment.

This will then create a credit for the customer.

You need to decide if you want this credit to automatically be applied to the next invoice you create for that customer or if you want to apply it manually at some future time.

As I mentioned above, I have my system set up to automatically apply the credit to the next invoice created for that customer. I do this so I don't have to worry about forgetting to apply the payment manually. Whichever way works best for you....This setting can be found by clicking on the GEAR at the top of your QB screen.

Select the following to find this: GEAR, Account & Settings, Advanced & under the AUTOMATION section,

click "Automatically apply credits" ON or OFF.

I am sure that every step advised above makes perfect sense but honestly, I got confused reading all the steps. Since you got stuck, I thought I would share my simple workaround. ONE LAST note: when you record the payment it WILL automatically appear in your deposit so you can record it & deposit immediately if you so desire. Hope this helps!

Thanks for your speedy reply. I am confused because my original question was how to register a payment WITHOUT an invoice. Our customers send an ACH and we don't send invoices. Your colleague mentioned creating a credit memo and linking it to our QBO linked checking account deposit. There was no mention of then creating and invoice. How do I do this without creating yet another step besides the credit memo? Thanks! Alonna

Hi Phenom,

Thanks for taking the time to explain what you do. My head is spinning and the last reply doesn't match with the previous answer. Will go at it tomorrow. Thanks again!

Hi Rea_M,

Thanks for your speedy reply. I am confused because my original question was how to register a payment WITHOUT an invoice. Our customers send an ACH and we don't send invoices. Your colleague mentioned creating a credit memo and linking it to our QBO linked checking account deposit. There was no mention of then creating and invoice. How do I do this without creating yet another step besides the credit memo? Thanks! Alonna

Let me elaborate on some details to clear out things that may cause you confusion, afsmith.

Typically, the seller records a credit memo as a reduction of its accounts receivable balance, while the buyer records it as a reduction in its accounts payable.

Apart from this, we're unable to link a credit memo to a bank transaction since a credit memo can never be posted to a bank account.

With this, the only option that you can do is to either create a sales receipt or record a bank deposit, as @Kevin_C provided and illustrated above. To create a sales receipt, follow the steps outlined below:

For more information on how to enter bank deposits, check out this article for the process: Record And Make Bank Deposits In QuickBooks Online. Aside from that, you may want to check the screenshots in the previous reply for your visual reference.

Moreover, learn from this article how QuickBooks downloads and suggest categories for transactions. This will help you identify tax deductions and tells you where your business makes and spends money: Categorize Online Bank Transactions In QuickBooks Online.

Reach out to us if you need help when entering customer payments. We're always right here to further assist you.

Our QBs account is connected to our bank. I receive notification in QBs when an ACH sales payment was deposited in our bank, and it's recorded by QBs as a "bank deposit". I confirm the amount and assign a category (in this case "Service/Income").

However, when I run reports of sales by these customers, these deposits are not in this sales report. Your solution, if I understand correctly, is to create a sales receipt or a bank deposit. Why would I need to create another "bank deposit" if QBs has already done so? Isn't that a redundant task? Or is this the proper way to manage ACH payments in accounting? Thanks for your help!

You're on the right track, @blambert5. I can see it's quite confusing, but I’m here to shed some light on handling your ACH payments in QuickBooks Online (QBO).

First off, it's correct to directly categorize the bank deposit transaction from the Banking page to the appropriate income account. Furthermore, you don't need to generate another bank deposit for it, as it will double your income. Other advice with handling your ACH payments in accounting would be best if you talked with your business accountant for accurate reporting.

Based on your statement, I take it that you're trying to run the Sales by Customer Summary or Sales by Customer Detail report, which allows you to view the total sales made for the specified period. However, it will only display specific sales transactions that affect product/service items. Sales transactions, namely invoices, sales receipts, and credit memos.

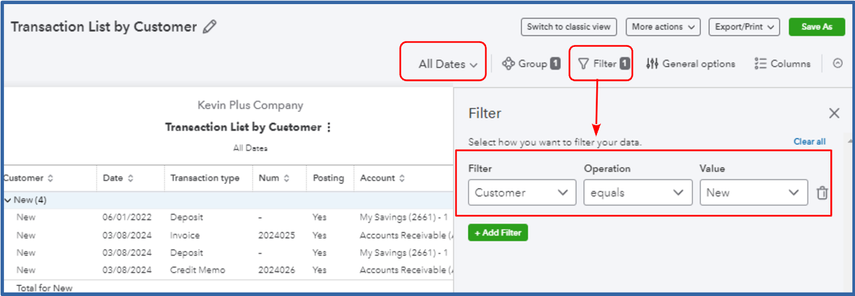

To get detailed information about your income for each of your customers, I suggest running the Transaction List by Customer or Profit and Loss by Customer reports. Here's how:

Another option you can utilize is to pull up the Profit and Loss by Customer report to see the detailed income and expense balances of a specific customer. You can click Customize and Filter it to view transactions for a specific customer.

Moreover, you may also visit this article to learn more about tailoring your reports, displaying particular accounts or customers, and configuring the layout for precise data placement: Customize reports in QuickBooks Online.

Just get back to me if you need further assistance, as I want to make sure this is resolved for you. Have a wonderful day ahead!

We are a non-profit and receive the vast majority of our income via donations for which we do not create invoices. Can we setup the donors as customers in QBs Online but simply record their payments through the bank deposit process (where we select the customer, enter contribution amount and credit a revenue account)? Will this payment show up on the customer side as a credit balance in their account? Or does that depend upon how setup our QBs file? I am hoping it will not affect/post to the customer account as the payment wasn't applied through the Customer Payment process. Thank you.

Hi there, Kerk.

Thanks for reaching us. I can see the importance of seamlessly using QuickBooks. Let me share some information on how to record payments in QuickBooks Online (QBO).

Yes, you can set up donors as customers in QuickBooks Online and record the payments through bank deposits. So with regards to the payment, if it shows as a credit balance to the customer, we can just create a sales receipt for that. Let me guide you through the process.

Here's how:

Keep in mind that if you are unsure about the Fair Market Value donation, I highly suggest consulting your accountant.

Moreover, you can also visit this link to help you manage your funds in QuickBooks Online: Track funds you receive from donors in QuickBooks Online.

If you have any questions or need assistance with managing your funds in QuickBooks Online, please don't hesitate to reach out. I'll be here to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here