Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI use a third party work-order system that automatically creates an invoice in QBO once the work order has been processed after the job is complete. We bill out a lot of our work so I will match the EFT/ACH or check to the open invoice and everything works out well.

Sometimes we take a credit card in the field which creates a sales receipt. This is before a QB invoice is automatically created.

Is there a way to apply the sales receipt to the open invoice? What is the best way to correlate a sales receipt with the invoice and show the invoice as paid?

Hello there, ChannelWatch.I can share what I know about the features and options you can use in QuickBooks Online (QBO).

Currently, the option to apply the sales receipt to the open invoice is unavailable. In QuickBooks Online, you need to select which one of these entries to use for your business.

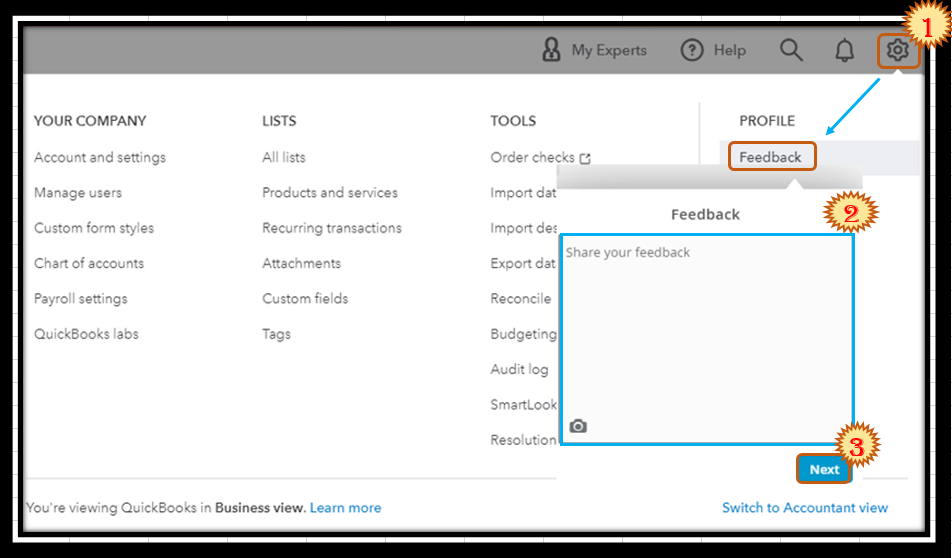

I can see how the functionality to edit your remittance slip would be beneficial to your business. I'd recommend sending a feature request directly to our Product Development team. This helps us improve your experience and the features of the program.

Here's how:

You can also track feature requests through the Customer Feedback for QuickBooks Online website.

Keep me posted if there's anything else you need with managing invoices or sales receipts in QBO. I'm always right here to help you. Have a great day!

You can prepare Receive Payments data with the following template

| RefNumber | TxnDate | PaymentRefNumber | Customer | PaymentMethod | DepositToAccount | InvoiceApplyTo | LineAmount | PrivateNote | Currency | ExchangeRate |

| 1 | 28/11/2020 | 50245 | Janice Johnson | Check | Checking | 101 | 100.00 | |||

| 2 | 28/11/2020 | 4908 | Leonard Walker Inc | Check | Checking | 102 | 138.78 | |||

| 3 | 28/11/2020 | 4908 | Lisa Smith | Check | Checking | 103 | 126.50 |

then use an importer tool to proceed

https://get.transactionpro.com/qbo

"Sometimes we take a credit card in the field which creates a sales receipt. This is before a QB invoice is automatically created. Is there a way to apply the sales receipt to the open invoice?"

The sales receipt is what makes this messy. QBO is unable to apply a Product/Service on a sales receipt to A/R, which is what allows you to automatically apply it to an invoice. IMO, the best thing to do is to create a Customer Deposit product that is mapped to a Customer Deposit (or Unearned Revenue) other current liability account. Then, move the deposit to the customer's A/R account with a journal entry so you can apply it to an invoice - debit Customer Deposit liability account, credit A/R. You now have a credit that can be applied to the invoice. This would be so much easier if QBO would allow you to assign A/R to a Product/Service so you could add that to the sales receipt and, at the same time, book the customer's A/R credit, but you can't.

The other option is to leave the deposit in the liability account and then add that same Customer Deposit product to the invoice as a negative amount, thereby reducing the balance owed. That looks better on an invoice IMO, but it's not as convenient to track as the A/R credit method above.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here