Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It seems our vendor applied credits to open invoices and we also took them in one of our payments. How do I enter a debit memo to show we still owe that money through quickbooks online?

Welcome to the QuickBooks family, @simplysweet02.

I can help you sort this out so you can get back on track. However, we need more information about it to provide the right resolution and to get this sorted out promptly.

Did you also create a payment during the time they used the credits? Any additional information you can provide will help ensure a timely solution.

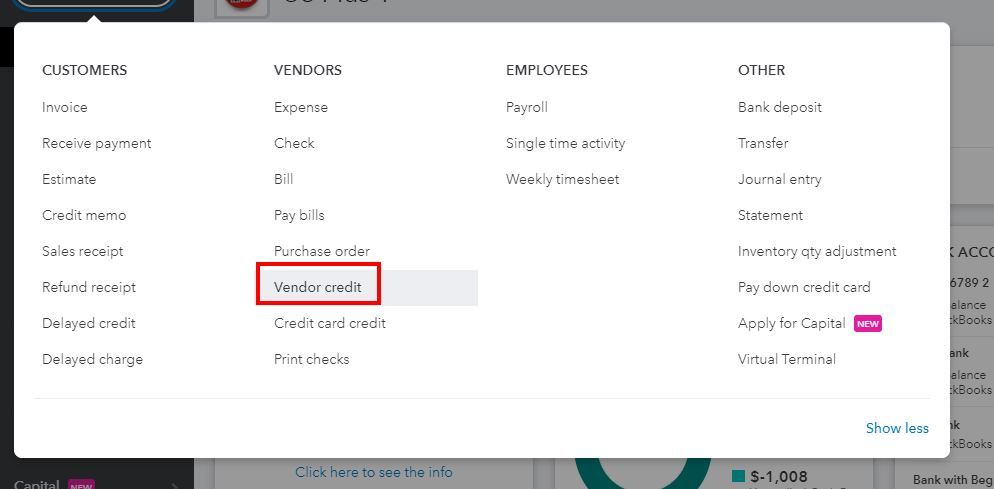

If a vendor applies credits to open bills, you can also record them the same way in QuickBooks Online. You can use the Vendor Credit option to add and apply the credits to your future transactions.

In case you need the detailed steps, here's how:

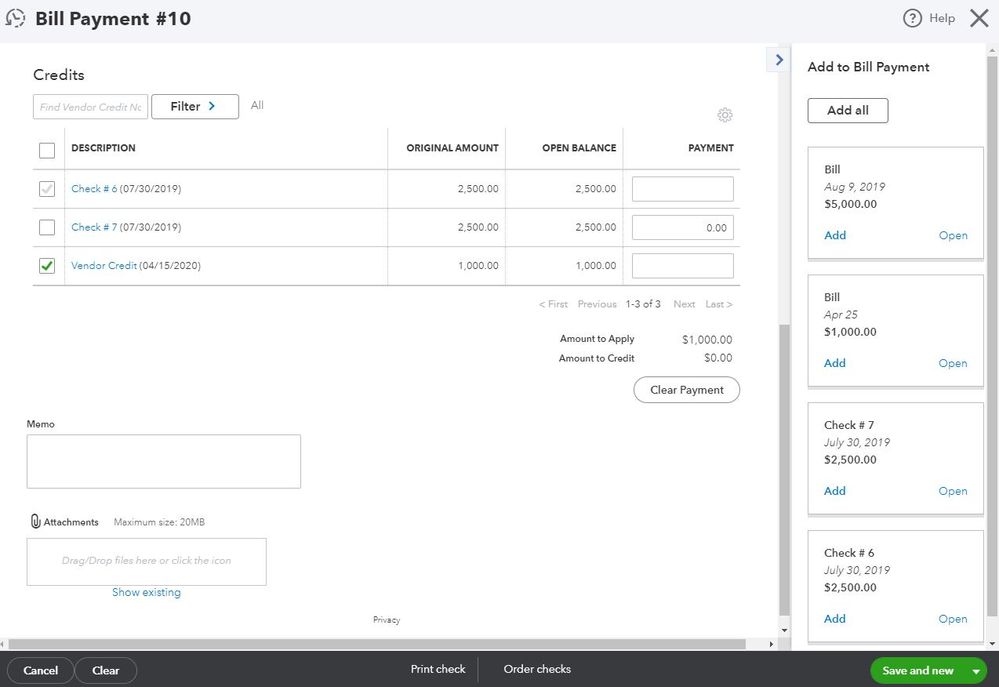

Once done, you can proceed with applying it toward any open or future bill. Whenever you're ready, you can follow these steps:

Additionally, I recommend the following resource which contains detailed steps of the process, as well as for those in Online Bill Pay:

Please let me know if there is anything else I can do to help by clicking the Reply button below. Have a great day ahead.

Thank you, but that isn't what I need to do. They applied credits to open invoices and we didn't know so we paid them with a check. Now, since we took the credits twice, I need to record a debit memo to show that we owe the money. I assumed it would just be entering a bill, but my boss says no. That it has to be a debit memo. I can't find anything on how to do this.

Thank you for the detailed information, @simplysweet02.

We'll notify the previous reply by my colleague to update the answer.

For this, if the Invoice(Bill) from your Vendor has already marked as paid. For the Credit given by your Vendor, just create a Vendor Credit. So the Balance will show a Negative Value which can be applied to the next Purchase/Bill.

Here's how:

Also, you can check out this related article entering a credit: Enter Credit from a Vendor.

Let me know if you have any follow-ups or other questions. I'm always here to help. Wishing you a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here