Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, I hope I can get some help on

A vendor was paid with paper online bill payment check through my bank. It was returned to the bank because the vendor's address had changed. The payment was redeposited 3 months later which was two months into the new year. How do I handle the bank's redeposit and the vendor's now unpaid bill from the prior fiscal year after all accounts had been reconciled? Other past years bills may be outstanding because of the same scenario. We have since contacted the vendor and updated the account information in the online banking.

Thank you for your help,

SanACC

Solved! Go to Solution.

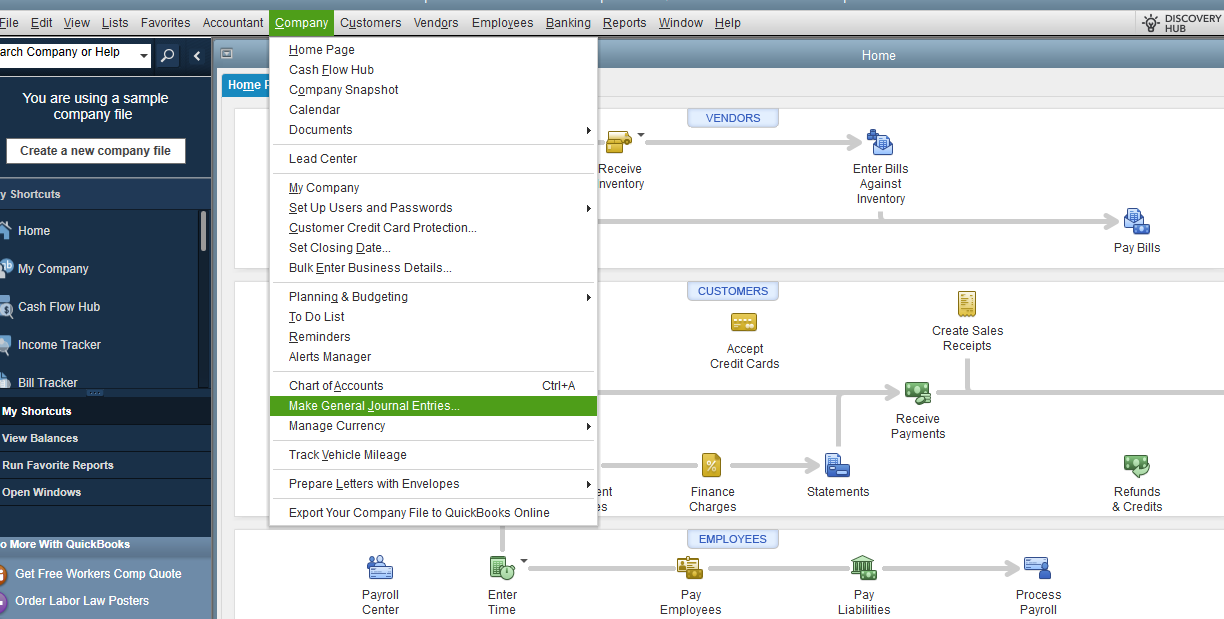

IMO, the proper way to handle this is to make a journal entry (a journal entry records this under the vendor's account) as of the date the check was returned to the bank: debit bank account, credit A/P (select vendor under 'NAME' on the A/P credit line). When you write the new check, assign A/P to the check. Then, go to Pay Bills and apply the "credit" created by the new check to the "bill" created by the returned check. This process keeps everything from last year reconciled and the only impact it has on the current year's financials is the deposit for the returned check and the payment issued by the new check, both of which you will clear the next time you reconcile the bank account.

Hello, @SanACC. I want to ensure you'll be able to record the returned bill payment correctly in QuickBooks Desktop (QDBT).

Thanks for sharing detailed information about your concern. To resolve this, we can create a Journal Entry (JE) to reverse the returned bill payment in QuickBooks. I highly recommend reaching out to your accountant to further advise you on how to handle the returned funds. If you're not affiliated with one, you can use our Find an Accountant tool to look for one near your area.

Let me guide you to accomplish the task:

The second is to unlink the bill from the payment check, then link it to the journal entry you've created. Here are the steps:

For the complete process, check this article and proceed with Steps 3 & 4: Manage a bounced check.

Once done, you can start reconciling the account to ensure your books are up-to-date.

Please don't hesitate to leave a reply below if you have any other concerns managing your transactions in QuickBooks. Have a good one and stay safe.

Thank you DebSheenD for your quick response. I kind of understand the instructions for creating the journal entry. Since the initial payment was made in the prior year and all bank statements were reconciled and tax documents have been filed, does this affect any of the previous year's reconciliations? Or create any discrepancies?

If you make updates or any adjustment entries for the impacted period, then yes, it affects your previous year’s reconciliation and tax documents, @SanACC. Allow me to chime in and provide additional information about managing returned bill payments from a prior year.

QuickBooks Desktop tracks transactions based on the date they're entered. Any changes after reconciliation or tax filing will impact and cause discrepancies.

As mentioned by my peer above, it’s best to contact your accountant for the best course of action. They can guide you further to ensure records remain intact, accurate, and error-free.

You can access this guide anytime if you need insights about doing or fixing a reconciliation: Learn the reconciliation workflow in QuickBooks. This includes ways to make changes after you process them.

If you have any specific concerns or need further assistance operating your books, please let me know. I'll always be here to help in any way I can.

IMO, the proper way to handle this is to make a journal entry (a journal entry records this under the vendor's account) as of the date the check was returned to the bank: debit bank account, credit A/P (select vendor under 'NAME' on the A/P credit line). When you write the new check, assign A/P to the check. Then, go to Pay Bills and apply the "credit" created by the new check to the "bill" created by the returned check. This process keeps everything from last year reconciled and the only impact it has on the current year's financials is the deposit for the returned check and the payment issued by the new check, both of which you will clear the next time you reconcile the bank account.

Thank Rainflurry for your advice. Your solution seems to answer the question of addressing the returned check in a way that does not affect the prior reconciliation. Also you address how to handle the payment in the current period. I will update when we have tried your solution. Is there a way to test and/or reverse the solution before a permanent application in the event there is a problem?

Thanks again,

SanAAC

Thank you MadelynC for your reply. The bill was marked a paid in the prior year. Now that the bank has returned the bill payment two months into the new year it would be hard for us to undo all of our tax documents to address this one issue. We are a small non profit. How do other companies handle this issue?

Thanks again,

SanAAC

I would suggest you do not listen to any advice from QB employees on this issue. They do not know the proper accounting. This situation comes up regularly on this forum and I have never seen a QB employee understand how to handle it.

"Is there a way to test and/or reverse the solution before a permanent application in the event there is a problem? "

Yes. Follow the procedure in my previous post and, if it doesn't work how you anticipate, delete both the journal entry and the check and you're back to where you are now.

Thank you Rainflurry for your directions. As I have noted, we are a small non profit and I am learning as I go so I appreciate your guidance as well as your patience. I have followed the steps but have not paid the bill yet, although, I did see that there would be a credit applied with the check that I wrote in QB. My question is, since we actually paid that outstanding bill in the same month we received the returned payment using a debit card from the same bank account as the original payment method, does writing the check with the same date as the debit card payment take care of the returned check as well as the payment in the current month? Again, I thank you because if I understand and get this right then it will be a big help in handling these type of situations that come up in the future.

SanAAC

"As I have noted, we are a small non profit and I am learning as I go so I appreciate your guidance as well as your patience."

Happy to help.

"My question is, since we actually paid that outstanding bill in the same month we received the returned payment using a debit card from the same bank account as the original payment method, does writing the check with the same date as the debit card payment take care of the returned check as well as the payment in the current month?"

Not exactly. There are two different things that you need to account for: 1) the deposit of the returned check and, 2) the issuing of the new payment. You need both in order for your your bank account to reconcile properly. The thing that is important to understand (forgive me if you know this already) is that QBO is based on double-entry accounting. That means that every entry you make in QB affects two accounts. When you issue a check, there is a reason why you issued that check and you need to specify it under Category. In this case, you have received a returned check. That retuned check is being deposited into your bank account (entry #1) and you now owe that amount to your vendor so it should be assigned to account payable (A/P) which is entry #2.

The deposit of the returned check is created using the journal entry - debit bank account, credit A/P. The reason I think it's best to use a journal entry in this case is because it will show under the vendor's account. You could make a deposit (New > Bank deposit), but it won't show under the vendor's account. That's just how QBO works. At this point, you now have the deposit of the returned check entered into your bank account and a corresponding amount sitting in A/P that you owe vendor.

Now you need to account for the reissued payment. In this case, since you paid the vendor out of the bank account, using the Check function works. Obviously, you didn't issue a check but, the payment came out of your bank account. I like to enter EFT or Card in the 'Check no.' box so I know the payment was not made with a check. You could also use the expense function (New > Expense) to record the reissued payment. However, I just think that sounds misleading when you look under the vendor account and you see an expense transaction listed. The reissued payment is not an expense, it is a reduction in the amount you owe the vendor (A/P). But, that's up to you. You can use either one. Just make sure to select A/P under Category on the Check or Expense. The payment reduces your bank account and A/P by the same amount.

Now, you just need to connect the journal entry from the returned check to the new check issued. Go to 'Pay bills', select the vendor, and you will see both listed. Check the boxes for the deposit and payment that offset and click save.

There are other ways to handle transactions like this. You could use a bank Clearing Account to offset the returned check and the new payment instead of A/P. That way, you don't need to connect the two transactions using 'pay bills' since you're not using A/P as the offset. Or, if the deposit and reissued payment occur on the same day, you can use the Check function and under Category, select the same bank account you're making the payment from. That will create a deposit and payment in one entry - quick and easy. Just make a note in the memo box as to why this check is being issued that way. In the future, it may not be you that has to make sense of that payment. Sorry for the long-winded response.

Hello @Rainflurry

Thank you very much for your detailed explanation how to handle this in QB (we are using QB Premiere) but also insights into concepts and principles that increased my understanding of how to handle this and other similar types of scenarios that come up.

I have followed the procedure you outlined above in your first post making sure that I use the correct dates. In the bill bay window I saw the journal entry and when checked, it automatically applied the credit. I then checked the A/P account and saw the bill was paid with the credit check (CheckCard) in the correct month! I will mark your original post as the solution.

So thank you very much again,

SanAAC

Hello Rainflurry,

Thank you for sharing your input to help address the issue. We love to see members supporting one another. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here