Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My employer is looking to turn on inventory and use EIR, but we are wary on how we can integrate this with the Bill.com sync. When Bill.com creates a bill it creates it as a billed expense, not as a billed item.

Right now when a bill is created through Bill.com it debits an expense account under COGS, and Credits AP. I was wondering if we would run into any issues if we debiting the Inventory Offset Account instead of the COGS?

| Type | Account | Debit | Credit |

| Bill | COGS | $100 | |

| Bill | Accounts Payable | $100 | |

| Bill Pmt -Check | Accounts Payable | $100 | |

| Bill Pmt -Check | Bill.com Money Out Clearing | $100 | |

| General Journal | Bill.com Money Out Clearing | $100 | |

| General Journal | Checking Account | $100 |

| Type | Account | Debit | Credit |

| Receipt | Inventory Asset | $100 | |

| Receipt | Inventory Offset (Liability) | $100 | |

| Bill | Inventory Offset (Liability) | $100 | |

| Bill | Accounts Payable | $100 | |

| Bill Pmt -Check | Accounts Payable | $100 | |

| Bill Pmt -Check | Bill.com Money Out Clearing | $100 | |

| General Journal | Bill.com Money Out Clearing | $100 | |

| General Journal | Checking Account | $100 |

To me this would debit inventory asset and credit the inventory offset when received with EIR, then debit the inventory offset and credit AP when the bill is created in Bill.com. Would this create any issues that I may have not considered, if so what would they be? Also would turning on EIR disrupt the sync with Bill.com to prevent this work around?

Thank you.

Solved! Go to Solution.

I use Bill.com with QBD and sync bills for inventory purchases to a temporary "purchases" asset account. This particular business is on the periodic inventory method so that's the reason I do it that way. The sync debits the purchases asset account and credits A/P. It works like a charm for this business. I'm not sure if there's an answer to your question in there or not but I don't see any issues with your proposed way of doing it.

Hi there, @Dan_.

I can share some insights on what accounts are affected once you use the Enhanced Inventory Receiving (EIR) in QuickBooks Desktop (QBDT).

QBDT debits the Inventory Asset Account and credits the Inventory Offset Account when you enter an Item Receipt. For the bill, QBDT debits the Inventory Offset Account and credits the Accounts Payable account.

In addition to this, any third-party applications that affect inventory may not work as expected when you use the EIR in QBDT.

I suggest browsing this guide first to learn more about what will happen when you use the EIR: Turn on Enhanced Inventory Receiving. It shares more about the functionality of the feature in QuickBooks.

I'm also adding this article to learn how to organize your transactions: Accounts Payable workflows in QuickBooks Desktop.

Keep me posted if there's anything else you need by commenting below. I'll be around whenever you have additional questions about the EIR and your bills.

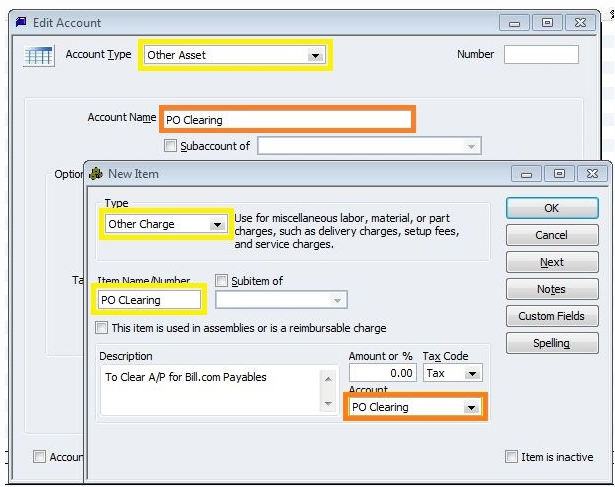

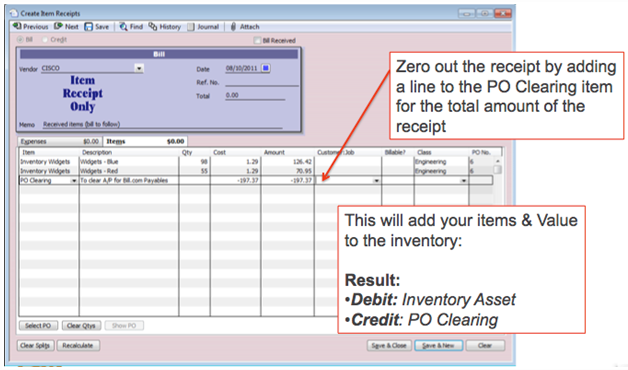

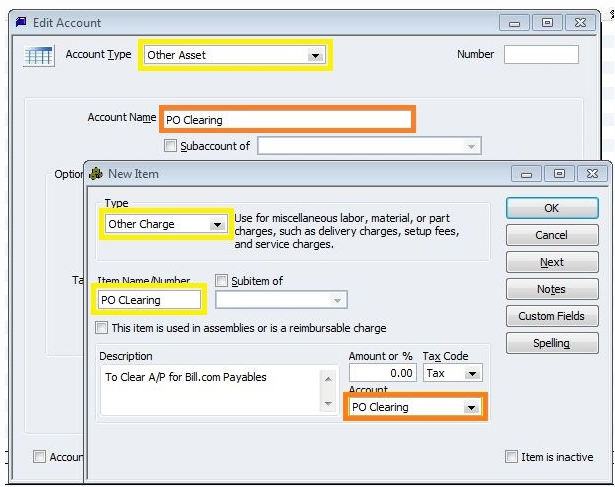

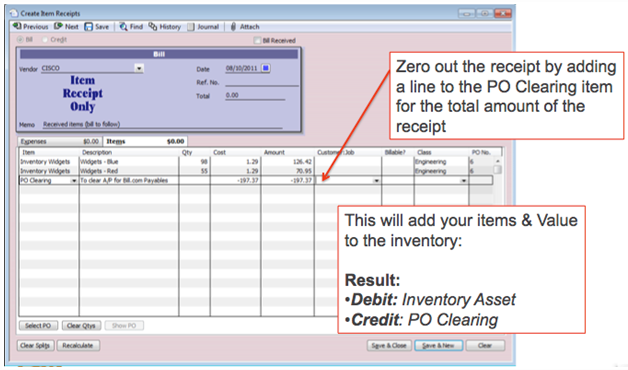

Bill.com does not affect inventory, because it only creates expense bills. Normally without turning on EIR the solution would be to create a Clearing Account and debit the Clearing Account through bill.com.

| Type | Account | Debit | Credit |

| Receipt | Inventory Asset | $100 | |

| Receipt | Accounts Payable | $100 | |

| Receipt | PO Clearing (Asset) | ($100) | |

| Receipt | Accounts Payable | ($100) | |

| Bill | PO Clearing (Asset) | $100 | |

| Bill | Accounts Payable | $100 | |

| Bill Pmt -Check | Accounts Payable | $100 | |

| Bill Pmt -Check | Bill.com Money Out Clearing | $100 | |

| General Journal | Bill.com Money Out Clearing | $100 | |

| General Journal | Checking Account | $100 |

Theoretically the same can be done with the Inventory Offset, assuming it does not change in a way that creates unforeseen issues. That is what I was wondering.

Bill.com does not affect inventory, because it only creates expense bills. Normally without turning on EIR the solution would be to create a Clearing Account and debit the Clearing Account through bill.com.

| Type | Account | Debit | Credit |

| Receipt | Inventory Asset | $100 | |

| Receipt | Accounts Payable | $100 | |

| Receipt | PO Clearing (Asset) | ($100) | |

| Receipt | Accounts Payable | ($100) | |

| Bill | PO Clearing (Asset) | $100 | |

| Bill | Accounts Payable | $100 | |

| Bill Pmt -Check | Accounts Payable | $100 | |

| Bill Pmt -Check | Bill.com Money Out Clearing | $100 | |

| General Journal | Bill.com Money Out Clearing | $100 | |

| General Journal | Checking Account | $100 |

Theoretically the same can be done with the Inventory Offset, assuming it does not change in a way that creates unforeseen issues. That is what I was wondering.

Thanks for reaching back out, Dan. I appreciate the information you’ve shared with us.

To shed your curiosity, I recommend contacting your accountant. They can provide more insights about accounts when managing inventories.

If you don’t have one yet, you can visit our ProAdvisor website to find an expert. Our advisors can also assist you from technical and accounting perspectives. Just simply enter your city or ZIP code.

For more information about handling inventories, products, and services in QuickBooks, check out this article: Manage inventory.

Don’t hesitate to let me know if you have any other concerns or questions besides EIR and Bill.com. We’re always here to help you out. Take care and have a good day!

Thank you for your response, but from an accounting aspect I think we have a pretty good handle on how to reconcile the transactions. It is less the accounting and more the technical aspects of doing this. Will there be anything to prevent Bill.com from debiting the inventory offset account? For example, when bill.com creates a bill, the bill would look like an expense bill with the account being the inventory offset as opposed to an item bill.

I use Bill.com with QBD and sync bills for inventory purchases to a temporary "purchases" asset account. This particular business is on the periodic inventory method so that's the reason I do it that way. The sync debits the purchases asset account and credits A/P. It works like a charm for this business. I'm not sure if there's an answer to your question in there or not but I don't see any issues with your proposed way of doing it.

Do you use enhanced inventory receiving? I know this workaround works with normal inventory, but I was unsure if EIR would disrupt this in any way by creating restrictions on the functionality between Bill.com and QBD.

Hello there, @Dan_.

I recommend consulting your accountant to quell your curiosity. When it comes to inventory management, they can supply more information about accounts.

If you don't already have one, you can look for one on our ProAdvisor website. Our consultants can also help you with technological and accounting issues. Simply type in your city or ZIP code to get started.

Check out this post for more information on managing inventories, products, and services in QuickBooks: Manage inventory.

Please don't hesitate to contact me if you have any additional problems or questions about EIR or Bill.com. We're always willing to assist you. Take care of yourself and have a wonderful day!

I AM the company's accountant. I am not worried about the accounting side, I am worried about functionality of the software. Please stop pitching an add on service that I have already declined.

Thank you, MaryLandT, for the links. I went to the one about the AP procedure. If we use the item receipt to enter the bill, the PO will also sit in bill entry - and the PO will not show that it is billed from the PO view. Is that correct?

Thanks for posting here in the Community, Kate. It'll be my pleasure to assist you with the Accounts Payable (AP) workflow in QuickBooks Desktop.

Before I can do that, I'd like to know more details about the process you've done so I can provide you with the exact solution to your concern. You can also provide us with a screenshot, it would be a great help.

I'll be waiting for your reply. Take care always!

Hi! Right now it goes: Client approves estimate --> estimate turns in to an SO --> PO is created. When job is done, Bill is entered against PO and item receipt is entered against PO.

When all is done, the Rcv'd column and the "qty on bills" both should equal the QTY on the PO.

Looking at this PO, I can see that the po has been received in full and bills have been entered in full.

Doing it this way was fine until the April 2021 update. Ever since the update, when I do an item receipt it throws and open item receipt into the bill entry section.

The work around that QB said to do is to enter the bill on the item receipt instead. But, from the PO screen how will I know that a bill has been entered? It will show, 0 for the QTY on "Qty on bills" column.

Thank you for your help!

It's my priority to help you run the report to see the quantity in QuickBooks Desktop, @Kate.

We can dive into the Transaction List by Vendor report and customize it to show the Billed Date, Quantity, and all the bills. This way, we can view and check quantity.

Since we have no specific report that shows all the quantities, I recommend sending feedback to our product developer.

Follow the steps below:

Moreover, several various reports tell how the business is doing in QuickBooks. These reports provide company-related information. For information on each report group offered by QuickBooks Desktop Pro and Premier, see the table in this article: Understand report in QuickBooks Desktop.

Let QuickBooks desktop memorize transactions so you'll receive a reminder each time it is due. To save time, QuickBooks can enter the remembered transactions on your behalf: Create, edit, or delete memorized transactions.

I've got your back if you have more questions about managing billing queries in QBDT. I'd love to hear from you in the comment section. Take care, and enjoy the rest of the day.

this is not helpful in the slightest

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here