Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi tsd81,

Having the right feature on the software is imperative. At the moment, you'll have to uncheck the Billable box manually.

I will send feedback request directly to our engineers regarding this option. They can consider the feature to turn off the billable box when creating from the Sales Order in the next update.

Also, in case you need some related help articles for your future task, please check this page: Accounts Payable workflows in QuickBooks Desktop.

If there's anything else you need, don't hesitate to reach out.

Thank-you for your reply. I appreciate your willingness to help but I can't agree with the scenario you described and it is not consistent with the logical use of QB for order entry and processing. Nor is it consistent with the purpose of a "billable" item within accounting. It would also create the following problem within QB that would cause the customer to be billed twice for an item:

1. A customer places an order and you create a Sales Order in QB for the items the customer has ordered. Lets say there are 20 items on the Sales Order and you do not have item3 in stock. The purchase price to the customer for item3 is $2.

2. You create a Purchase Order directly from from the Sales Order for item3 at a cost from the vendor of $1. In your scenario, item3 automatically gets flagged as "billable". The purpose of creating the PO from within the SO is to fill in the information directly to avoid errors and save time .

3. When you receive item3 from the vendor, you create a bill and, since item3 is flagged as "billable", you will create an invoice to the Customer for $1. for item3. It doesn't make sense at all to bill the customer for the amount you paid for an item ($1. here) you intend to resell them on a Sales Order at a higher price.

4. When you ship the Customer's order, you create an invoice for the Sales Order and send it to the Customer. As part of that invoice, the Customer is billed $2. for item3.

Do you see the problem here? In this scenario, you would be sending your customer 2 invoices for item3 AND, if that isn't bad enough, the bill you send for $1 tells your customer what you paid for the item.

As I understand it, "billable" expenses are the expenses that are incurred by you on behalf of your customer in performing some work, services or supplies such as travel expenses, or other expenses that are not reflected on a Sales Order from a customer.

So the "bug", be it a software bug or a design bug is that items should NOT default to "billable" simply because you created the PO from the SO. It is a nice feature to be able to see what customer the item is for but this should not automatically flag it as billable. Also, the preference to disable "billable" should actually work.

Can we please admit this is a bug? If not, please try the scenario I described above which proves it.

I would add that even if you just add a PURCHASE ORDER first. Then proceed to receive items + bill it will mark the billable checkbox. (So no sales order, etc.)

All they have to do is add a link on the column label 'billable' to allow you to select all and de-select all by one click. That's all. Easy to solve on the spot in the meantime. Otherwise you have to click 1 by one and with many items -- a pain.

Your understanding of what constitutes a billable item -- is what I believe. They could either add a clear column box to at least make it one click. Ideally they just add an attribute on the item setup for any item to determine whether or not this is 'billable by default'.

One would never bill at cost or in the case of travel or hotel it typically involves pass-thru. I could also see getting prints from a printer -- and passing that thru as part of 'incidentals' expenses.

Any updates on this enhancement?

Thanks for joining this thread, BeanCounter146.

I haven't received any reports about the enhancement of billable check marks on bills.

Let me clears things out for you about disabling the billable check marks on bills in QuickBooks Desktop (QBDT).

QBDT lets you incur expenses to customers when you work for them. That being said, the system will automatically check the Billable field in the Bill page when a customer is assigned to it in the purchase order. See the screenshots below for your visual reference.

You'll want to delete the customer from the purchase order (PO). This will remove the check mark when you create a bill.

I'm adding the What’s new in QuickBooks Desktop 2020 link for additional information. This includes new features and improvements in the product.

Keep me posted if there's anything else you need. I'm always around to help ensure your success.

Thank you and keep safe!

This exactly. One box at the top of the billable column the selects or de-selects them all.

Hi MaryLandT,

What you are asking (to remove customer name from PO) is as much a pain as unchecking every item in a bill. I am a paper and print broker, and don’t hold inventory. I create a sales order with upwards of 20 items at times. Then create a PO from that sales order to keep it all connected to the client. I upgraded QB long ago to be able to create a PO from a Sales Order. Keeping it all connected to the client, because those items are for that client only.

The solutions being offered are not convenient in any way. I don’t understand why a simple solution like a deselect all box on top of the billable column is not being implemented after so many are requesting this. Obviously there are many here that use QB this very way, and have upgraded to have these conveniences.

Thanks for sharing your thoughts about enhancing your QuickBooks Desktop experience as well as for the benefit of other users, @FR2X-MP.

I'm glad to take note of this and pass it over to our developers. Like you, I'm also hoping to see this in our upcoming releases of features updates.

Right now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Don't hesitate to drop by again if you'd like to ask or share anything about QuickBooks. We're always here to get back to you.

Please add me to the list also! I do not want bills to be automatically checked billable !

Hello,

Please add me to the list for this bug-fix. As a home builder, I use both Class and Customer:Job categories for each check, and rarely are these allocated to Expense. They're mostly allocated to Items because it's a capital asset until the building is sold.

Please let us know when this fix is coming, and if it's not on your roadmap please indicate why and when it will be.

@chrystalrena wrote:Please add me to the list also! I do not want bills to be automatically checked billable !

Yet another complaint. Please listen to your customer feedback. We use Enterprise and have the same problem. Dont understand what the big problem is by offering an option.

John

Just checking to see if any movement has been made on a solution to prevent everything assigned a customer on a PO to being "billable" by default.

It is unreasonable for us to remove the customer from the PO -- this is how we assign certain costs to jobs. I agree with everyone here, a simple "uncheck all" option on various screens would be a great addition/enhancement/bug fix/whatever you want to call it.

I can't believe this is still not fixed. This is a major bug that needs to be handled asap. Your use of the customer field is not acceptable as we are required to track every purchase to the vendor and customer to maintain legal compliance. We deal with single customer orders that may result in 2000 different line items from 300 vendors. This is a problem that is costing us hundreds or even thousands of dollars in labor to "simply uncheck" the boxes. These needs to be corrected immediately.

Count me in too! I can have bills come in with 50 or more lines that have to have the billable check mark deleted for each line. I can't understand why you can't at least add a box at the top to delete all the check marks. QB forces us to upgrade every 3 years, but won't fix a flaw that obviously affects a lot of people. Please have this fixed ASAP!!

Thank you for escalating this issue to your engineering/development team. Having to manually uncheck the billable box for every bill is exceedingly tedious. I am looking at upgrading to the 2021 Desktop Pro version but want to make sure this issue is resolved.

Dear QB/Intuit,

I am very disappointed to see that this issue is unresolved in over two years. There should at least be a bug patch. Why would I buy the 2021 version if you cannot fix something as simple as this in a timely manner.

I do not consider this solved.

M

What is Teamviewer's response to this issue after so long a time?

Hello there, @Michael222.

I understand how important this feature working for you. Currently, the option to delete all the billable checks is unavailable. Like you, I'm also hoping to see this in our upcoming releases of features updates.

Right now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Don't hesitate to drop by again if you'd like to ask or share anything about QuickBooks. We're always here to get back to you.

It appears that the problem itself is not understood. This is a BUG which I VERY CLEARLY detailed in my initial posts. The solution is NOT a FEATURE to delete all the billable checks. The solution is that when you create a PO from a sales order, it should not cause the items on that PO to be billable. This seems like a very reasonable thing to require a bug fix for, especially for people like myself who have spent years "unchecking" all of the "billable" boxes when they they receive a PO for billing simply because the QB people won't fix the problem.

QB now disables CC processing and other features if you don't upgrade to the latest version of QB (a good way to hold you hostage to pay for the upgrade) but I agree that if they can't fix a bug like this, why spend the money to upgrade?

This has haunted me for years and I absolutely hate it. I'm on enterprise and still have to uncheck every box. Hoped when I upgraded this year from premier that enterprise would have this "Enhancement" in it.

It's a bug. I find myself constantly mistakenly not unchecking the box and having to go back through and audit my transactions and clean them up.

Billable is when you are doing work time and material with no set price. Most have a set price contract or sale and just need to track costs incurred to deliver what the customer purchased. The total invoice amount does not change.

I'm glad that I can finally see that if you don't attach a customer to Purchase order it's unchecked. Could never figure out how there's a setting in preference's that doesn't work.

THIS IS ABSOLUTLEY INSANE FOR A PRODUCT I PAY 1000's OF DOLLARS FOR EACH YEAR.

SO MANY WAYS TO EASILY FIX THIS!

This is a very annoying BUG. But I'm not really surprised that it hasn't been fixed yet. I'll add it to the list of other bugs which QB refuses to fix.

"Have you tried updating to the most recent version of QB that still contains all the bugs as your current version"

Our goal is to make QuickBooks as user-friendly as possible, @NotThatQuick.

I can see how it would be beneficial to you and your business to have this specific feature. I'll make sure to pass along your request to the Product Development Team.

Also, you can visit our QuickBooks Blog so you'd be updated on the latest product updates, improvements, and feature releases.

Drop your comments below if you have other questions or concerns. I'll be here to ensure your success. Keep safe.

I would also comment on this being a needed fix, 2 years this thread has been going on and still no fix. This is a major annoyance to have to manually remove the CUSTOMER:JOB or uncheck each box, individually.

We are not strangers to Quickbooks not fixing important bugs, but how many years and complaints does it literally take? Quickbooks loves adding new report features for the bean counters every update, but never fixes bugs or adds useful features that people ask for.

Hi there, @acuddemi1.

I can understand why being able to uncheck the Billable boxes at once would be handy. It allows you to save more time and effort as you won't need to unmark them individually. Rest assured that I'll relay this message to our team in concern here on my end and add your vote for this one.

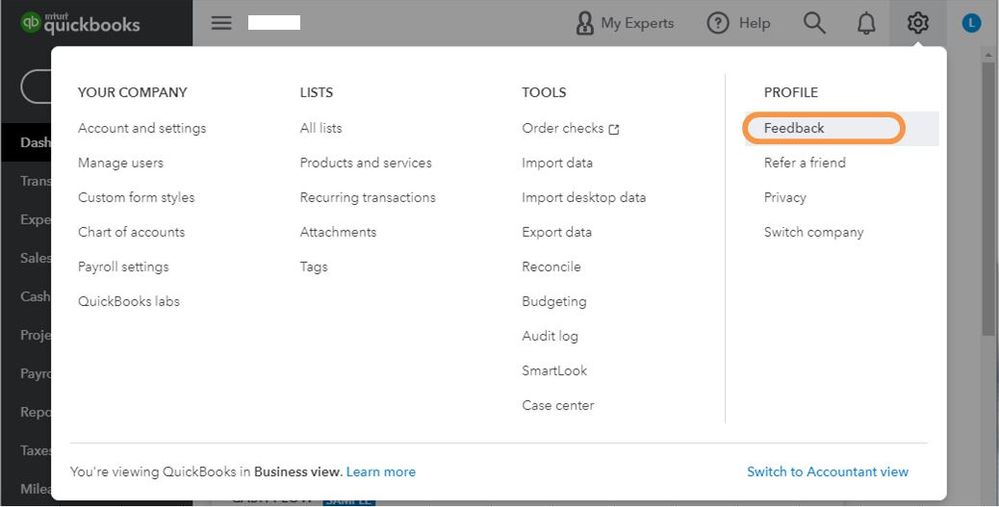

You can also share your thoughts and ideas through your account. Our product development team reviews all the feedback we receive to ensure we’re meeting the needs of our customers.

Here's how:

You can also check out our guide for your convenience: How to Submit Feedback.

To learn more about recent improvements, news, and product enhancements, visit the QuickBooks Blog. You’ll also get suggestions on how to grow the business.

If you have any other questions, just let me know and I'll be happy to help. Thanks again for reaching us and have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here