Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

I use QBO, and I got very behind in connecting my deposits to outstanding invoices. I have no outstanding invoices for last year, so is there a way to mark them all as paid without matching them?

Thanks for the help,

Kim

Hello, Kmbrlee.

From what I'm getting, the deposits are downloaded bank transactions and are added to QuickBooks instead of having to match them to the old invoices, and this step leaves those invoices open.

The only way to mark those old invoices as paid is to record a Receive payment transaction for each of them.

However, this step will double your cash-ins/deposits. Therefore, our better option is to unmatch/undo the downloaded deposits and then match them to the invoices.

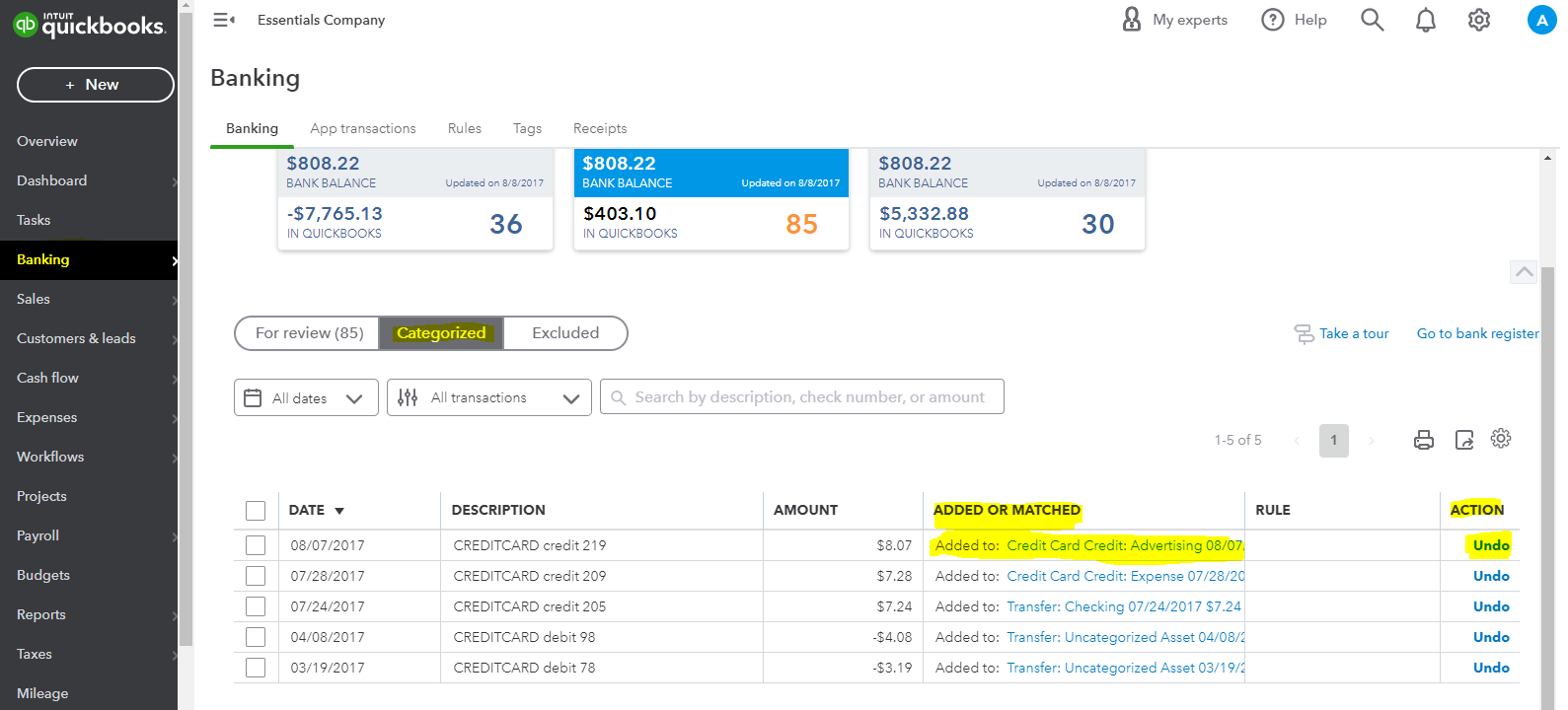

To undo bank transactions:

Then let's match the undone transactions to the invoices. You can refer to this article for detailed steps: Categorize and match online bank transactions in QuickBooks Online.

Once everything is set, you can start reconciling your account to ensure your books are accurate. Reconcile an account in QuickBooks

Feel free to place a comment below if you have any other questions in mind. I'll get back to you as soon as I can. Have a great day!

Hi,

Thank you for your response. I was reading another way, something about making a credit memo. I was trying to match some of them up, but things weren't adding up. Trying to make my life easier.

Thanks for your help!

Kim

Thanks for coming back, Kmbrlee.

Yes, you can also create credit memos and apply them as payments to those old invoices. This will offset the reported income from the invoices, which was already realized when you added the deposits. You can monitor your Profit and Loss report as you create credit memos. Here's how:

If you turn on the auto-apply credits, QuickBooks will apply the credit for you. If you turn it off, here's how to manually apply a credit memo to an invoice.

The steps above will help you apply the credit to your customer’s open invoices. For your reference, you may check out this article: Create and apply credit memos or delayed credits in QuickBooks Online. You can also visit our Reports and accounting page for QuickBooks Online to learn some tips on managing your report.

Also, in case you want to export your report to MS Excel, you can read this article for the detailed steps: Export your Reports to Excel from QuickBooks Online.

Know that our door is open 24/7 in case you need further assistance with this. You can also mention me in the comment section below. This way, I'll be notified and can help you right away. Take care always.

If I follow this method, will this affect last years reconciliations? All of our books for the prior year have been reconciled, but I have hundreds of open invoices from previous years that were never matched and it gives me an inaccurate idea of how many actual open invoices I have. I'm trying to figure out the best way to remove those open invoices without messing up my accountants work.

Thanks for joining this thread, f47h7.

To properly identify if making these changes to your open invoices from prior years will affect reconciliations, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form:

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

If there's any additional questions, I'm just a post away. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here