Thanks for taking the time to share your concern here in the Community, brophy.

I'll gladly guide you on how you can record your transactions affecting both expense and income accounts using billable expenses.

A billable expense is one you incur on your customer's behalf when you do work for them. Recording and tracking billable expenses enables your customer to reimburse you after they receive their invoice.

In your scenario, you'll need to generate a bill for the vendor, ensure to mark the Billable column, and assign it to the sister store, then create an invoice for the sister store for the existing one with the products they're paying for, and finally record the check from the sister store. Rest assured, I'll walk you through the process.

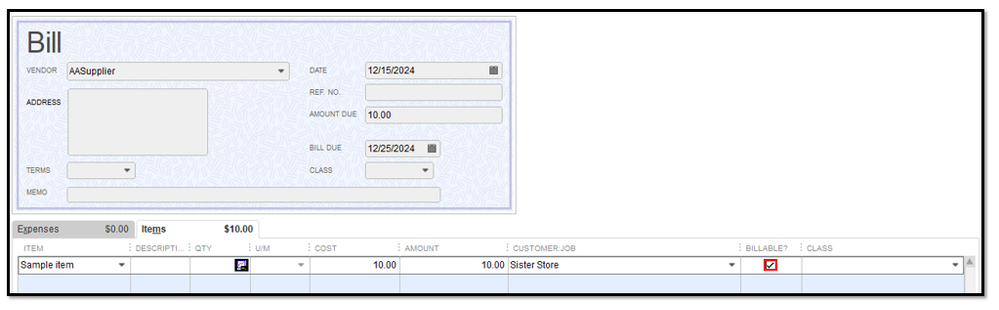

First, let's create a bill for the vendor. Here's how:

- On the top menu, click Vendors.

- Select Enter bills.

- Pick the vendor. Then, fill in the necessary fields on the Items tab.

- Under the Customer:Job column, choose the sister store. Then, tick the Billable column.

- Hit Save & Close.

Then, take note of the details of the existing invoice for your sister store. Delete it, then create a new one. Here's how to do it:

- Click Customers on the top menu.

- Select Create Invoices.

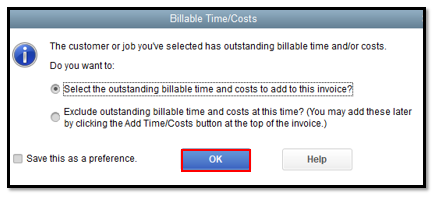

- Pick the sister store on the Customer:Job field.

- Click OK when prompted to add the billable costs.

- Go to the Items tab. Then, tick the billable expenses you want to add to the invoice.

- Hit OK.

- Add the details from the existing invoice.

- Hit Save & Close.

Lastly, let's record the check you receive. I'll list down the steps for you below.

- Click Customers on the top menu.

- Select Receive Payments.

- Pick the sister store on the Received from field.

- Tick the open invoice.

- Hit Save & Close.

Once you've gone through all the steps, you should be able to record your transactions affecting both expense and income accounts.

You can also read this article for more info on job costing: Track job costs in QuickBooks Desktop.

For easier tracking of your vendors and billable expenses, I recommend running reports in QuickBooks Desktop. Feel free to read this article for more details: Understand reports.

If you need further guidance in recording your transactions in QuickBooks, please feel free to leave a reply below. I'll be around to offer a helping hand. Keep safe.