Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood evening. I received 1 payment for 2 invoices through Paypal. How do I tie both invoices to the deposit and include the Paypal fee? The bank feed only shows the invoice less fee. I have set up a Receive Payment tying the 2 invoices but not sure how to get that to tie to my bank fee that is less the Paypal fee? Any suggestions are welcome. We won't be using Paypal again...

Thanks for reaching out to the Community about your concern, @Jackie804. Let me help and guide you in the right direction on how to record the PayPal payment.

These links will walk you through the process of managing your deposits and other banking-related tasks for additional resources:

After that, you can match the downloaded bank transactions to the existing entries in your QBO account. You can refer to this article for the step-by-step guide: Categorize and match online bank transactions in QuickBooks Online. It also includes steps about excluding personal or duplicate transactions.

Let me know if you have other questions or need more help handling payment transactions in QBO. The Community is always around to help. Take care and stay safe.

So the funds less the Paypal fee have already hit the bank account. It involves 2 invoices for 1 customer and a $92.18 fee for Paypal. I'm not sure how I should account for the funding and split the payment between the two invoices. Normally, it's straightforward and we use either Quickbooks or Venmo. This client wanted Paypal which we will never use again due to the steep fee.

Hello, Jackie804.

I'll share more insights on how to split a payment between two invoices and guide you in matching them to your bank feed so you can manage your income transactions in QuickBooks Online (QBO) accordingly.

QBO has special ways to add bank fees and combining transactions so your records match your real-life bank deposit. You can either add the PayPal fee on your deposit (as directed by my colleague above) or include it while matching transactions.

To perform the latter process, you'll have to record a Receive payment transaction for each of the invoices and make sure to post them to the Undeposited Funds account. This way, you're splitting the payment between the two invoices.

When you're done, group the payments together into a single deposit. Then, resolve the difference (funds less the PayPal fee) between the invoice and the payment when matching transactions from your bank feed. Make sure to create an expense account for the bank fee (if you haven't already) to account for the PayPal charge.

Once you're done recording the payment and deposit, match them to your bank feed:

Also, I encourage you to reconcile your accounts in QBO regularly (every month). This helps monitor your income and expense transactions and detect possible errors accordingly. You may want to check out this article as your reference in doing and fixing reconciliations in QBO: Learn the reconcile workflow in QuickBooks.

If you have other banking concerns or questions about managing payments and deposit transactions in QBO, please don't hesitate to let me know in the comments below. I'll gladly help. Take care, and have a great weekend.

My paypal processing fee which I have categorized, are winding up in the non specified vendor report. I have looked at the transaction. I have categorized it as an expense. Help!

Thank you for joining this thread to let us know about your concerns with vendor reports, akm. I’m here to shed some light on why reports do not specify particular transactions.

Would it be possible for you to share the name of the report that you are currently using to review your transactions? Providing any additional information on the matter would assist me in offering appropriate solutions to resolve this issue.

On the other hand, if you run reports by classes, the report will show the transactions that were not assigned by class to a non-specified column. This will be grouped in the Not Specified column as they're just classes, not categories or accounts.

Otherwise, if the processing fee you categorized to the expense account doesn’t have a payee or vendor assigned to it. They will also be grouped in the Not Specified column. To rectify this, we can open the transaction and assign a payee or vendor to it. Here’s how:

I have gathered a list of helpful articles for you that specifically focus on managing your reports in QuickBooks Online. These articles are tailored to assist you in streamlining your reporting process and making the most out of your QuickBooks experience.

If you require any additional assistance with anything, simply let me know and I will be more than happy to assist you. My primary goal is to provide you with any information or support you may need. I hope you have a fantastic day ahead!

Surely there is a simple function that can be toggled off/on to make the customers be charged the fees on top of their invoice total and not added into their total. Has anyone come across anything like this before?

Yes, Sco3. You can add processing fees on top of your customer's invoice total if you use QuickBooks Payments. I'll provide more details about this.

With QuickBooks Payments, your customers can conveniently pay their invoices through the payment portal using their bank account. This payment will cover the full invoice amount plus the added convenience fee. This subscription is only available in the United States.

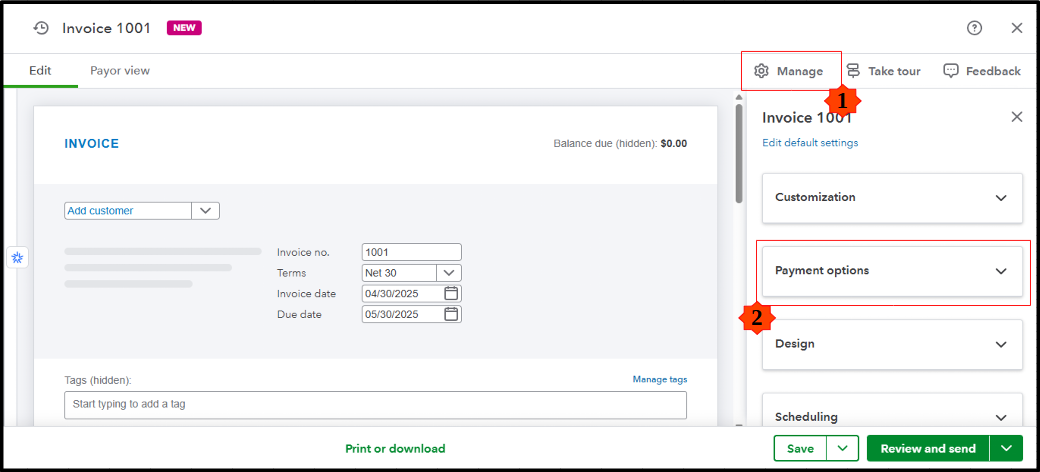

Now, if you have QuickBooks Payments, I can guide you through the process of enabling this option:

For more info, check out this article: Let your customers pay invoices by ACH bank payment with a convenience fee.

In other regions, we have two available options for managing charge fees. The first option is to manually add the fees to the invoices, ensuring each fee is accurately accounted for.

The second option is to leverage third-party applications designed for this purpose. You can visit the QuickBooks App Store or navigate the Apps menu on your QBO account to find the application suitable for your business needs.

Lastly, I've included several articles to help you learn how to send invoice reminders and personalize your sales forms:

Feel welcome to come back to this thread if you have questions about processing fees. We're always here to back you up.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here