You'll need to process a receive payment so the invoice and credits will be removed from the A/R aging schedule, HalHin. Let me guide you with this.

In your scenario, there's no need to create a cash receipt. Instead, you should process a receive payment to link the journal entry and invoice. After that, make sure that the affected account in the journal entry is A/R and choose the right customer, so it will appear in the credits section when processing the received payment.

Here's how:

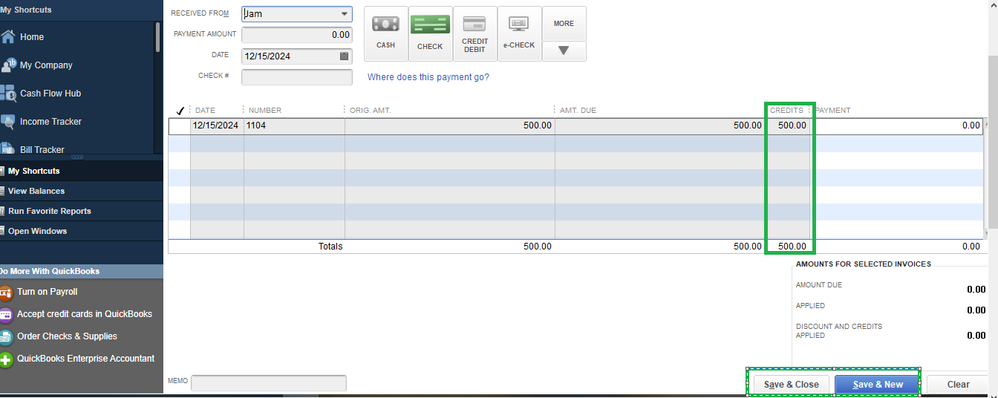

- From the QuickBooks Home page or the Customers menu, select Receive Payment.

- In the Received From drop-down, select the customer's name.

- Make sure the date is correct.

- Select the invoice or invoices you'd like to pay.

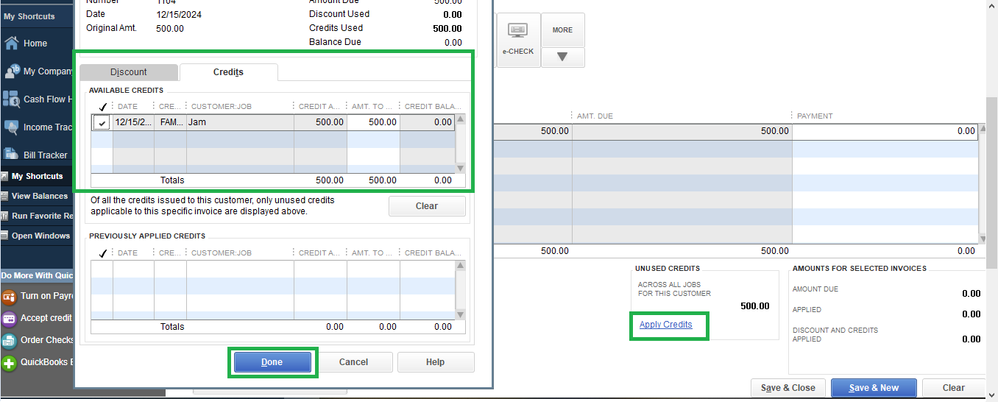

- Click the Apply Credits and choose the transaction.

- Click the Done button.

- The credits will now appear and click Save & Close.

For more details about the process above, see this article: Record an invoice payment.

Also, I'll be sharing this article that will guide you in tracking customer transactions: Get started with customer transaction workflows in QuickBooks Desktop.

Keep me posted if you have any concerns with your transactions or reports in QuickBooks. I'll be glad to help you with the process. Take good care.