Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi all!

I am entering a bill that has some credits and normal charges on it. It ends up as a credit balance. I am just trying to figure out how to put the whole bill in the system.

For example

service charge $30

regular service $50

**CREDIT** correction for past service $120

Credit Balance of $40

I want to enter this all as one unit instead of making a credit AND a bill. Can I do that?

Solved! Go to Solution.

Entering a bill that has charges and credits isn't possible, jroneill.

QuickBooks doesn't allow you to enter a negative amount on a Bill. Therefore, if you receive a correction for service, you need to record it as a separate transaction. Once done, you can apply it to the Bill. It's a simple way to ensure your records are accurate and up-to-date in QuickBooks.

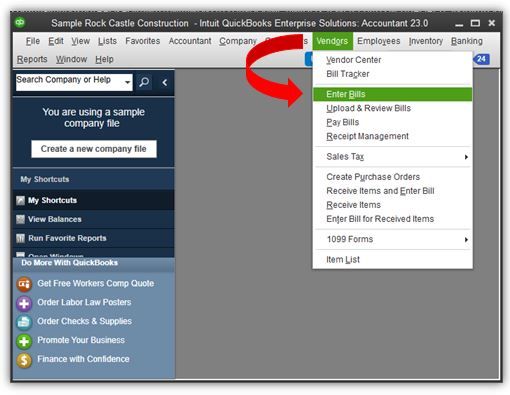

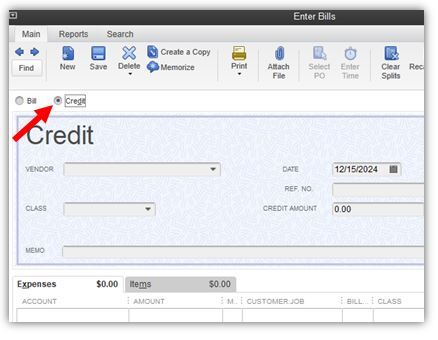

To enter a separate credit:

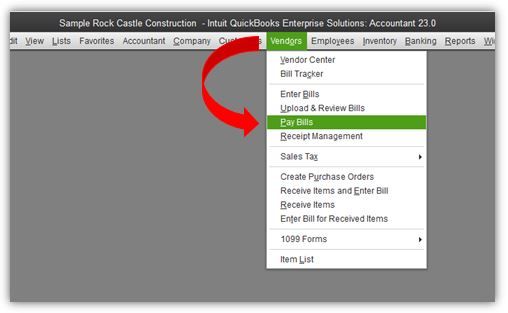

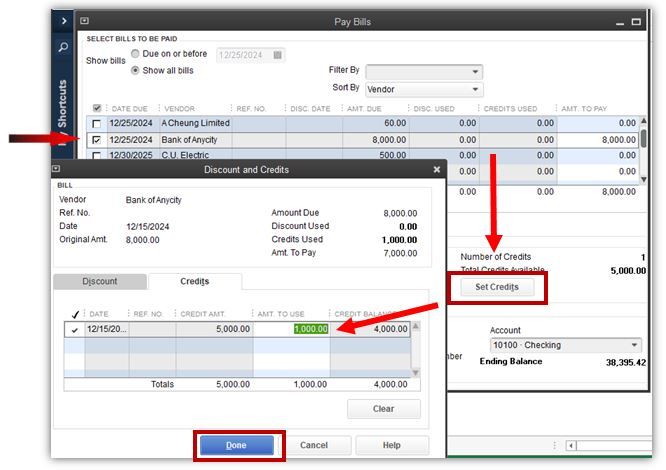

To apply the credit to a bill:

I'll add this article to see the complete list of workflows and vendor-related transactions for another task: Accounts Payable workflows in QuickBooks Desktop.

If you need additional help in handling your vendor credit or any other tasks, feel free to inform me. I'm here, ready to assist you promptly.

Entering a bill that has charges and credits isn't possible, jroneill.

QuickBooks doesn't allow you to enter a negative amount on a Bill. Therefore, if you receive a correction for service, you need to record it as a separate transaction. Once done, you can apply it to the Bill. It's a simple way to ensure your records are accurate and up-to-date in QuickBooks.

To enter a separate credit:

To apply the credit to a bill:

I'll add this article to see the complete list of workflows and vendor-related transactions for another task: Accounts Payable workflows in QuickBooks Desktop.

If you need additional help in handling your vendor credit or any other tasks, feel free to inform me. I'm here, ready to assist you promptly.

Ok thats what I thought. It's dumb.

I'll process it the way you mentioned.

It is not dumb. It is SO common of a workflow. I do negatives on bills. I have chargeback items created in my products and services. I enter negative amounts on the bill and it takes off the total. The credit way makes the biggest mess in workflow for me anyway.

I just tried again. It's letting me do negative lines now. I swear I wasn't able to do this before. The QB person even told me I couldn't put a negative on a bill.

I thought it was dumb that a separate credit would have had to have been issued in QB if a vendor just put a credit on an invoice. From what I can see, everything should be ok now and I can process stuff exactly the way you were doing.

Hi, I am having the same problem. I have a invoice with a credit and the items that we purchased. I want to keep it all on that bill to keep things straight. Can you tell me how you applied the credit with the charges? I am new to QuickBooks, and sometimes I am at a loss as to what to do. And as far as the account to attach the credit to, is it the same as the expense account as I am working with?

Thank you !!

Jenn

I can share some information about entering credits to your bills, @Jenn701.

When you receive a credit, you can record it as a bill credit and apply it when processing a bill payment. Yes, the credit will be attached to the same expense account.

Here's how to record a Bill Credit for the amount of the credit:

When processing bill payments:

Here's more information about recording a vendor refund in QuickBooks Desktop. It'll guide you in recording refunds or credits you received from a vendor. Choose the appropriate scenario and follow the recommended steps to record the refund in QuickBooks.

For detailed guidance on running and customizing vendor reports, check out these articles. They provide more information on vendor reports that help you track your company's expenses and accounts payable:

Let me know if you need further information about adding and applying credits to your bill. I'm always here to assist. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here