Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, jg_flowers.

If you create a transaction by accident, there are a few ways to remove it. You can either void or delete it to remove it from the invoice list.

When you void a transaction, you cancel all payments associated with it (a process called "zeroing out"). The transaction won't impact your reports or account balances, and you'll always have a record of it.

When you delete a transaction, you erase it from your books. It won't appear anywhere on your reports or in your accounts. You can use your Audit Log to recover some information/details, but you're unable to recover the transaction.

Please follow the steps below on how to delete or void the transaction from invoice list:

1. Click the Sales ate the left panel. Then the Invoices tab.

2. Select the invoice and click it to expand the page.

3. Choose More button at the bottom of the page.

4. Hit the Delete or Void.

5. You'll be prompted with Are you sure you want to void/delete this? Select the Yes button.

Please check this article how to send your invoices directly from QuickBooks, using a link and send invoices by batch: Send an invoice.

Please let me know how it goes or if you have any other concerns with QuickBooks. I'll be around to help you out. Have a good one.

The issue is the original transactions disputed by the bank. The transactions were resolved, but there are still items marked disputed on the Invoice list.

Thanks for the additional information about your concern, jg_flowers.

You can make a copy of the disputed invoice using the original date. Then, void the original disputed invoice so you can apply the payment to the newly created invoice. This removes the items and the disputed charges on your Invoice list.

To create a new invoice:

To void an invoice:

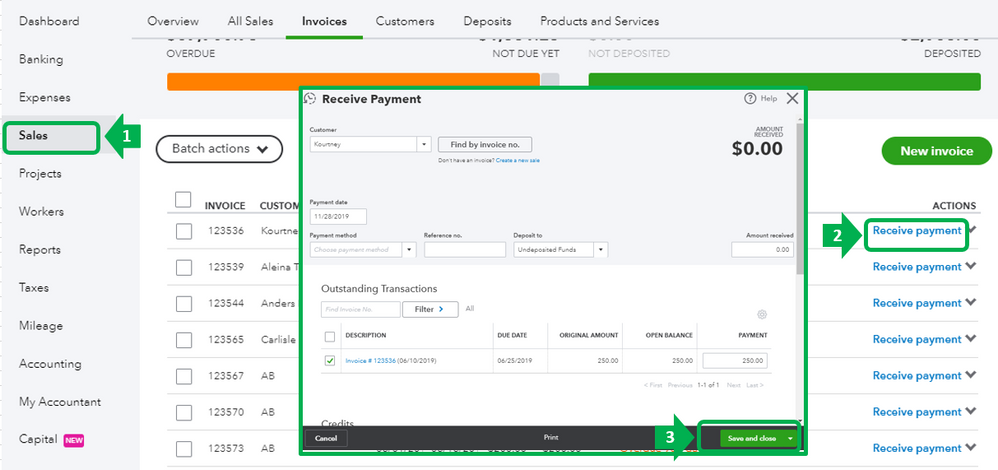

Go back to the Sales menu and open the newly created invoice to apply the payment.

Here's how:

Also, you can visit our Help Articles page for QuickBooks Online if in case you need some tips and related articles for your future tasks.

Let me know if you have other questions. I'm always happy to help you all the way. Have a good one.

I followed the steps, but it did not remove the returned payment line from the Invoice Dashboard.

The new instructions to handle a returned payment are to create an invoice with a "Payment Returned" line item, then apply the returned payment to that invoice. That makes the original invoice still open until the customer sends a new payment.

But doing that still does not remove the items that are causing the red "Returned!" status notifications. We now have four items that need to be removed.

Thanks.

I can see that your bank resolved the disputed transactions, jg_flowers.

We can make deposits for the returned payments. This is to zero out the invoices and remove the Returned status from the Transaction lists.

First, we'll need to receive the returned payment. Once done, we can now make deposits for the returned one. Here's how:

I've added screenshots for your additional reference:

It's important to record the cashflow of your business. That said, transactions need to be listed every time we processed them. At this time, the invoice will be marked as zero and show the status as Deposited one.

For additional reference you can also visit this article: Common Questions about QuickBooks Payments Deposits.

Give us an update on these steps go. We're just here to help you more. I hope you're well today!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here