Welcome to the QuickBooks Community forum, Veronique. I'm thrilled to have you join us today. I'll share information about matching vendor credits and bills to a single payment.

You can apply the existing vendor credit to a bill and match the associated bill payment to your downloaded transactions. Since matching both the bills and the vendor credits to a payment isn't available in QuickBooks Online (QBO), as vendor credits are a type of credit that can be applied to a vendor account and used to offset future purchases or payments.

Let me guide you through the steps involved:

- Create a vendor credit by navigating to the +New button.

- Choose Vendor credit and enter the necessary information.

- Click Save and close.

- After that, hit Pay bills.

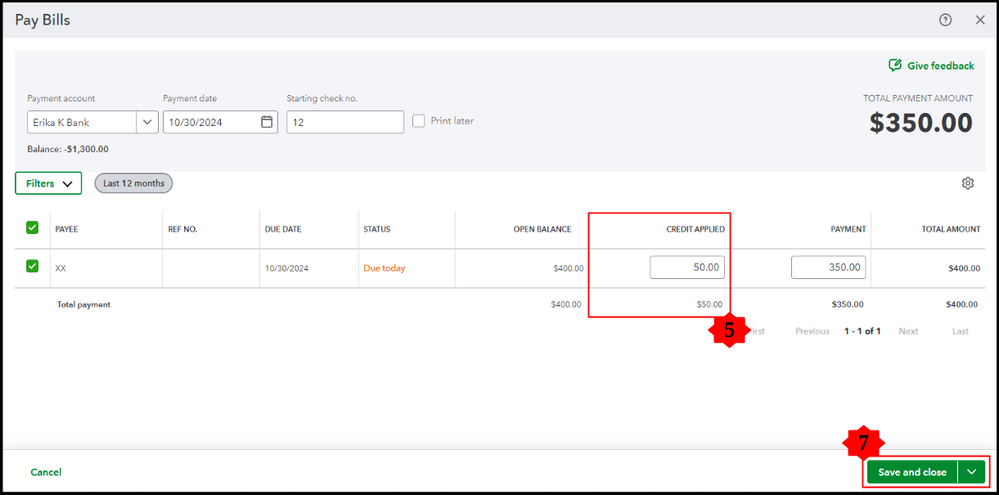

- Then, pick a bill for your vendor from the list. You'll see the available credit with this vendor in the Credit Applied field.

- Complete the rest of the fields like you usually do.

- Once done, click Save and close.

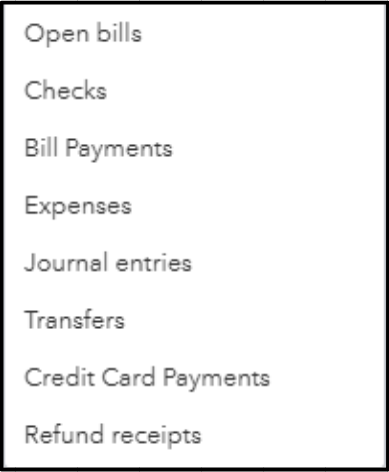

Also, downloaded vendor payments are exclusively matched with certain money-out transactions. To assist you in understanding the different types involved, here is a list of various categories:

Furthermore, I've attached a guide to help you organize your accounts, enabling you to maintain accurate financial records: Reconcile an account in QuickBooks Online.

Finally, if you have questions or need further clarification regarding vendor credit management, hit the Reply button, Veronique. I’ll be here to assist you and provide the information you need to navigate this process effectively. Your inquiries are important, and I look forward to helping you with any concerns or topics you’d like to explore further.