I'll help you clear out the bills, lorriesci.

In QuickBooks Desktop, we'll have to track the transactions as billable expenses so your customer can reimburse the expenses when they receive their invoices. Beforehand, I'd recommend deleting the entries you've created to avoid duplicates. To do so, open the transactions and then press CTRL + D.

Once done, we can create billable expenses. First, let's turn on the feature. I'll show you how:

- From the Edit menu, choose Preferences.

- Select Time & Expenses.

- Go to the Company Preferences tab.

- In the Invoicing Options section, check the Mark all expenses as billable option.

- Click OK.

Then, you can now create bills. Make sure to place a checkmark under the Billable? column. Then, add the name of the customer.

To reimburse the cost, link the billable expense to your customer's invoice. Here's how:

- Go to the Customers menu, then select Create Invoices.

- Choose the customer name that you added to the bill/s.

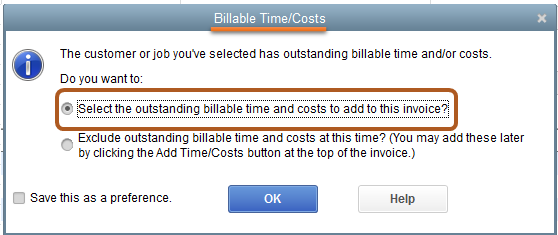

- Put a checkmark on the select the outstanding billable time and costs to add this invoice option on the Billable Time/Costs pop-up window.

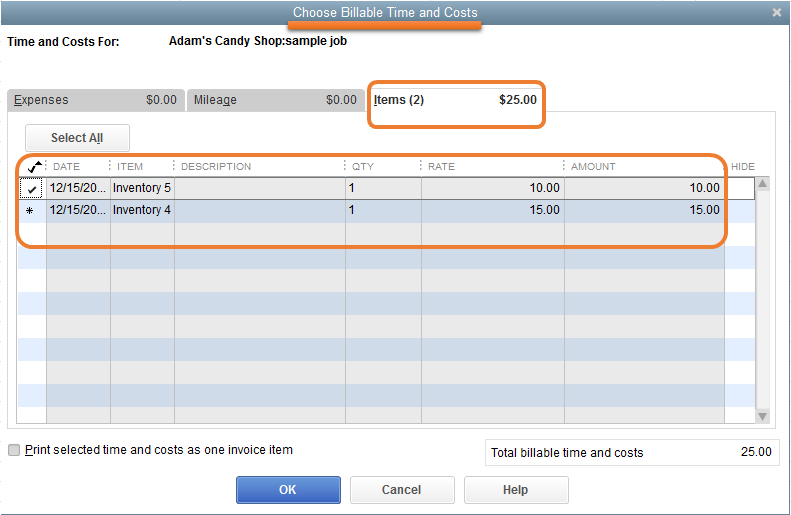

- On the Choose Billable Time and Costs window, select Items.

- Make sure to put a checkmark on the billable items you want to add to your invoice.

- Click OK and then Save & Close.

Additionally, I've added these articles that'll help you learn more about tracking and managing your customer and vendor transactions in QuickBooks Desktop:

I'd appreciate it if you'll get back to us for additional assistance with the process. We want to make sure your record is accurate. Keep safe always!