Let me help you with this one, @Tracey2022. I’d be glad to share the steps to record the reimbursed amount to your personal credit card used to purchase a business expense.

To prevent scenarios like this, we do not advise combining personal and company funds in QuickBooks. However, since your husband has already used his personal bank account to pay for business expenditures, you’ll need to make a journal entry to record it in QuickBooks.

Here's how:

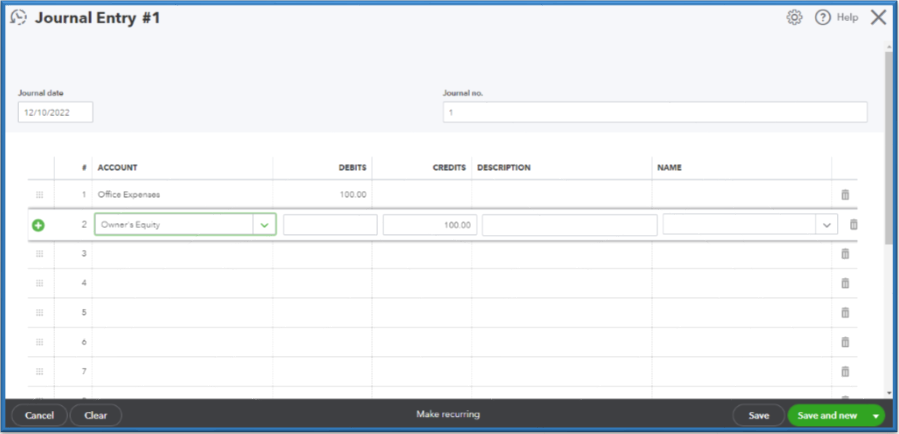

- Go to the + New button, then select Journal entry.

- Select the expense account for the purchase on the first line. Then, enter the amount under the Debits column.

- On the second line, choose between Partner's equity or Owner's equity. Then, enter the same purchase amount in the Credits column.

- Hit Save and close.

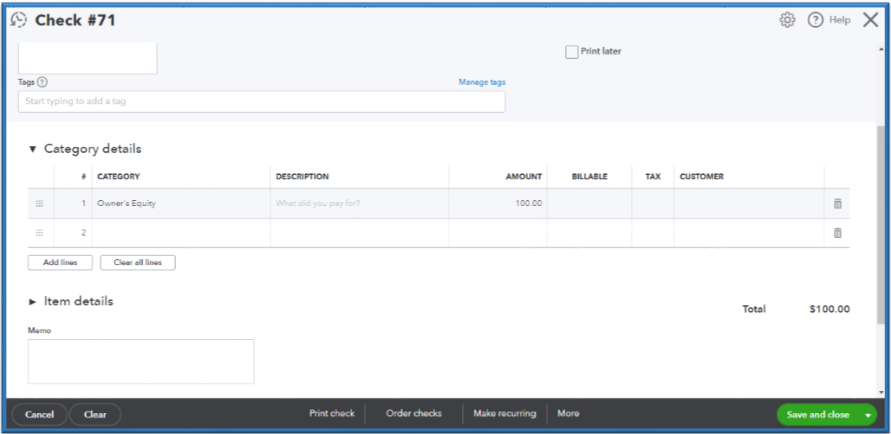

Once done, you'll have to reimburse the personal expense by entering a check or an expense transaction. I’ll show you how:

- Click the + New button, then choose between Check or Expense.

- Pick a bank account to use to reimburse the personal funds.

- In the category column, select partner's equity or owner's equity.

- Enter the amount of the reimbursement.

- Press Save and close.

See these screenshots below for your reference:

Furthermore, I’d still recommend consulting your accountant for more guidance. This way, we can ensure the correct accounts are affected.

You’ll want to check out this article to view the short video of recording business expenses paid with a personal credit card account: Pay for business expenses with personal funds.

I’ve attached these resources to help you with using journal entries and handling a personal expense if you use a business account to pay for it:

QuickBooks Community is always open to help you again if you have any other concerns or follow-up questions about recording reimbursement transactions. Have a great day ahead!