Hello there,

Thank you for posting here in the Community. I'm here to help you handle overage on the customer's account in QuickBooks Online.

Since Customer ABC shows an overage on his account, you can affect the Accounts Receivable when entering an expense. This way, you'll be able to receive payment to link the expense/check and the available credit.

Here's how:

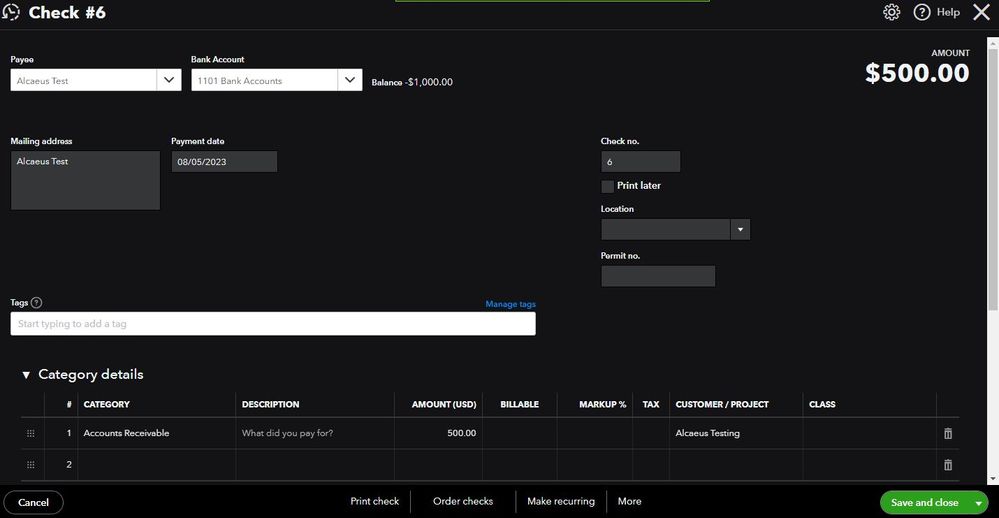

- Create an expense or check.

- Use the Accounts Receivable account and add the customer name.

- Hit Save and close.

- Access the Receive Payment section.

- Select the customer.

- Below Outstanding Transactions, put a checkmark on the check and the credit to clear the balance.

- Hit Save and close.

Also, journal entries let you move money between accounts and force your books to balance in specific ways. I've attached a link you can use for a better understanding of debits and credits in QuickBooks: Create journal entries in QuickBooks Online.

Let us know if you have additional questions about getting the account to reflect zero in QBO. We're always here to help. Take care always.